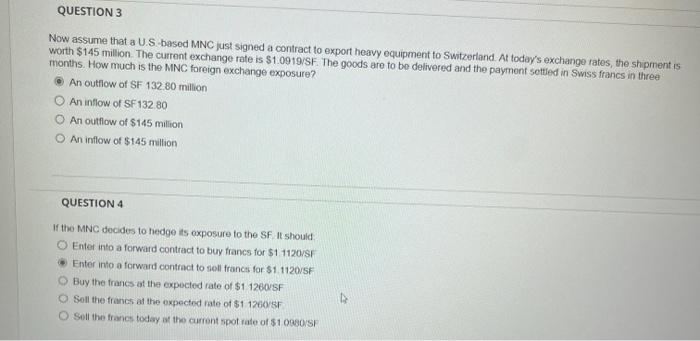

Question: Now assume that a U.S based MNC just signed a contract to export heavy equipment to Swizerland. At today's exchange rates, the shipment is worth

Now assume that a U.S based MNC just signed a contract to export heavy equipment to Swizerland. At today's exchange rates, the shipment is worth $145 million. The current exchange rate is $1.0919/SF. The goods are to te delivered and the payment sotted in Swiss francs in three months. How much is the MNC fareign exchange exposure? An outflow of SF 132.80 milion An inflow of SF132.80 An outflow of $145 milion An inflow of $145 million QUESTION 4 If the MNC decides to hedge its exposure to the SF. It should Enter into a forward contract to buy francs for $111201SF Enter into a forward contract to sell francs for $1.112015F Buy the francs at the expected rate of $1 1260rsF Soll the frenes at the oxpected rate of \$1 1260/sF Sell the francs today as the current spot zate of $1 oxsolsp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts