Question: NPV - Mutually exclusive projects Hock indistries is considering the replacement of one of its old metal stamping machines. Throe alternative replacement machines are under

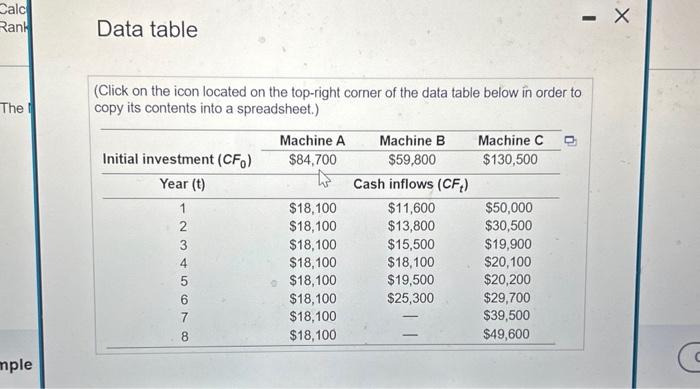

NPV - Mutually exclusive projects Hock indistries is considering the replacement of one of its old metal stamping machines. Throe alternative replacement machines are under consideration. The relevant cash flows associnted with each are shown in tho following tible: The firm's cost of capat is 10%. a. Cakculate the net present value (NPV) of each peess. b. Using NPV, evaluate the acceptabilly of each press. c. Rank the prestes from best to worst using NPV. d. Calculate the profitability inder (PV) for each press. e. Rank the presses from best to worst using Pi. a. The NPV of press A is s (Round to the noarest cert.) NPV - Mutually exclusive projects Hock indistries is considering the replacement of one of its old metal stamping machines. Throe alternative replacement machines are under consideration. The relevant cash flows associnted with each are shown in tho following tible: The firm's cost of capat is 10%. a. Cakculate the net present value (NPV) of each peess. b. Using NPV, evaluate the acceptabilly of each press. c. Rank the prestes from best to worst using NPV. d. Calculate the profitability inder (PV) for each press. e. Rank the presses from best to worst using Pi. a. The NPV of press A is s (Round to the noarest cert.) Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts