Question: NPV Calculation: HELP with an Excel spreadsheet to calculate the net present value of investing in bottling. Would you or would you not invest in

- NPV Calculation: HELP with an Excel spreadsheet to calculate the net present value of investing in bottling. Would you or would you not invest in this project?

- Sensitivity Analysis (interest rates): Calculate NPV if interest rates were 5%, 8%, 10%, and 12%. Discuss how NPV would change and the impact of that change on your decision to invest?

- Optional: Sensitivity Analysis (price of beer): How sensitive is the investment decision to the price of beer? The owners chose to sell its beer at a high price. Would the investment decision be the same if the beer sold for $1.00 less per six-pack at retail? Recalculate the NPV and be definitive. Would you or would you not invest in this project?

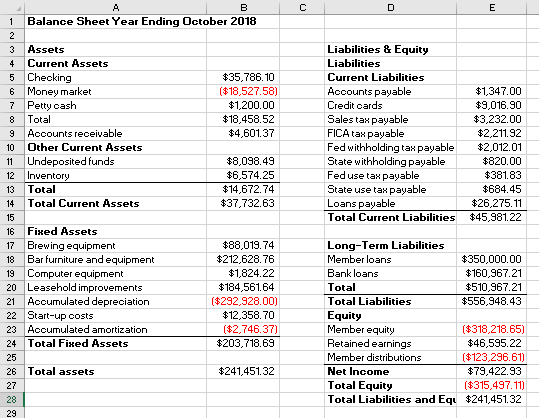

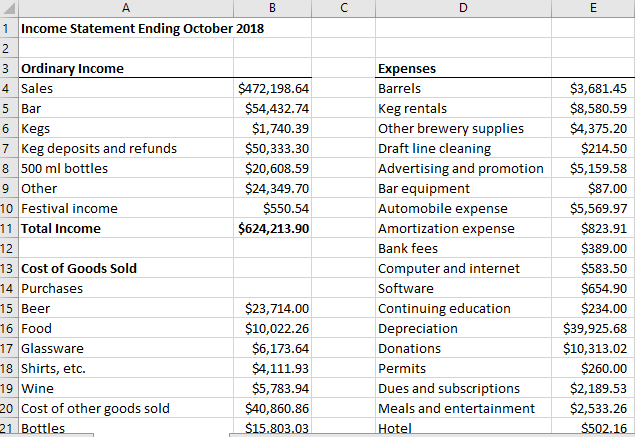

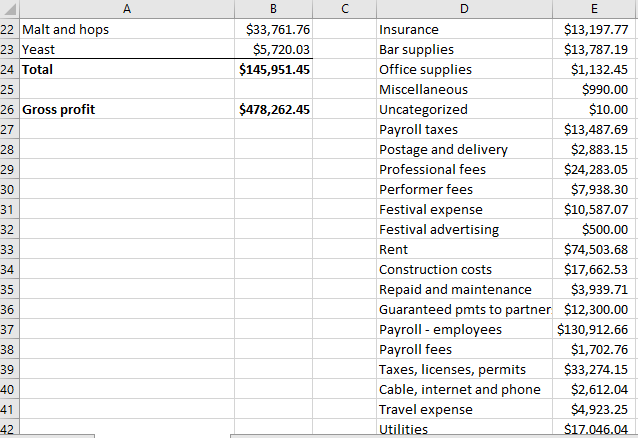

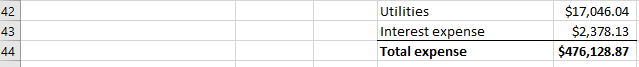

1 Balance Sheet Year Ending October 2018 3 Assets 4 Current Assets 5 Checking 6 Money market 7 Petty cash 8 Total 9Accounts receivable 10 Other Current Assets 11 Undeposited funds 12 Invento 13 Total 14 Total Current Assets Liabilities & Equity Liabilities Current Liabilities Accounts payable Credit cards Sales ta payable FICA ta payable Fed withholding ta payable$2,012.0 State withholding payable Feduse ta payable State use tax payable Loans payable Total Current Liabilities $45,981.22 $35.786.10 $18,527.58) $1,200.00 $18,458.52 $4,601.37 $1.347.00 $9.016.90 $3,232.00 $2,211.92 $8,098.4:9 $6,574.25 $14,672.74 $37.732.63 $820.00 $381.83 $684.45 $26,275.11 16 Fixed Assets 17 Brewing equipment 18 Bar furniture and equipment 19 Computer equipment 20 Leasehold improvements 21 Accumulated depreciation 22 Start-up costs 23 Accumulated amortization 24 Total Fied Assets $88.019.74 $212,628.76 $1,824.22 $184,561.64 ($292,928.00) $12,358.70 ($2,746.37) $203,718.69 Long-Term Liabilities Member loans Bank loans Total Total Liabilities Equity Member equity Retainedearnings Member distributions Net Income Total Equity Total Liabilities and Equ $241451.32 $350,000.00 $160,967.21 $510,967.21 $556,948.43 ($318,218.65) $46,595.22 $123,.296.61 $79,422.93 ($315,497.11) 26 Total assets 27 28 $241,451.32 $33,761.76 $5,720.03 $145,951.45 $13,197.77 $13,787.19 $1,132.45 $990.00 $10.00 $13,487.69 $2,883.15 $24,283.05 $7,938.30 $10,587.07 $500.00 $74,503.68 $17,662.53 Repaid and maintenance $3,939.71 Guaranteed pmts to partner $12,300.00 $130,912.66 $1,702.76 Taxes, licenses, permits$33,274.15 Cable, internet and phone$2,612.04 $4,923.25 6.04 22 Malt and hops 23 Yeast 24 Total 25 26 Gross profit 27 28 29 30 31 32 Insurance Bar supplies Office supplies Miscellaneous Uncategorized Payroll taxes Postage and delive Professional fees Performer fees Festival expense Festival advertising Rent Construction costs $478,262.45 34 35 36 37 38 39 40 41 42 Payroll employees Payroll fees Travel expense lities 42 43 $17,046.04 $2,378.13 $476,128.87 Interest expense Total expense 1 Balance Sheet Year Ending October 2018 3 Assets 4 Current Assets 5 Checking 6 Money market 7 Petty cash 8 Total 9Accounts receivable 10 Other Current Assets 11 Undeposited funds 12 Invento 13 Total 14 Total Current Assets Liabilities & Equity Liabilities Current Liabilities Accounts payable Credit cards Sales ta payable FICA ta payable Fed withholding ta payable$2,012.0 State withholding payable Feduse ta payable State use tax payable Loans payable Total Current Liabilities $45,981.22 $35.786.10 $18,527.58) $1,200.00 $18,458.52 $4,601.37 $1.347.00 $9.016.90 $3,232.00 $2,211.92 $8,098.4:9 $6,574.25 $14,672.74 $37.732.63 $820.00 $381.83 $684.45 $26,275.11 16 Fixed Assets 17 Brewing equipment 18 Bar furniture and equipment 19 Computer equipment 20 Leasehold improvements 21 Accumulated depreciation 22 Start-up costs 23 Accumulated amortization 24 Total Fied Assets $88.019.74 $212,628.76 $1,824.22 $184,561.64 ($292,928.00) $12,358.70 ($2,746.37) $203,718.69 Long-Term Liabilities Member loans Bank loans Total Total Liabilities Equity Member equity Retainedearnings Member distributions Net Income Total Equity Total Liabilities and Equ $241451.32 $350,000.00 $160,967.21 $510,967.21 $556,948.43 ($318,218.65) $46,595.22 $123,.296.61 $79,422.93 ($315,497.11) 26 Total assets 27 28 $241,451.32 $33,761.76 $5,720.03 $145,951.45 $13,197.77 $13,787.19 $1,132.45 $990.00 $10.00 $13,487.69 $2,883.15 $24,283.05 $7,938.30 $10,587.07 $500.00 $74,503.68 $17,662.53 Repaid and maintenance $3,939.71 Guaranteed pmts to partner $12,300.00 $130,912.66 $1,702.76 Taxes, licenses, permits$33,274.15 Cable, internet and phone$2,612.04 $4,923.25 6.04 22 Malt and hops 23 Yeast 24 Total 25 26 Gross profit 27 28 29 30 31 32 Insurance Bar supplies Office supplies Miscellaneous Uncategorized Payroll taxes Postage and delive Professional fees Performer fees Festival expense Festival advertising Rent Construction costs $478,262.45 34 35 36 37 38 39 40 41 42 Payroll employees Payroll fees Travel expense lities 42 43 $17,046.04 $2,378.13 $476,128.87 Interest expense Total expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts