Question: Note : You need to write your own spreadsheet programs . You can adopt the basic format of the sample Black-Scholes OPM and modify the

Note: You need to write your own spreadsheet programs. You can adopt the basic format of the sample Black-Scholes OPM and modify the inputs and parameters according to the given formulae. You work out with the pricing model only. (No sensitivity analysis or charts needed.)

Use the attached written out answer and use above instructions to create spreadsheet model.

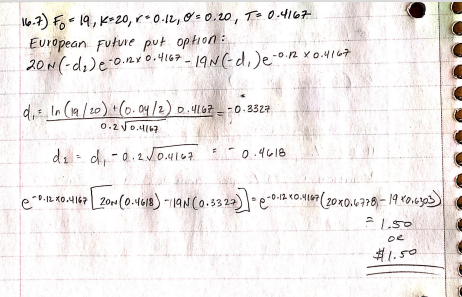

16.7) F-14, K-20, r* 0-12, Os 0.20, TO0-4167 European Future put ophon: 20N(-de)e-0.18 0.4167-19N (-d,)e-0.62 x 0.4767 di: In (14/20) (6.04/2) 0.467 - - 0.832 0.2 0.4167 dad, -0.250.4167 0.4618 *20-140 (200(0.448) 19N (0.332)]* 20.4 60 (207069791 14 80.233) 1.50 #1.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts