Question: * nt AaBbCcDc AabbCcDc AaBbc Aabbcc AaB A-D-A-EES- 1 Normal TNo Spac... Heading 1 Heading 2 Title Paragraph 83) The general journal entry to record

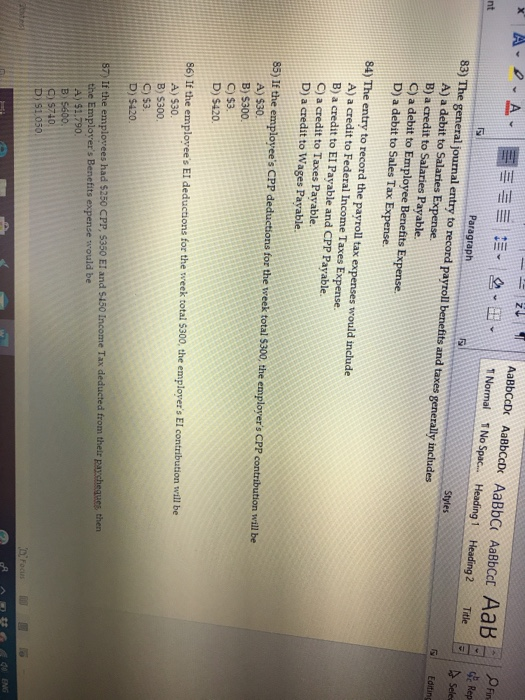

* nt AaBbCcDc AabbCcDc AaBbc Aabbcc AaB A-D-A-EES- 1 Normal TNo Spac... Heading 1 Heading 2 Title Paragraph 83) The general journal entry to record payroll benefits and taxes generally includes A) a debit to Salaries Expense. B) a credit to Salaries Payable. C) a debit to Employee Benefits Expense D) a debit to Sales Tax Expense. Styles Rep A Selec Editing 5 84) The entry to record the payroll tax expenses would include A) a credit to Federal Income Taxes Expense. B) a credit to El Payable and CPP Payable. C) a credit to Taxes Payable. D) a credit to Wages Payable. 85) If the employee's CPP deductions for the week total 5300, the employer's CPP contribution will be A) $30. B) $300. C) $3. D) $420. 86) If the emplovee's El deductions for the week total $300, the employer's El contribution will be A) $30. B) 5300 C) $3. D) $420 So If the emplovees had $250 CPP, 5350 EI and 150 Income Tax deducted from their paycheques then the Emplover's Benefits expense would be A) $1,790 B 5600 ) 5740 D) $1050 i o Drocin A w 2 0 ENG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts