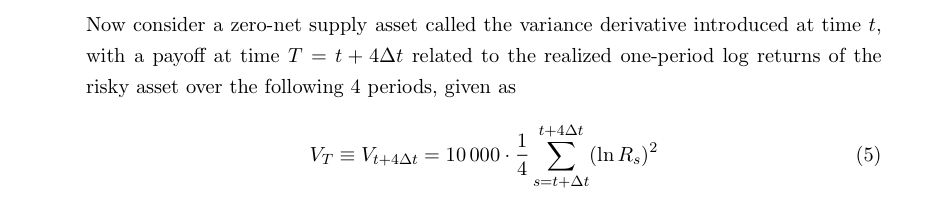

Question: Now consider a zero-net supply asset called the variance derivative introduced at time t, with a payoff at time T = t + 4At related

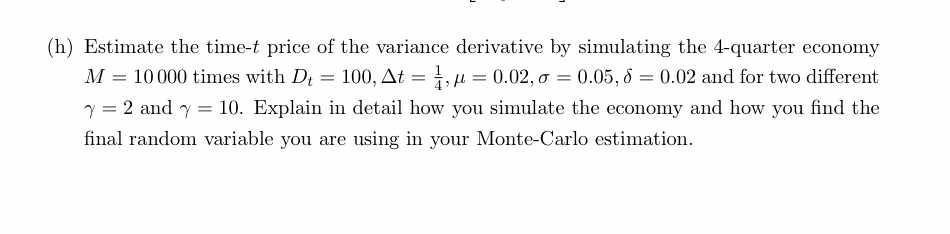

Now consider a zero-net supply asset called the variance derivative introduced at time t, with a payoff at time T = t + 4At related to the realized one-period log returns of the risky asset over the following 4 periods, given as t+4At VT = Vt+4At = 10000 (In R,)? () (5) 4 s=t+At (h) Estimate the time-t price of the variance derivative by simulating the 4-quarter economy M = 10 000 times with Dt 100, At = 1, y = 0.02, 0 = 0.05,8 = 0.02 and for two different 7 = 2 and 7 = 10. Explain in detail how you simulate the economy and how you find the final random variable you are using in your Monte-Carlo estimation. Now consider a zero-net supply asset called the variance derivative introduced at time t, with a payoff at time T = t + 4At related to the realized one-period log returns of the risky asset over the following 4 periods, given as t+4At VT = Vt+4At = 10000 (In R,)? () (5) 4 s=t+At (h) Estimate the time-t price of the variance derivative by simulating the 4-quarter economy M = 10 000 times with Dt 100, At = 1, y = 0.02, 0 = 0.05,8 = 0.02 and for two different 7 = 2 and 7 = 10. Explain in detail how you simulate the economy and how you find the final random variable you are using in your Monte-Carlo estimation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts