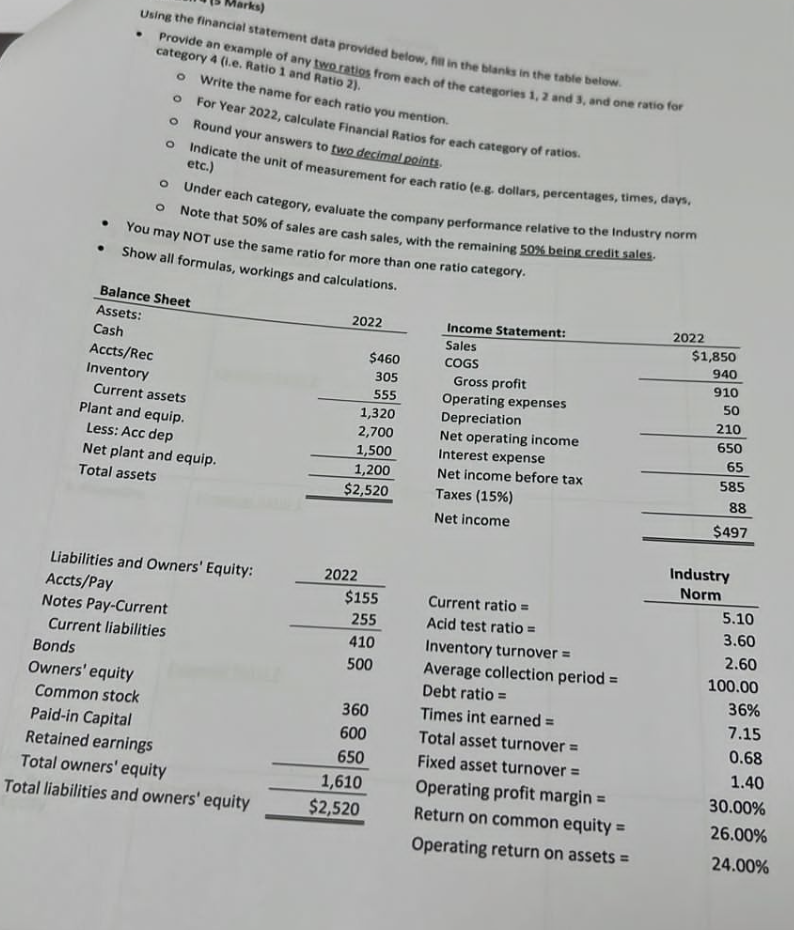

Question: . o Using the financial statement data provided below, will in the blanks in the table below Provide an example of any two ratios from

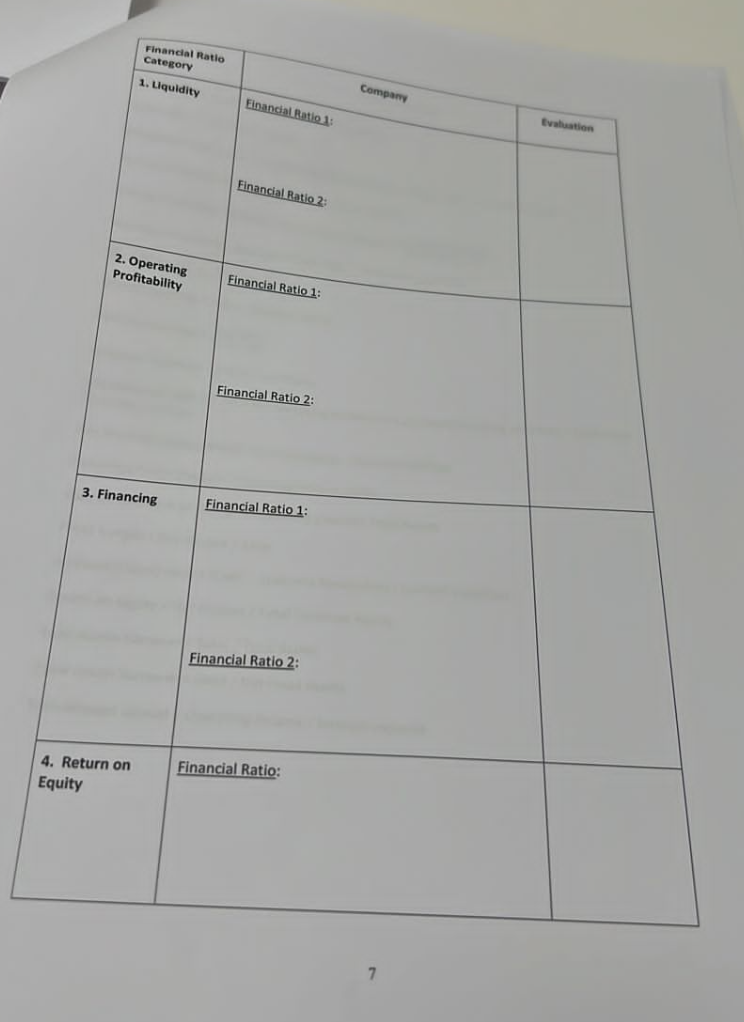

. o Using the financial statement data provided below, will in the blanks in the table below Provide an example of any two ratios from each of the categories 1, 2 and 3, and one ratio for category 4 (i.e. Ratio 1 and Ratio 2). Write the name for each ratio you mention o For Year 2022, calculate Financial Ratios for each category of ratios. Round your answers to two decimal points Indicate the unit of measurement for each ratio (e.g. dollars, percentages, times, days. etc.) Under each category, evaluate the company performance relative to the industry norm Note that 50% of sales are cash sales, with the remaining 50% belog credit sales. You may NOT use the same ratio for more than one ratio category. Show all formulas, workings and calculations. O O . . 2022 Balance Sheet Assets: Cash Accts/Rec Inventory Current assets Plant and equip. Less: Acc dep Net plant and equip. Total assets $460 305 555 1,320 2,700 1,500 1,200 $2,520 Income Statement: Sales COGS Gross profit Operating expenses Depreciation Net operating income Interest expense Net income before tax Taxes (15%) Net income 2022 $1,850 940 910 50 210 650 65 585 88 $497 Liabilities and Owners' Equity: Accts/Pay Notes Pay-Current Current liabilities Bonds Owners' equity Common stock Paid-in Capital Retained earnings Total owners' equity Total liabilities and owners' equity 2022 $155 255 410 500 360 600 650 1,610 $2,520 Current ratio = Acid test ratio = Inventory turnover = Average collection period = Debt ratio = Times int earned = Total asset turnover = Fixed asset turnover = Operating profit margin = Return on common equity = Operating return on assets = Industry Norm 5.10 3.60 2.60 100.00 36% 7.15 0.68 1.40 30.00% 26.00% 24.00% = Financial Ratio Category 1. Liquidity Company Financial Ratio Evaluation Financial Ratio 2: 2. Operating Profitability Financial Ratio 1: Financial Ratio 2: 3. Financing Financial Ratio 1: Financial Ratio 2: 4. Return on Equity Financial Ratio: 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts