Question: O O Carlyle Inc. is considering two mutually exclusive projects. Both require an initial investment of $14,200 at t = 0. O Project S has

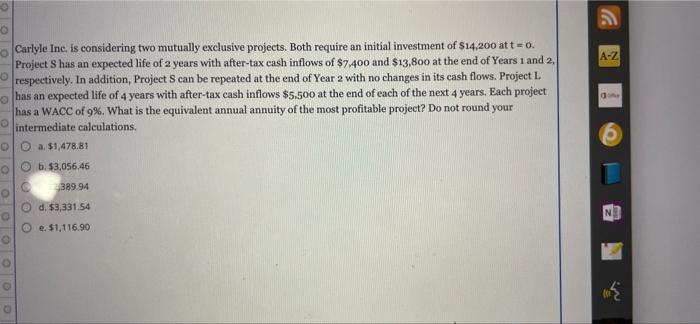

O O Carlyle Inc. is considering two mutually exclusive projects. Both require an initial investment of $14,200 at t = 0. O Project S has an expected life of 2 years with after-tax cash inflows of $7,400 and $13,800 at the end of Years 1 and 2, respectively. In addition, Project S can be repeated at the end of Year 2 with no changes in its cash flows. Project L has an expected life of 4 years with after-tax cash inflows $5.500 at the end of each of the next 4 years. Each project has a WACC of 9%. What is the equivalent annual annuity of the most profitable project? Do not round your intermediate calculations. a. $1,478.81 b. $3,056.46 C 389.94 d. $3,331.54 e. $1,116.90 OO A-Z done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts