Question: npv for a= npv for b= eac for a= eac for b= You are considering two different methods of constructing a new warehouse. The first

npv for a= npv for b=

npv for a= npv for b=

eac for a= eac for b=

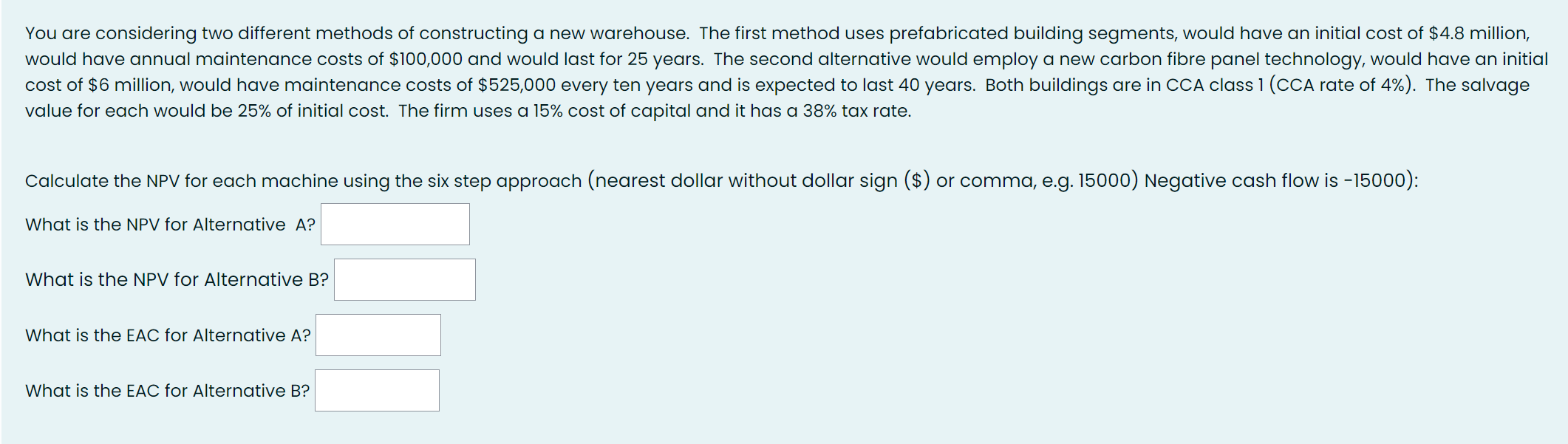

You are considering two different methods of constructing a new warehouse. The first method uses prefabricated building segments, would have an initial cost of $4.8 million, would have annual maintenance costs of $100,000 and would last for 25 years. The second alternative would employ a new carbon fibre panel technology, would have an initial cost of $6 million, would have maintenance costs of $525,000 every ten years and is expected to last 40 years. Both buildings are in CCA class 1 (cCA rate of 4% ). The salvage value for each would be 25% of initial cost. The firm uses a 15% cost of capital and it has a 38% tax rate. Calculate the NPV for each machine using the six step approach (nearest dollar without dollar sign (\$) or comma, e.g. 15000) Negative cash flow is - 15000 ): What is the NPV for Alternative A? What is the NPV for Alternative B? What is the EAC for Alternative A? What is the EAC for Alternative B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts