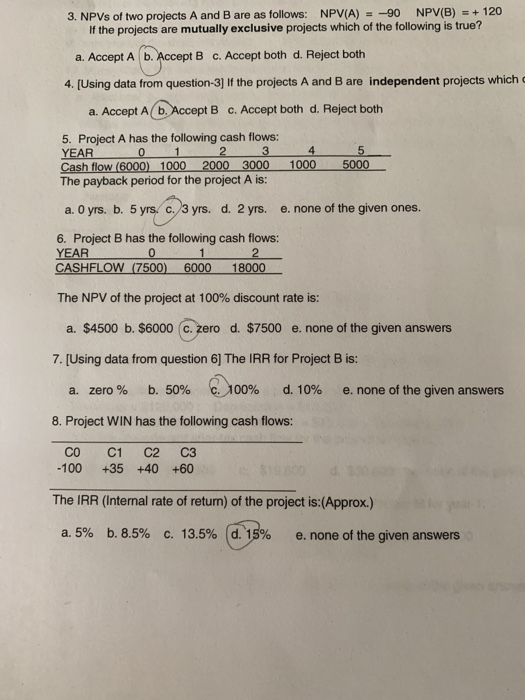

Question: question 6 and 7 please! NPV(B) 120 NPV(A) =-90 3. NPVS of two projects A and B are as follows: If the projects are mutually

NPV(B) 120 NPV(A) =-90 3. NPVS of two projects A and B are as follows: If the projects are mutually exclusive projects which of the following is true? a. Accept A b. Accept B c. Accept both d. Reject both 4. [Using data from question-3] If the projects A and B are independent projects which o a. Accept A(b.Accept B Accept both d. Reject both C. 5. Project A has the following cash flows: 1 3 4 5 2 3000 YEAR 0 1000 5000 2000 Cash flow (6000) 1000 The payback period for the project A is: c. 3 yrs. d. 2 yrs. e. none of the given ones. a. 0 yrs. b. 5 yrs 6. Project B has the following cash flows: 2 18000 YEAR 0 1 CASHFLOW (7500) 6000 The NPV of the project at 100% discount rate is: a. $4500 b. $6000 c. zero d. $7500 e. none of the given answers 7. [Using data from question 6) The IRR for Project B is: b. 50% c. 100% d. 10% e. none of the given answers a. zero % 8. Project WIN has the following cash flows: CO C1 C2 C3 -100 +35 +40 +60 10 00 The IRR (Internal rate of return) of the project is:(Approx.) yn t. b. 8.5 % a. 5% c. 13.5% d. 15 % e. none of the given answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts