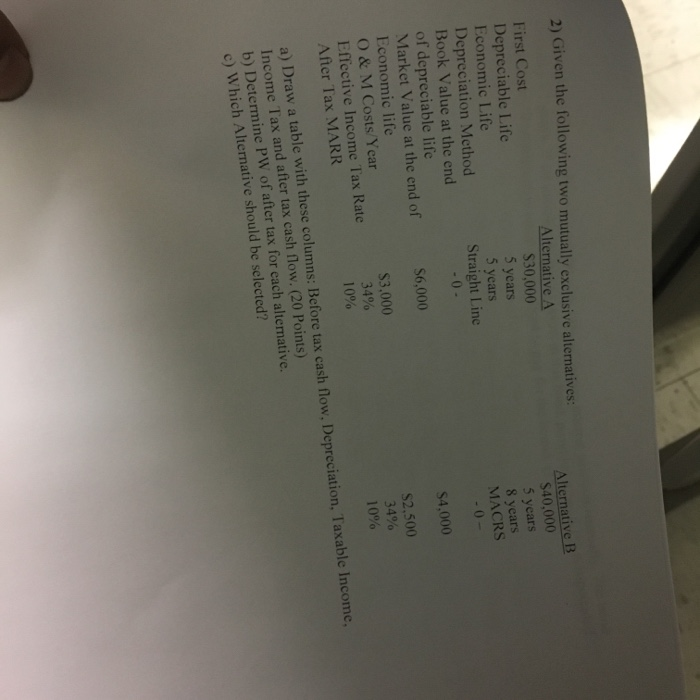

Question: 2) Given the following two mutually exclusive alternatives: Alternative A S30,000 5 years 5 years Straight Line Alternative B S40,000 5 years 8 years MACRS

2) Given the following two mutually exclusive alternatives: Alternative A S30,000 5 years 5 years Straight Line Alternative B S40,000 5 years 8 years MACRS First Cost Depreciable Life Economic Life Depreciation Method Book Value at the end of depreciable life Market Value at the end of Economic life O & M Costs/Year Effective Income Tax Rate After Tax MARR S6,000 S4,000 S3,000 34% 10% S2.500 3490 10% ash flow, Depreciation, Taxable Income, a) Draw a table with these columns Income Tax and after tax cash flow. (20 Points) b) Determ c) Which Alternative should be selected ine PW of after tax for each altemative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts