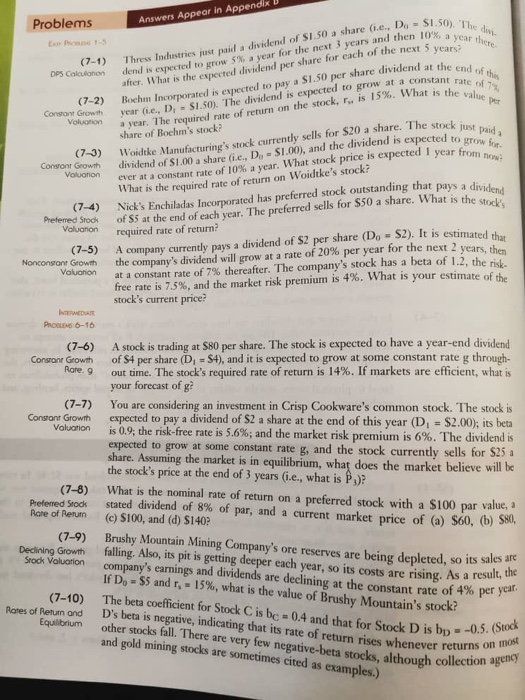

Question: oblems swers Appear in Appendix l to grow 5% a year for the next 3 years and then l expected dividend per share for each

oblems swers Appear in Appendix l to grow 5% a year for the next 3 years and then l expected dividend per share for each of the nex 10% a year ther. Thress Industries just paid a dividenor the next 3 year dend is expected after. What is the (7-1) 05 Calafohon l is expected to pay a S1.50 per share dividend at expected to the end of grow at a constant rate of 7 (7-2) Bochm Incorporated 15%. What is the, , stock, r," is a year. The required rate of return on the s share of Bochm's stock? Congant Growsh onvoy rowt year Ge., D, S1.50). The dividend is (7-3) Woidtke Manufacturing's stock currently sells for $20 a share. The stock jiust $1.00), and the dividend is expected to grid a Gdividend of $1.00 a share (i.e., D Valuarion ever at a c What is the required rate of return on Woidtke's stock? Nick's Enchiladas Incorporated has preferred stock outstanding that pays a d of S5 at the end of each year. The preferred sells for $50 a share. What is the dend ever at a constant rate of 10% a year. What stock price is expected 1 year from oonon Prefemed Stock (7-5) A company currently pays a dividend of S2 per share (D $2). It is estimated oon at a constant rate of 7% thereafter. The company's stock has a beta of 1.2, then required rate of return? the company's dividend will grow at a rate of 20% per year for the next 2 years, the free rate is 7.5%, and the market risk premium11s 4%. What is your estimate ofthe No congont Gowt Valuation stock's current price? (7-6) A stock is trading at $80 per share. The stock is expected to have a year-end dividend Consronr Growth of S4 per share (Di S4), and it is expected to grow at some constant rate g through- Rare, 9 out time. The stock's required rate of return is 14%. If markets are efficient, what is your forecast of g? (7-7) You are considering an investment in Crisp Cookware's common stock. The stock is Consant Growth expected to pay a dividend of S2 a share at the end of this year (Di $2.00); its beta Valuation e risk-free rate is 5.6%, and the market risk premium is 6%. The dividend is expected to grow at some constant rate g, and the stock currently sells or S25. share. Assuming the market is in equilibrium, what does the market believe will be is 0.9, th the stock's price at the end of 3 years (ie, what is P,)? (7-8) What is the nominal rate of return on a preferred stock with a $100 par value, a Preferred Stock stated dividend of 8% of par, and a current market price of (a) S60, (b) so Rare of Rerun (c) $100, and (d) $140? Decdining Growth falling. Also, its pit is getting deeper each year, so its costs are rising. As a result, thi Company's ore reserves are being depleted, so1 Stock Voloron company's earnings and dividends are declining at the constant rate of 4% pe If Do-S5 and r, , 15%, what is the value of Brushy Mountain's stock? 7-10) The beta coeficient for Stock C is be 04 and that for Stock D is bp -0.5,St Rates of Retum and Equilbrium other stocks fall. There are very few negative-beta stocks, although collection D's beta is negative, indicating that its rate of return rises whenever returns on and gold mining stocks are sometimes cited as examples.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts