Question: O O O 5. It is not possible to diversify away systematic risk. 6. A portfolio's standard deviation decreases as more stocks are added. 7.

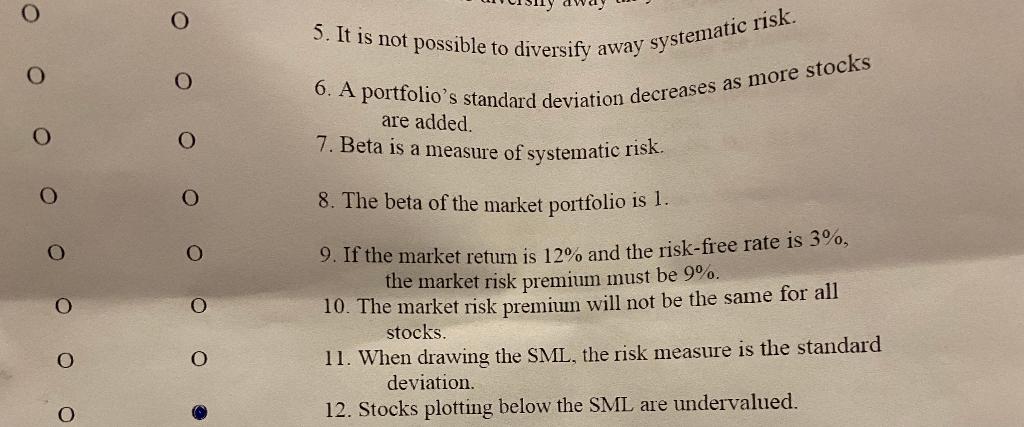

O O O 5. It is not possible to diversify away systematic risk. 6. A portfolio's standard deviation decreases as more stocks are added. 7. Beta is a measure of systematic risk. O O O O O O 8. The beta of the market portfolio is 1. 9. If the market return is 12% and the risk-free rate is 3%, the market risk premium must be 9%. 10. The market risk premium will not be the same for all stocks. 11. When drawing the SML, the risk measure is the standard deviation. 12. Stocks plotting below the SML are undervalued

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock