Question: Number A = = E Wrap Text Merge & Center - Paste E % Cut Arial 11 e Copy Format Painter BIU - B A

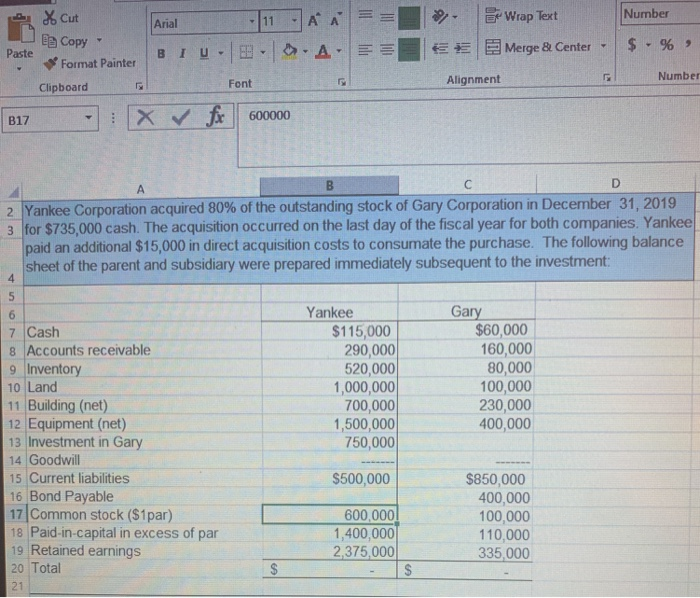

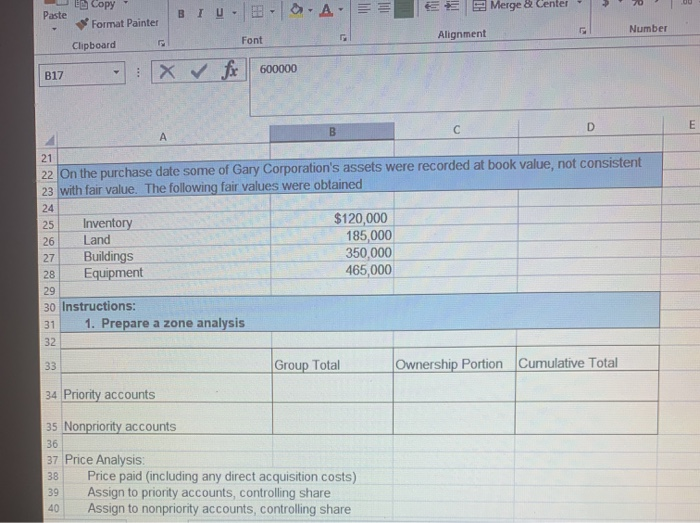

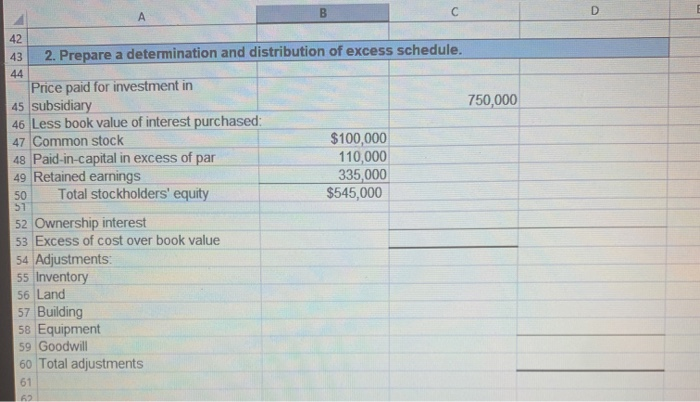

Number A = = E Wrap Text Merge & Center - Paste E % Cut Arial 11 e Copy Format Painter BIU - B A Clipboard Font : X foc 600000 Alignment Number B17 2 Yankee Corporation acquired 80% of the outstanding stock of Gary Corporation in December 31, 2019 3 for $735,000 cash. The acquisition occurred on the last day of the fiscal year for both companies. Yankee paid an additional $15,000 in direct acquisition costs to consumate the purchase. The following balance sheet of the parent and subsidiary were prepared immediately subsequent to the investment: 6 7 Cash 8 Accounts receivable 9 Inventory 10 Land 11 Building (net) 12 Equipment (net) 13 Investment in Gary 14 Goodwill 15 Current liabilities 16 Bond Payable 17 Common stock ($1par) 18 Paid-in-capital in excess of par 19 Retained earnings 20 Total Yankee $115,000 290,000 520,000 1,000,000 700,000 1.500.000 750,000 Gary $60,000 160,000 80,000 100,000 230,000 400,000 $500,000 600.000 1,400,000 2,375,000 - $850,000 400,000 100,000 110,000 335,000 $ $ 21 A. E Merge & Center 5 70 BIU - .00 - Copy Paste Format Painter Clipboard Number Alignment Font B17 : X fic 600000 22 On the purchase date some of Gary Corporation's assets were recorded at book value, not consistent 23 with fair value. The following fair values were obtained Inventory Land Buildings Equipment $120,000 185,000 350,000 465,000 30 Instructions: 31 1. Prepare a zone analysis Group Total Ownership Portion Cumulative Total 34 Priority accounts 35 Nonpriority accounts 38 37 Price Analysis: Price paid (including any direct acquisition costs) Assign to priority accounts, controlling share Assign to nonpriority accounts, controlling share 39 40 C D 43 2. Prepare a determination and distribution of excess schedule. 44 750,000 Price paid for investment in 45 subsidiary 46 Less book value of interest purchased: 47 Common stock 48 Paid-in-capital in excess of par 49 Retained earnings 50 Total stockholders' equity $100,000 110,000 335,000 $545,000 52 Ownership interest 53 Excess of cost over book value 54 Adjustments 55 Inventory 56 Land 57 Building 58 Equipment 59 Goodwill 60 Total adjustments 61 Number A = = E Wrap Text Merge & Center - Paste E % Cut Arial 11 e Copy Format Painter BIU - B A Clipboard Font : X foc 600000 Alignment Number B17 2 Yankee Corporation acquired 80% of the outstanding stock of Gary Corporation in December 31, 2019 3 for $735,000 cash. The acquisition occurred on the last day of the fiscal year for both companies. Yankee paid an additional $15,000 in direct acquisition costs to consumate the purchase. The following balance sheet of the parent and subsidiary were prepared immediately subsequent to the investment: 6 7 Cash 8 Accounts receivable 9 Inventory 10 Land 11 Building (net) 12 Equipment (net) 13 Investment in Gary 14 Goodwill 15 Current liabilities 16 Bond Payable 17 Common stock ($1par) 18 Paid-in-capital in excess of par 19 Retained earnings 20 Total Yankee $115,000 290,000 520,000 1,000,000 700,000 1.500.000 750,000 Gary $60,000 160,000 80,000 100,000 230,000 400,000 $500,000 600.000 1,400,000 2,375,000 - $850,000 400,000 100,000 110,000 335,000 $ $ 21 A. E Merge & Center 5 70 BIU - .00 - Copy Paste Format Painter Clipboard Number Alignment Font B17 : X fic 600000 22 On the purchase date some of Gary Corporation's assets were recorded at book value, not consistent 23 with fair value. The following fair values were obtained Inventory Land Buildings Equipment $120,000 185,000 350,000 465,000 30 Instructions: 31 1. Prepare a zone analysis Group Total Ownership Portion Cumulative Total 34 Priority accounts 35 Nonpriority accounts 38 37 Price Analysis: Price paid (including any direct acquisition costs) Assign to priority accounts, controlling share Assign to nonpriority accounts, controlling share 39 40 C D 43 2. Prepare a determination and distribution of excess schedule. 44 750,000 Price paid for investment in 45 subsidiary 46 Less book value of interest purchased: 47 Common stock 48 Paid-in-capital in excess of par 49 Retained earnings 50 Total stockholders' equity $100,000 110,000 335,000 $545,000 52 Ownership interest 53 Excess of cost over book value 54 Adjustments 55 Inventory 56 Land 57 Building 58 Equipment 59 Goodwill 60 Total adjustments 61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts