Question: Notes: All work with methodology and equations used must be shown in detail. The actual equations and careful explanations are required to receive credit for

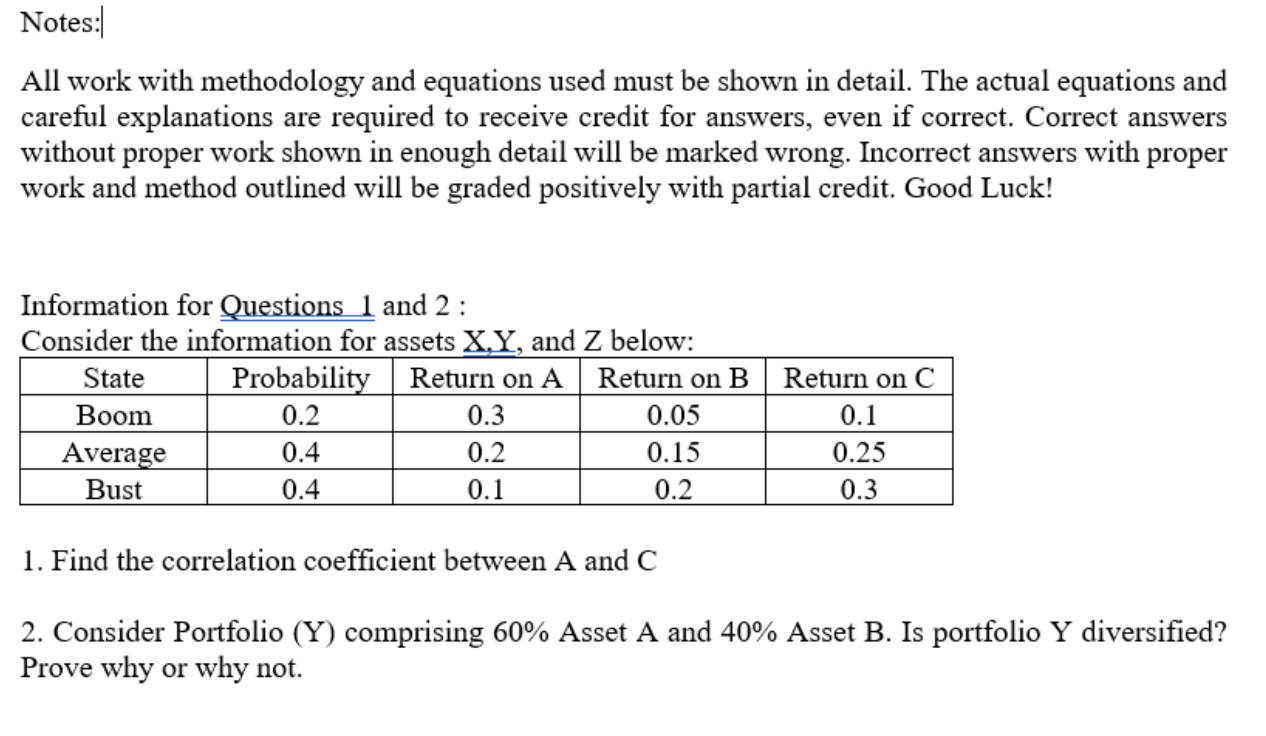

Notes: All work with methodology and equations used must be shown in detail. The actual equations and careful explanations are required to receive credit for answers, even if correct. Correct answers without proper work shown in enough detail will be marked wrong. Incorrect answers with proper work and method outlined will be graded positively with partial credit. Good Luck! Information for Questions 1 and 2: Consider the information for assets X,Y, and Z below: State Probability Return on A Return on B Boom 0.2 0.3 0.05 Average 0.4 0.2 0.15 Bust 0.4 0.1 0.2 Return on C 0.1 0.25 0.3 1. Find the correlation coefficient between A and C 2. Consider Portfolio (Y) comprising 60% Asset A and 40% Asset B. Is portfolio Y diversified? Prove why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts