Question: Notes: All work with methodology and equations used must be shown in detail. The actual equations and careful explanations are required to receive credit for

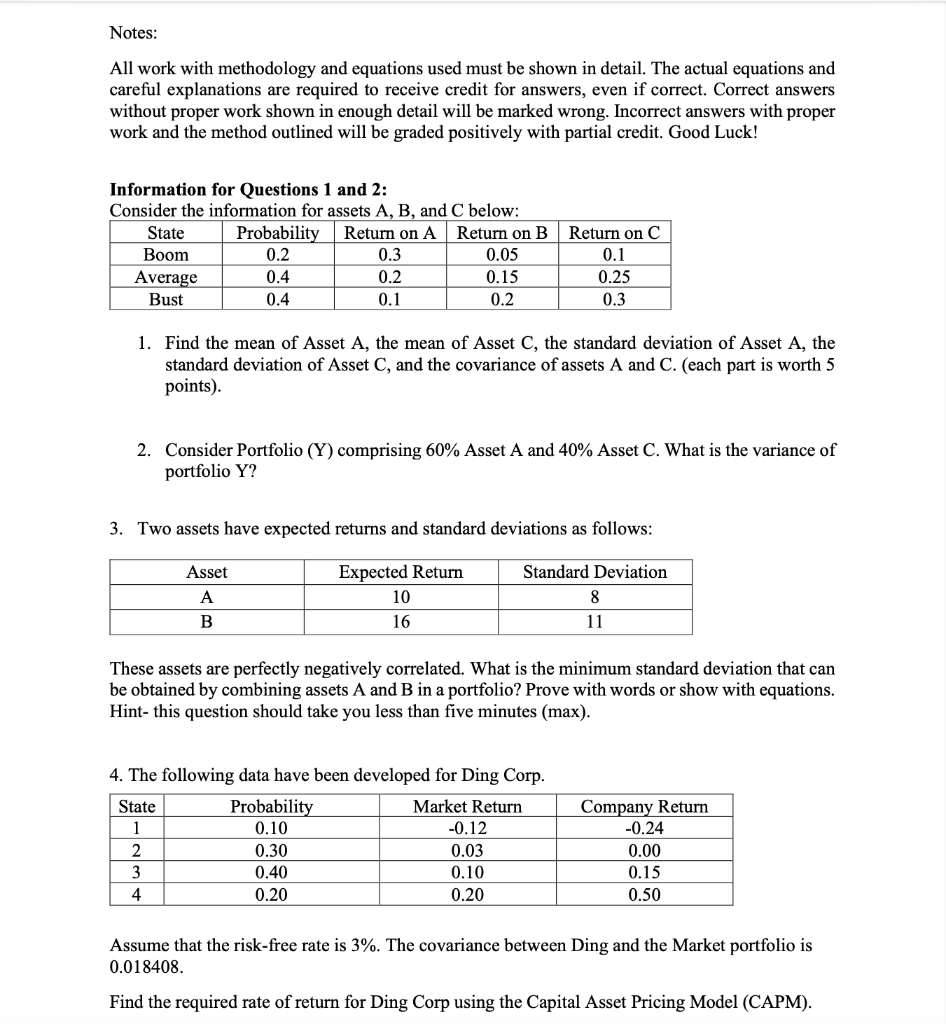

Notes: All work with methodology and equations used must be shown in detail. The actual equations and careful explanations are required to receive credit for answers, even if correct. Correct answers without proper work shown in enough detail will be marked wrong. Incorrect answers with proper work and the method outlined will be graded positively with partial credit. Good Luck! Information for Questions 1 and 2: Consider the information for assets A. B. and C below: 1. Find the mean of Asset A, the mean of Asset C, the standard deviation of Asset A, the standard deviation of Asset C, and the covariance of assets A and C. (each part is worth 5 points). 2. Consider Portfolio (Y) comprising 60\% Asset A and 40% Asset C. What is the variance of portfolio Y ? 3. Two assets have expected returns and standard deviations as follows: These assets are perfectly negatively correlated. What is the minimum standard deviation that can be obtained by combining assets A and B in a portfolio? Prove with words or show with equations. Hint- this question should take you less than five minutes (max). 4. The following data have been developed for Ding Corp. Assume that the risk-free rate is 3%. The covariance between Ding and the Market portfolio is 0.018408 Find the required rate of return for Ding Corp using the Capital Asset Pricing Model (CAPM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts