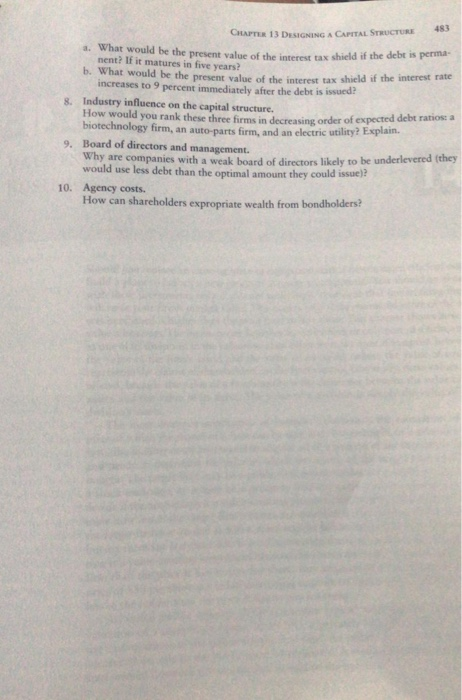

Question: number 8,9,10 CHAPTER 13 DESIGNING A CAPITAL STRUCTURE a. What would be the present value of shield if the debt is perma ment? If it

number 8,9,10

number 8,9,10CHAPTER 13 DESIGNING A CAPITAL STRUCTURE a. What would be the present value of shield if the debt is perma ment? If it matures in five years? b. What would be the present value of the rest a shield if the interest increases to 9 percent immediately after the debt is issued Industry influence on the capital structure. How would you rank these three firms in der eine order of expected debt ratione biotechnology firm, an auto-parts firm, and an electric utility? Explain. 9. Board of directors and management. Why are companies with a weak board of directors likely to be underlevered they would use less debt than the optimal amount they could issue)? 10. Agency costs. How can shareholders expropriate wealth from bondholders? CHAPTER 13 DESIGNING A CAPITAL STRUCTURE a. What would be the present value of shield if the debt is perma ment? If it matures in five years? b. What would be the present value of the rest a shield if the interest increases to 9 percent immediately after the debt is issued Industry influence on the capital structure. How would you rank these three firms in der eine order of expected debt ratione biotechnology firm, an auto-parts firm, and an electric utility? Explain. 9. Board of directors and management. Why are companies with a weak board of directors likely to be underlevered they would use less debt than the optimal amount they could issue)? 10. Agency costs. How can shareholders expropriate wealth from bondholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts