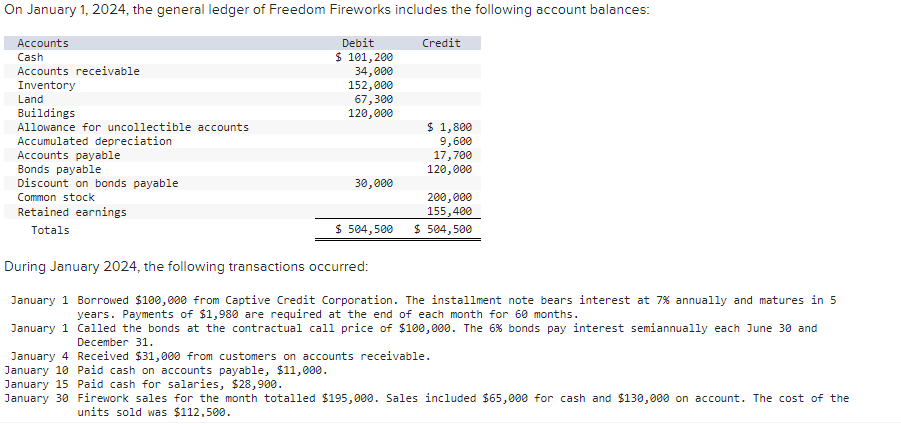

Question: O n January 1 , 2 0 2 4 , the general ledger o f Freedom Fireworks includes the following account balances: ? b egin

January the general ledger Freedom Fireworks includes the following account balances:

egin

line Accounts & Debit & Credit

Cash & $ &

Accounts receivable & &

Inventory & &

Land & &

Buildings & &

Allowance for uncollectible accounts & & $

Accumulated depreciation & &

Accounts payable & &

Bonds payable & &

Discount bonds payable & &

Cormmon stock & &

Retained earnings & &

Totals & $ & $

During January the following transactions occurred:

January Borrowed $ from Captive Credit Corporation. The installment note bears interest annually and matures

years. Payments $ are required the end each month for months.

January Called the bonds the contractual call price $ The bonds pay interest semiannually each June and

December

January Received $ from customers accounts receivable.

January Paid cash accounts payable, $

January Paid cash for salaries, $

January Firework sales for the month totalled $ Sales included $ for cash and $ account. The cost the

units sold was $

Danuary Paid cash for salaries, $

January Firework sales for the month totalled $ Sales included $ for cash and $ account. The cost the

units sold was $

January Paid the first monthly installment $ related the $ borrowed January

The following information available January

Depreciation the building for the month January calculated using the straightline method. the time the building was

purchased, the company estimated a service life ten years and a residual value $

the end January, $ accounts receivable are past due, and the company estimates that these accounts will

not collected. the remaining accounts receivable, the company estimates that will not collected. accounts were

written off uncollectible January.

Unpaid salaries the end January are $

Accrued income taxes the end January are $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock