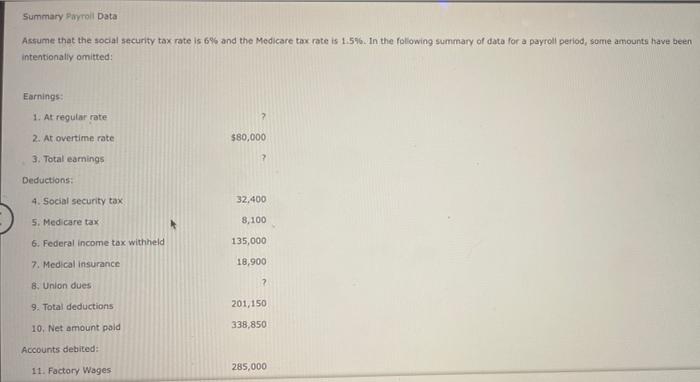

Question: Summary Payroll Data Assume that the social security tax rate is 6% and the Medicare tax rate is 1.5%. In the following summary of data

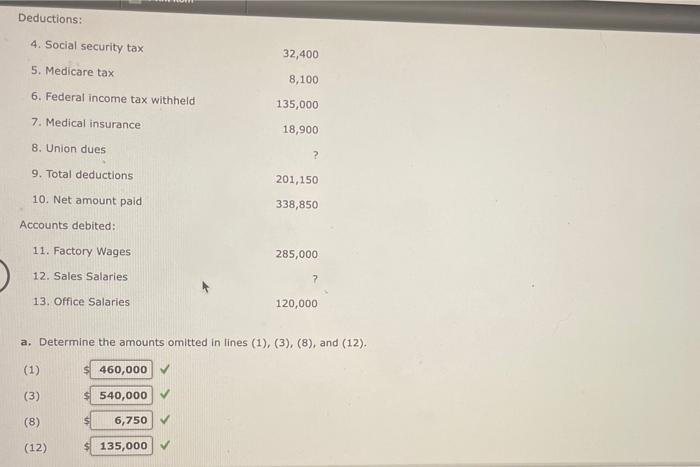

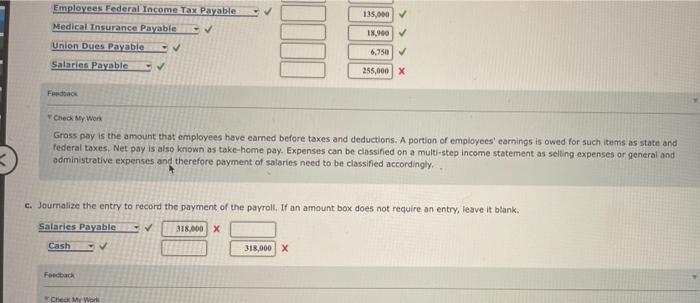

Summary Payroll Data Assume that the social security tax rate is 6% and the Medicare tax rate is 1.5%. In the following summary of data for a payroll period, some amounts have been intentionally omitted: Earnings: 1. At regular rate 2 2. At overtime rate $80,000 3. Total earings 2 Deductions: 4. Social security tax 32,400 5. Medicare tax 8,100 6. Federal income tax withheld 135,000 7. Medical insurance 18,900 8. Union dues 2 9. Total deductions 201,150 10. Net amount pald 338,850 Accounts debited: 11. Factory Wages 285,000 Deductions: 4. Social security tax 32,400 5. Medicare tax 8,100 6. Federal income tax withheld 135,000 7. Medical insurance 18,900 8. Union dues ? 9. Total deductions 201,150 10. Net amount paid 338,850 Accounts debited: 11. Factory Wages 285,000 12. Sales Salaries 7 13. Office Salaries 120,000 a. Determine the amounts omitted in lines (1), (3), (8), and (12) $ 460,000 (3) $540,000 (8) 1 6,750 (12) 135,000 Employees Federal Income Tax Payable Medical Insurance Payable 135,000 18,000 Union Dues Payable 6,750 Salaries Payable 255,000 X Check My Work Gross pay is the amount that employees have earned before taxes and deductions. A portion of employees' earnings is owed for such items as state and federal taxes. Net pay is also known as take home pay. Expenses can be classified on a multi-step income statement as selling expenses or general and administrative expenses and therefore payment of salaries need to be classified accordingly.. C. Journalize the entry to record the payment of the payroll. If an amount box does not require an entry, leave it blank. Salaries Payable 318.000X Cash 318,000 X Feedback Check My World

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts