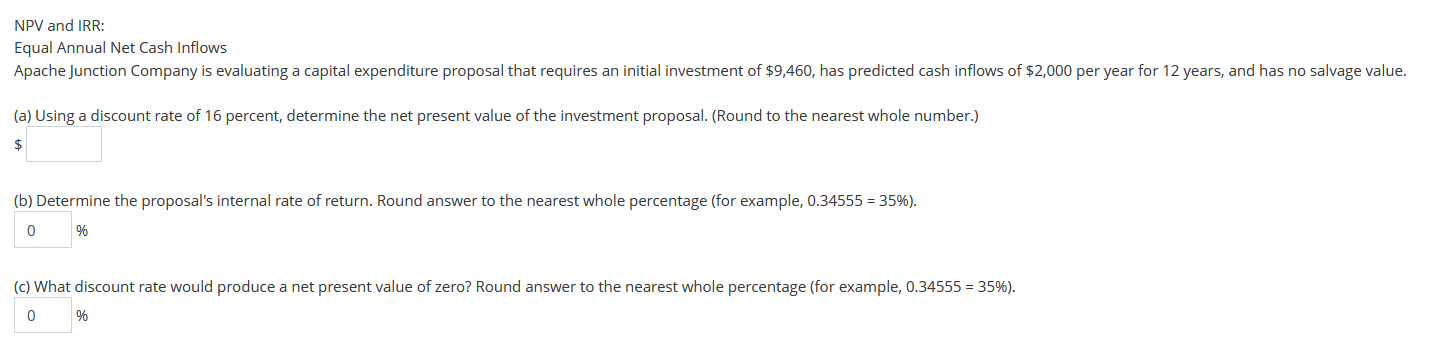

Question: NPV and IRR: Equal Annual Net Cash Inflows Apache Junction Company is evaluating a capital expenditure proposal that requires an initial investment of $9,460,

NPV and IRR: Equal Annual Net Cash Inflows Apache Junction Company is evaluating a capital expenditure proposal that requires an initial investment of $9,460, has predicted cash inflows of $2,000 per year for 12 years, and has no salvage value. (a) Using a discount rate of 16 percent, determine the net present value of the investment proposal. (Round to the nearest whole number.) $ (b) Determine the proposal's internal rate of return. Round answer to the nearest whole percentage (for example, 0.34555 = 35%). 0 % (c) What discount rate would produce a net present value of zero? Round answer to the nearest whole percentage (for example, 0.34555 = 35%). % 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts