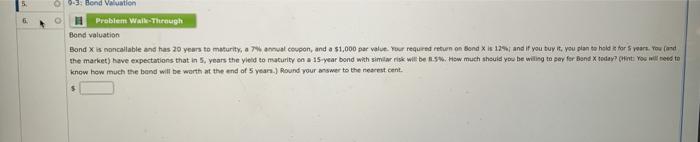

Question: O9-3. Bond Valuation Problem Walkthrough Bond valuation Bond X is moncailable and has 20 years to maturity, a 7 annual coupon, and a $1,000 par

O9-3. Bond Valuation Problem Walkthrough Bond valuation Bond X is moncailable and has 20 years to maturity, a 7 annual coupon, and a $1,000 par value your required return on dona X is 125 and if you buy it. you plan to hold for years. You and the market) have expectations that in 5 years the yield to maturity on 15-year bond with similar risk will be 1.5. How much should you be willing to pay for hand today? Hint You will need to know how much the band will be worth at the end of years) Round your answer to the nearest cent. 5

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock