Question: Required information Exercise 8 - 1 9 ( Algo ) Complete the accounting cycle ( LO 8 - 1 , 8 - 2 , 8

Required information

Exercise Algo Complete the accounting cycle LO

Skip to question

The following information applies to the questions displayed below.

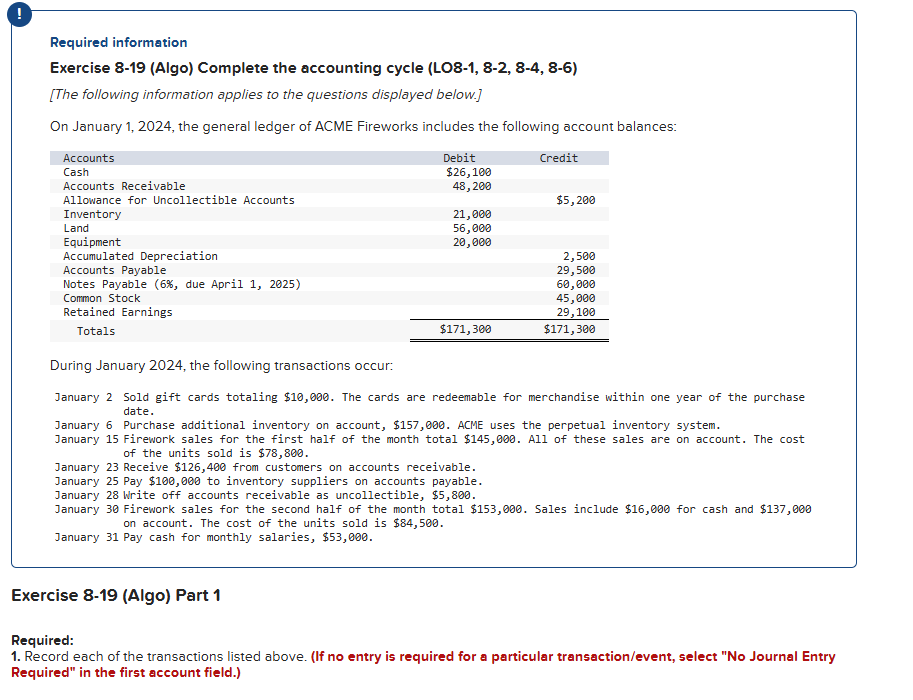

On January the general ledger of ACME Fireworks includes the following account balances:

AccountsDebitCreditCash$Accounts ReceivableAllowance for Uncollectible Accounts$InventoryLandEquipmentAccumulated DepreciationAccounts PayableNotes Payable due April Common StockRetained EarningsTotals$$

During January the following transactions occur:

January Sold gift cards totaling $ The cards are redeemable for merchandise within one year of the purchase date.January Purchase additional inventory on account, $ ACME uses the perpetual inventory system.January Firework sales for the first half of the month total $ All of these sales are on account. The cost of the units sold is $January Receive $ from customers on accounts receivable.January Pay $ to inventory suppliers on accounts payable.January Write off accounts receivable as uncollectible, $January Firework sales for the second half of the month total $ Sales include $ for cash and $ on account. The cost of the units sold is $January Pay cash for monthly salaries, $

Exercise Algo Part

Required:

Record each of the transactions listed above. If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field.

Required information

Exercise Algo Complete the accounting cycle LO

The following information applies to the questions displayed below.

On January the general ledger of ACME Fireworks includes the following account balances:

During January the following transactions occur:

January Sold gift cards totaling $ The cards are redeemable for merchandise within one year of the purchase

date.

January Purchase additional inventory on account, $ ACME uses the perpetual inventory system.

January Firework sales for the first half of the month total $ All of these sales are on account. The cost

of the units sold is $

January Receive $ from customers on accounts receivable.

January Pay $ to inventory suppliers on accounts payable.

January Write off accounts receivable as uncollectible, $

January Firework sales for the second half of the month total $ Sales include $ for cash and $

on account. The cost of the units sold is $

January Pay cash for monthly salaries, $

Exercise Algo Part

Required:

Record each of the transactions listed above. If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field. Exercise Algo Part

Required:

Record each of the transactions listed above. If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field.

Journal entry worksheet

Record sale of gift cards totaling $ The cards are redeemable for merchandise within one year of the purchase date.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock