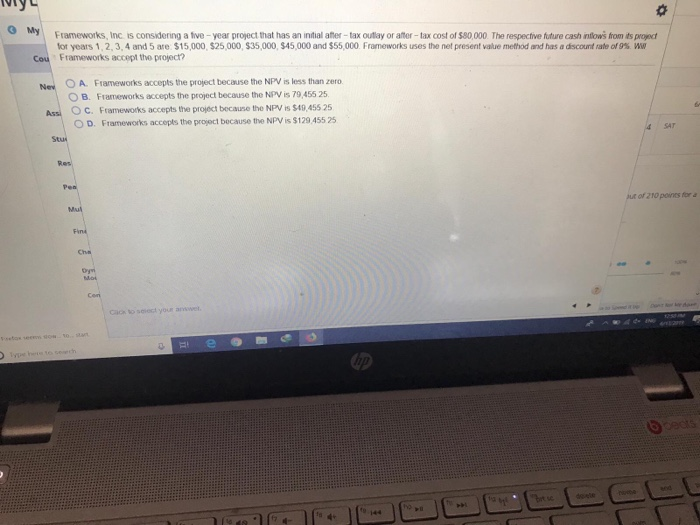

Question: O My Frameworks, Inc is considering a five-year project that has an initial after-tax outlay or after- tax cost of $80,000. The respective future cash

O My Frameworks, Inc is considering a five-year project that has an initial after-tax outlay or after- tax cost of $80,000. The respective future cash intows from its project for years 1,2, 3,4 and 5 are $15,000, $25,000, $35,000, $45,000 and $55,000. Frameworks uses the net present value method and has a discount rate of 9% W Cou Frameworks accept the project? OA Frameworks accepts the project because the NPV is less than zero O B. Frameworks accepts the project because the NPV is 79,455 25 Nev O C. Frameworks accepts the project because the NPV is $49.455 25 Assi O D. Frameworks accepts the project because the NPV is $129.455 25 SAT Stui Res Pen Jut of 210 poines for a Muk Find Che Dyi Mo Cen Cio to sesect your answe sefow seem so 0 an vee heto seech aed home deete tse ho

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts