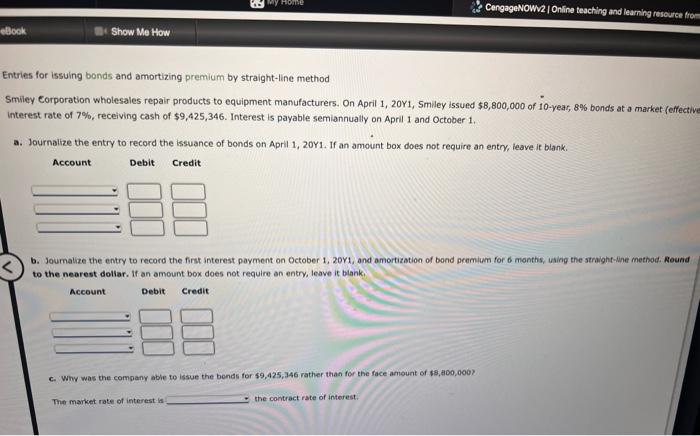

Question: ntries for issuing bonds and amortizing premium by straight-line method Smiley Corporation wholesales repair products to equipment manufacturers. On April 1,20Y1,5miley issued $8,800,000 of 10

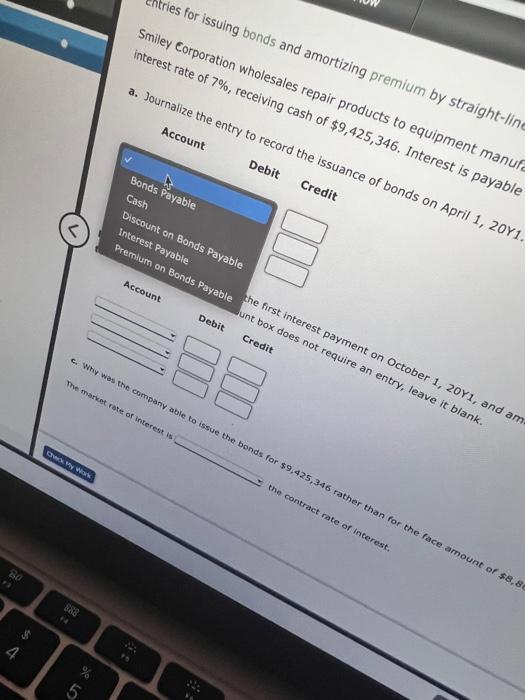

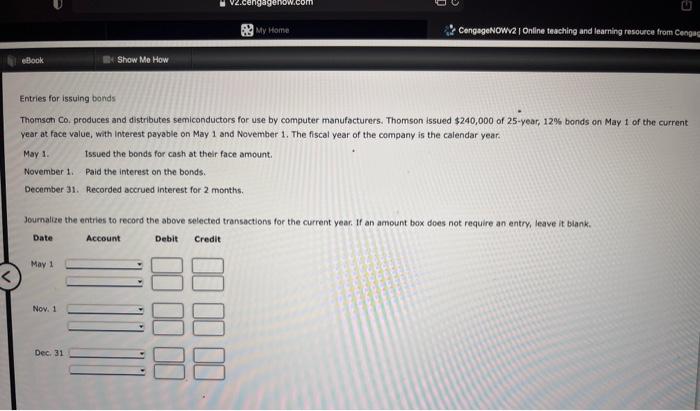

ntries for issuing bonds and amortizing premium by straight-line method Smiley Corporation wholesales repair products to equipment manufacturers. On April 1,20Y1,5miley issued $8,800,000 of 10 -year, 8% bonds at a market (effectiv interest rate of 7%, receiving cash of $9,425,346. Interest is payable semiannually on April 1 and October 1 . a. Journalize the entry to record the issuance of bonds on April 1, 20Y1. If an amount box does not require an entry, leave it blank. b. Joumalize the entry to record the first interest payment on October 1 , 20y1, and amortization of bond peemium for 6 months, using the straight-ine method. Reund to the nearest doliar. If an amount box does not require an entry, leave it blank; c. Why was the company able to issue the bends for 49,425,746 rather than for the face amount of 49,400,0007 The market rate of interest is the contract rate of interest. Smiley corporation wholesales repair products to eceiving cash of $9,425,346, eqipment manup interest rate of 7%, receiving cash of $9,425,346. Interest a. Journalize the entry to Thomsch Co, produces and distributes semiconductors for use by computer manufacturers. Thomson issued $240,000 of 25 -year, 12% bonds on May 1 of the current year at face value, with interest payable on May 1 and November 1 . The fiscal year of the company is the calendar year. May 1. Issued the bonds for cash at their face amount. November 1. Paid the interest on the bonds. December 31. Recorded accrued interest for 2 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts