Question: Now suppose a money demand function (M/P ) =L(i,Y)=Y/3i. c. (3 points) Real income still grows by 3 percent and the nominal interest rate grows

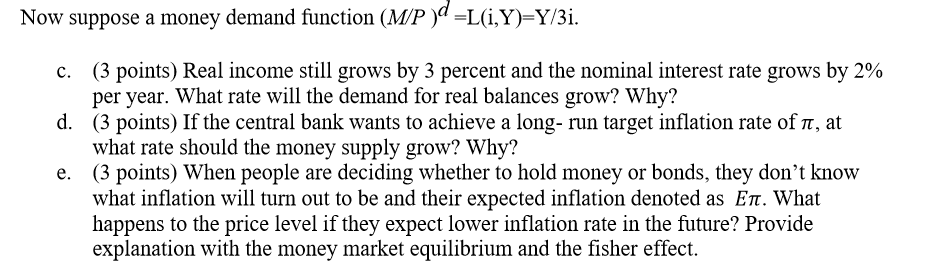

Now suppose a money demand function (M/P ) =L(i,Y)=Y/3i. c. (3 points) Real income still grows by 3 percent and the nominal interest rate grows by 2% per year. What rate will the demand for real balances grow? Why? d. (3 points) If the central bank wants to achieve a long- run target inflation rate of n, at what rate should the money supply grow? Why? e. (3 points) When people are deciding whether to hold money or bonds, they don't know what inflation will turn out to be and their expected inflation denoted as En. What happens to the price level if they expect lower inflation rate in the future? Provide explanation with the money market equilibrium and the fisher effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts