Question: Notes - I must be able to click on each cell containing your computed value and see the formula or function used to determine the

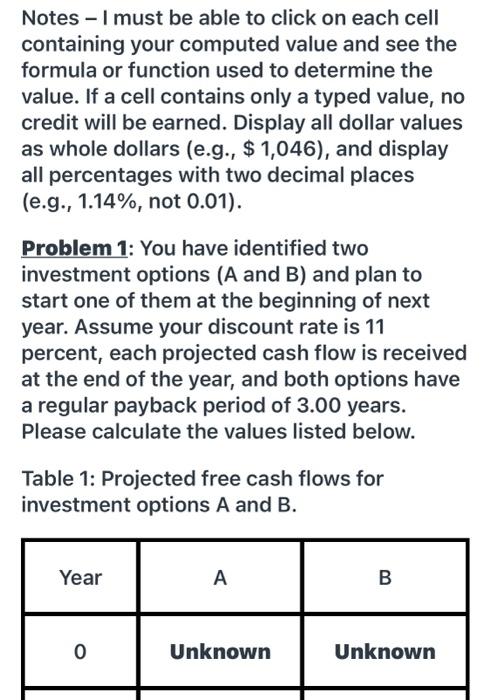

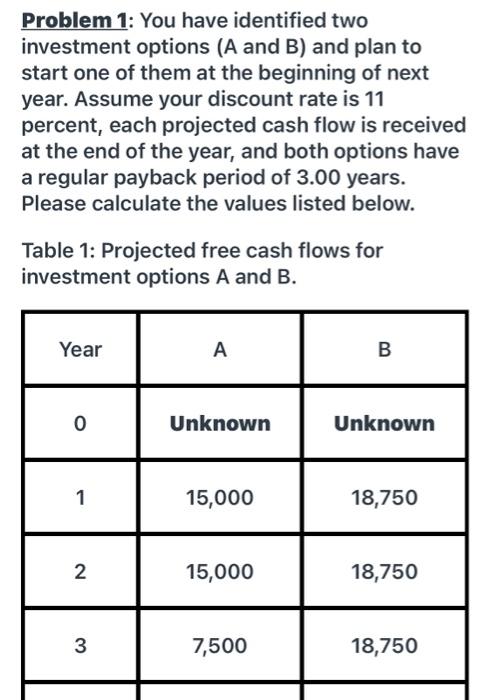

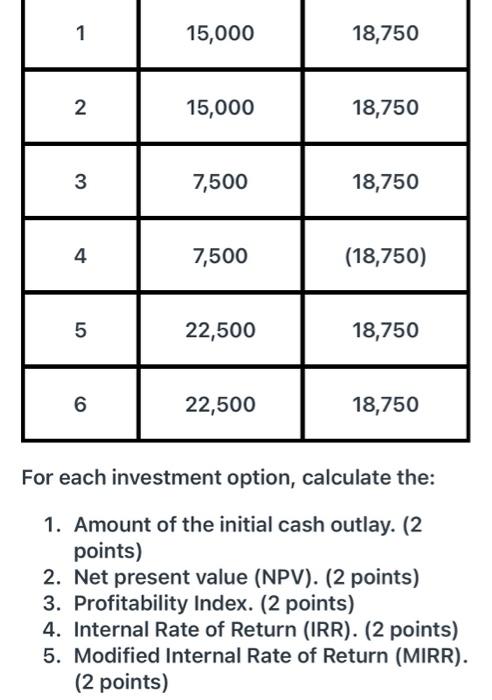

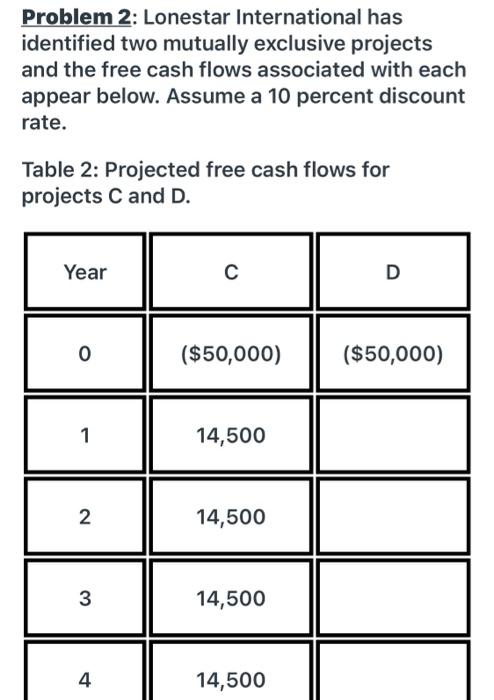

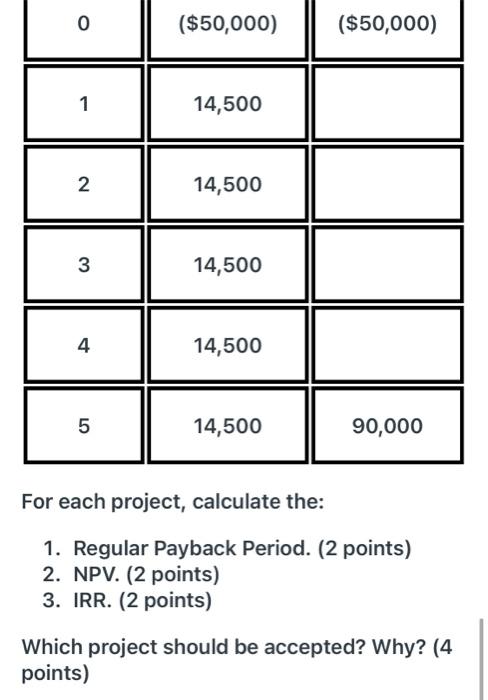

Notes - I must be able to click on each cell containing your computed value and see the formula or function used to determine the value. If a cell contains only a typed value, no credit will be earned. Display all dollar values as whole dollars (e.g., $ 1,046), and display all percentages with two decimal places (e.g., 1.14%, not 0.01). Problem 1: You have identified two investment options (A and B) and plan to start one of them at the beginning of next year. Assume your discount rate is 11 percent, each projected cash flow is received at the end of the year, and both options have a regular payback period of 3.00 years. Please calculate the values listed below. Table 1: Projected free cash flows for investment options A and B. Year B O Unknown Unknown Problem 1: You have identified two investment options (A and B) and plan to start one of them at the beginning of next year. Assume your discount rate is 11 percent, each projected cash flow is received at the end of the year, and both options have a regular payback period of 3.00 years. Please calculate the values listed below. Table 1: Projected free cash flows for investment options A and B. Year A B 0 Unknown Unknown 1 1 15,000 18,750 2 15,000 18,750 3 7,500 18,750 1 15,000 18,750 2 15,000 18,750 3 7,500 18,750 4 7,500 (18,750) LO 22,500 18,750 CO 22,500 18,750 For each investment option, calculate the: 1. Amount of the initial cash outlay. (2 points) 2. Net present value (NPV). (2 points) 3. Profitability Index. (2 points) 4. Internal Rate of Return (IRR). (2 points) 5. Modified Internal Rate of Return (MIRR). (2 points) Problem 2: Lonestar International has identified two mutually exclusive projects and the free cash flows associated with each appear below. Assume a 10 percent discount rate. Table 2: Projected free cash flows for projects C and D. Year D 0 ($50,000) ($50,000) 1 14,500 2 14,500 3 14,500 4 14,500 O ($50,000) ($50,000) 1 1 14,500 14,500 N 3 14,500 4 14,500 5 14,500 90,000 For each project, calculate the: 1. Regular Payback Period. (2 points) 2. NPV. (2 points) 3. IRR. (2 points) Which project should be accepted? Why? (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts