Question: number 4 chap 7 hw Check my work 3 Exercise 7.4 (Algo) Second-Stage Allocation (L07-4) 10 points eBook Klumper Corporation is a diversified manufacturer of

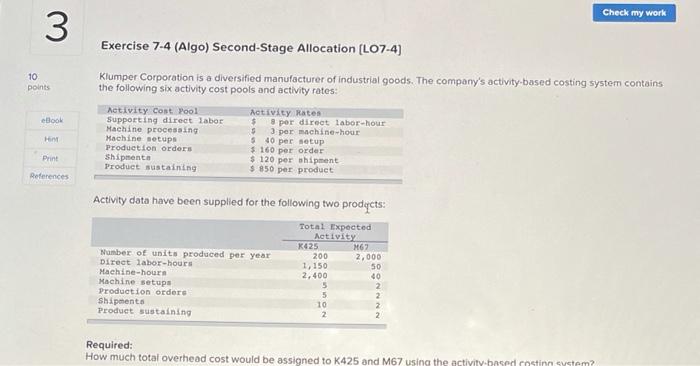

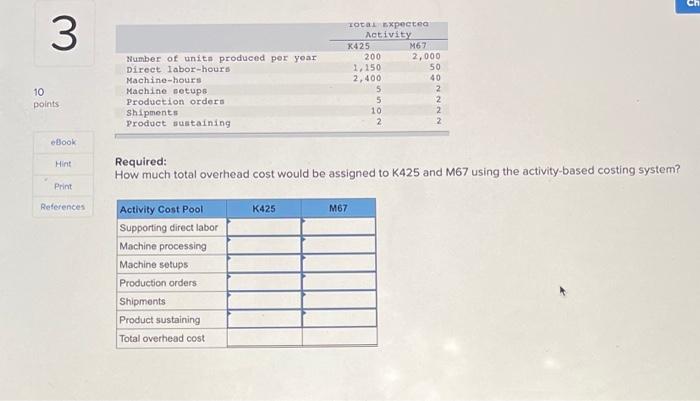

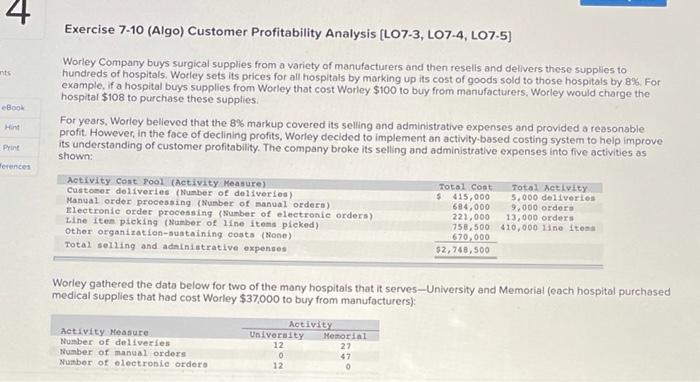

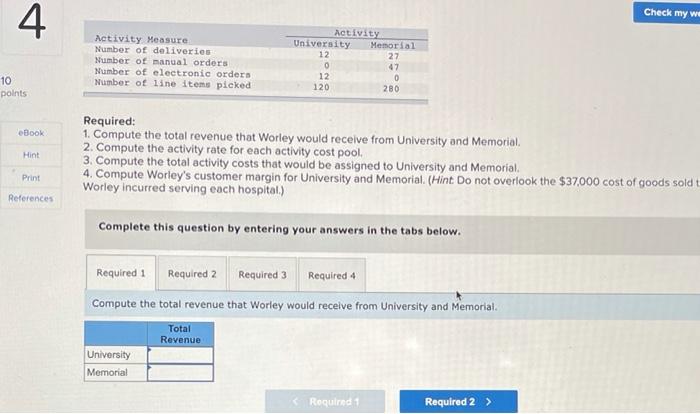

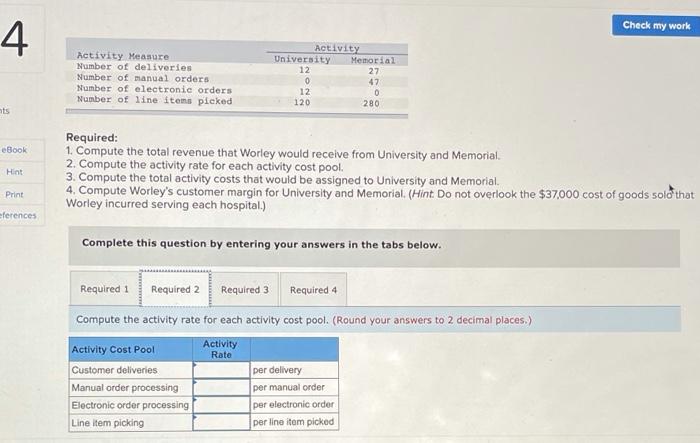

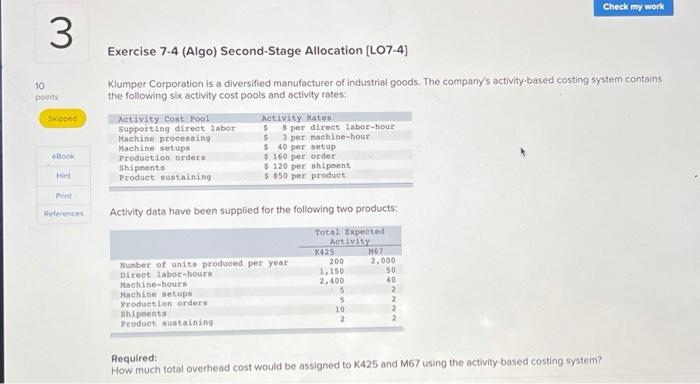

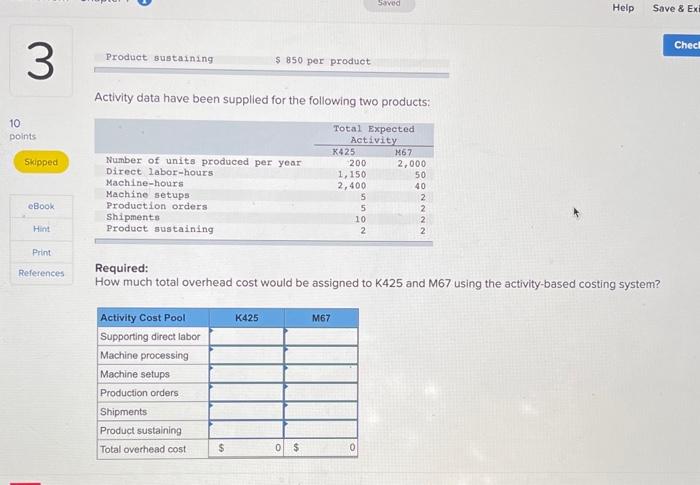

Check my work 3 Exercise 7.4 (Algo) Second-Stage Allocation (L07-4) 10 points eBook Klumper Corporation is a diversified manufacturer of industrial goods. The company's activity based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Activity Rates Supporting direct labor $ per direct labor-hour Machine processing $ per machine-hour Machine setups S40 per setup Production orders 160 per order Shipmenta $ 120 per shipment Product sustaining $ 850 per product Him Print References Activity data have been supplied for the following two prodacts: Number of units produced per year Direct labor-hours Machine-hours Machine setups Production orders Shipments Product sustaining Total Expected Activity K425 M67 200 2,000 1,150 50 2.400 40 5 2 5 2 10 2 2 2 Required: How much total overhead cost would be assigned to K425 and M67 using the activity based costing system? ch 3 TOTAL s.xpected Activity K425 M67 200 2,000 1. 150 50 2,400 40 5 2 5 2. 10 2 2 2 Number of units produced per year Direct labor-hours Machine-hours Machine botups Production orders Shipments Product sustaining 10 points eBook Hint Required: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? Print References K425 M67 Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Total overhead cost 4 Exercise 7-10 (Algo) Customer Profitability Analysis (L07-3, L07-4, LO7.5) nts eBook Worley Company buys surgical supplies from a variety of manufacturers and then resells and delivers these supplies to hundreds of hospitals, Worley sets its prices for all hospitals by marking up its cost of goods sold to those hospitals by 8%. For example, if a hospital buys supplies from Worley that cost Worley $100 to buy from manufacturers, Worley would charge the hospital $108 to purchase these supplies. For years, Worley believed that the 8% markup covered its selling and administrative expenses and provided a reasonable profit. However , in the face of declining profits, Worley decided to implement on activity-based costing system to help improve its understanding of customer profitability. The company broke its selling and administrative expenses into five activities os shown: Hint Print Herences Activity Control (Activity Measure) Customer deliveries (Number of deliveries) Manual order processing (Number of manual orders) Electronie order processing Number of electronie orders) Line Item picking (Number of line itoms picked) Other organization-sustaining costs (none) Total selling and administrative expenses Total Cost Total activity $415,000 5.000 deliver Los 684,000 9,000 orders 221,000 13,000 orders 758,500 410,000 Line itens 670.000 52,748,500 Worley gathered the date below for two of the many hospitals that it serves-University and Memorial (each hospital purchased medical supplies that had cost Worley $37.000 to buy from manufacturers): Activity Measure Number of deliveries Number of manual orders Number of electronie orders Activity University Memorial 12 27 0 47 12 0 Check my we 4 Activity Measure Number of deliveries Number of manual orders Number of electronic orders Number of line items picked Activity University Memorial 12 27 0 47 12 0 120 280 10 points eBook Hint Required: 1. Compute the total revenue that Worley would receive from University and Memorial 2. Compute the activity rate for each activity cost pool. 3. Compute the total activity costs that would be assigned to University and Memorial 4. Compute Worley's customer margin for University and Memorial. (Hint Do not overlook the $37,000 cost of goods soldt Worley incurred serving each hospital.) Print References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the total revenue that Worley would receive from University and Memorial Total Revenue University Memorial Required Required 2 > Check my work 4. Activity Measure Number of deliveries Number of manual orders Number of electronic orders Number of line itens picked Activity University Memorial 12 27 0 47 12 0 120 280 ts eBook Hint Required: 1. Compute the total revenue that Worley would receive from University and Memorial 2. Compute the activity rate for each activity cost pool. 3. Compute the total activity costs that would be assigned to University and Memorial 4. Compute Worley's customer margin for University and Memorial. (Hint Do not overlook the $37,000 cost of goods sold that Worley incurred serving each hospital.) Print eferences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the activity rate for each activity cost pool. (Round your answers to 2 decimal places.) Activity Cost Pool Activity Rate Customer deliveries per delivery Manual order processing per manual order Electronic order processing per electronic order Line item picking per line item picked Check my work 3 Exercise 7.4 (Algo) Second-Stage Allocation (L07-4) 10 points Side Klumper Corporation is a diversified manufacturer of industrial goods. The company's activity based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Activity rates Supporting direct labor $ per direct labor-hour Machine processing 5 per machine-hour Machine setups $ 40 per setup Production orders $ 160 per order Shipments $ 120 per shipment Product sustaining $ 850 per product Book Hint Print melecences Activity data have been supplied for the following two products: Number of units produced per year Direct labor-hours Machine-hours Machine setup Production orders shipments Product sustaining Total txpected Activity X425 M67 200 2.000 1.150 So 2,400 40 5 2 5 10 2 Required: How much total overhead cost would be assigned to K425 and M67 using the activity based costing system? Saved Help Save & Ex Check Product sustaining 3 $ 850 per product Activity data have been supplied for the following two products: 10 points Skipped Number of units produced per year Direct labor-hours Machine-hours Machine setups Production orders Shipments Product sustaining Total Expected Activity K425 M67 200 2,000 1,150 50 2,400 40 5 2 5 2 10 2 2 2 eBook Hint Print References Required: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? K425 M67 Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Total overhead cost $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts