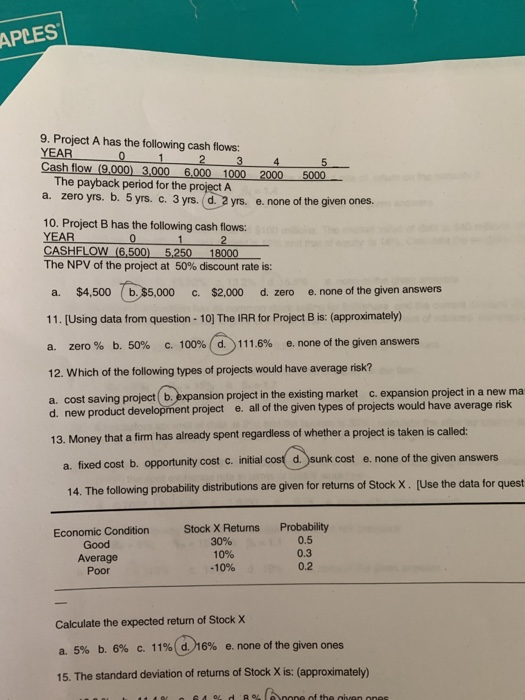

Question: number 10 by hand please! APLES 9. Project A has the following cash flows: YEAR 0 Cash flow (9,000) 3,000 1 2 4 5 6,000

APLES 9. Project A has the following cash flows: YEAR 0 Cash flow (9,000) 3,000 1 2 4 5 6,000 1000 2000 5000 The payback period for the project A a. zero yrs. b. 5 yrs. C. 3 yrs. (d. 2 yrs. e. none of the given ones. 10. Project B has the following cash flows: YEAR 0 1 2 CASHFLOW (6,500) The NPV of the project at 50% discount rate is: 5,250 18000 b. $5,000 e. none of the given answers $4,500 d. zero $2,000 a. 11. [Using data from question- 10] The IRR for Project B is: (approximately) e. none of the given answers C. 100% ( d. 111.6% zero % b. 50% a. 12. Which of the following types of projects would have average risk? a. cost saving project b. expansion project in the existing market c. expansion project in a new ma d. new product development project e. all of the given types of projects would have average risk 13. Money that a firm has already spent regardless of whether a project is taken is called: a. fixed cost b. opportunity cost c. initial cost d. )sunk cost e. none of the given answers 14. The following probability distributions are given for returns of Stock X. [Use the data for quest Probability 0.5 Stock X Retuns 30% 10% -10% Economic Condition Good 0.3 Average Poon 0.2 Calculate the expected return of Stock X c. 11% ( d. 16% e. none of the given ones a. 5% b. 6% 15. The standard deviation of returns of Stock X is: (approximately) One of the niven ones 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts