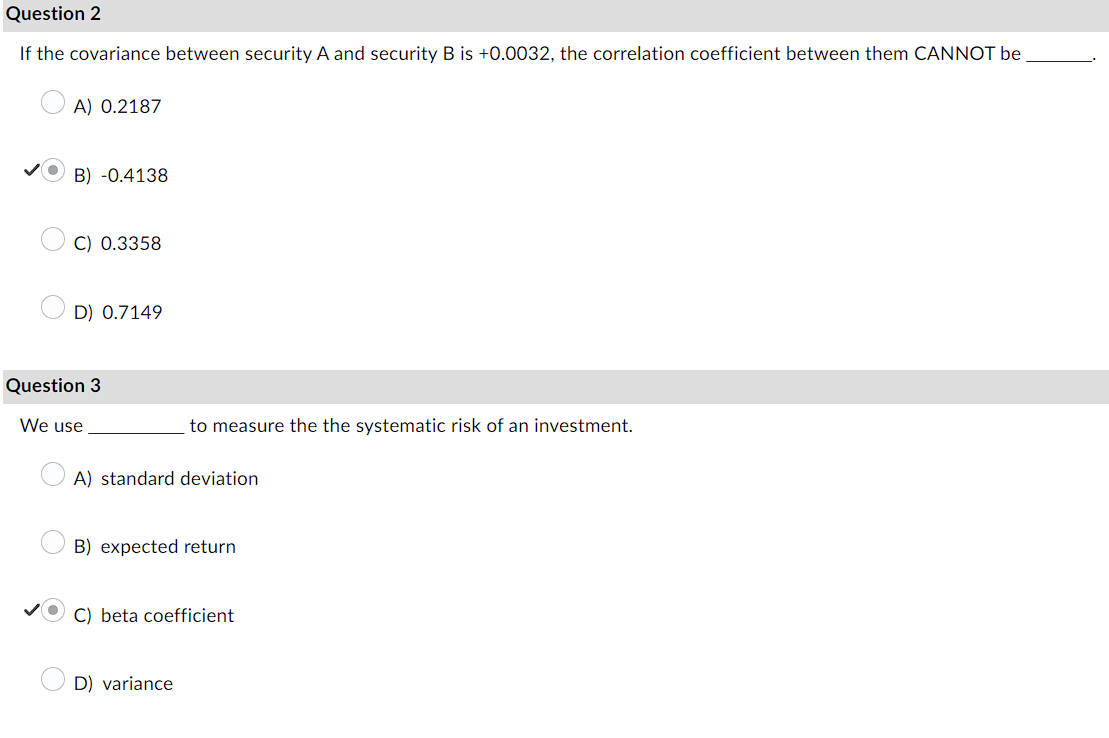

Question: Question 2 If the covariance between security A and security B is +0.0032. the correlation coefficient between them CANNOT be A} 0.2187 ~' 9 B]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock