Question: Now assume that a U.S, based MNC just signed a contract to import electronic equipment to the U.K. At today's exchange rates and if the

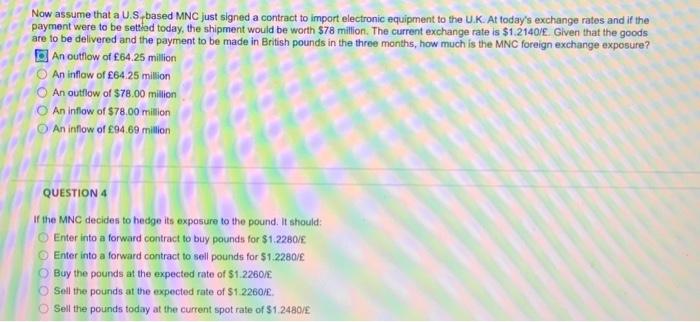

Now assume that a U.S, based MNC just signed a contract to import electronic equipment to the U.K. At today's exchange rates and if the payment were to be settiod today, the shipment would be worth $78 million. The current exchange rate is $1.2140/E. Given that the goods are to be delivered and the payment to be made in British pounds in the three months, how much is the MNC foreign exchange exposure? An outflow of 64.25 milion An inflaw of 64.25 milion An outllow of $78.00 milition An inflow of $78.00 million An inflow of 94.69 million QUESTION 4 If the MNC decides to hedge its exposure to the pound. It should: Enter into a forward contract to buy pounds for $1.2280VE Enter into a forward contract to sell pounds for $1.22.80/E. Buy the pounds at the expected rate of $1.2260/E. Sell the pounds at the expected rate of $1.2260/E. Sell the pounds todiay at the current spot rate of $1.2480/2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts