Question: obprinciples-of-managerial-finance, 14e (S) pdf (SECURED) , Adobe Acrobat Reader DC Edit View Window Help me Tools cob_principles of Expe Cre PART 5 Long-Term Investment Decisions

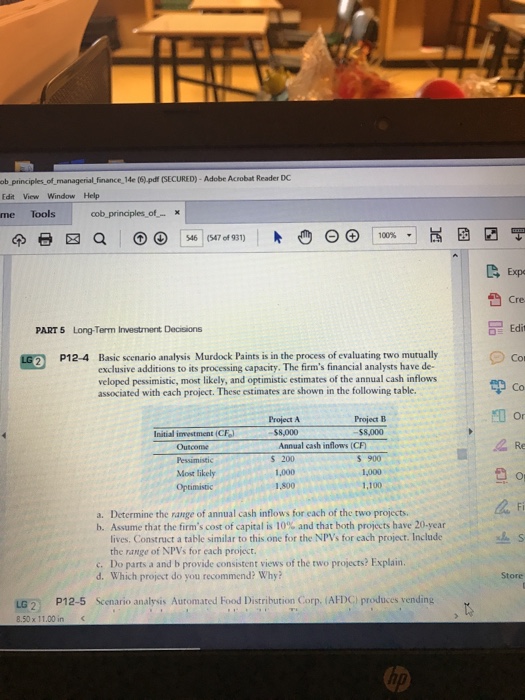

obprinciples-of-managerial-finance, 14e (S) pdf (SECURED) , Adobe Acrobat Reader DC Edit View Window Help me Tools cob_principles of Expe Cre PART 5 Long-Term Investment Decisions Edit LG2 P12-4 Basic scenario analysis Murdock Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. The firm's financial analysts have de- veloped pessimistic, most likely, and optimistic estimates of the annual cash inflows associated with each project. These estimates are shown in the following table. Or Project B ProjectA$.000 Initial inmestment (CF $8,000 OucomAnual cah infions CF Re Pessimisti Most likely Optimistic s 200 1,000 1,800 S 900 1,000 1,100 Determine the range of annual cash inflows for each of the two projects. Assume that the firm's cost of capital is 10% and that both projects have 20-year lives. Construct a table similar to this one for the NPVs for each project. Include the range of NPVs for each project Do parts a and b provide consistent views of the two projects? Explain. Which project do you recommend? Why? a. h, c. d. Store LGP12-5 Scenario analysis Automated Food Distribution Corp. (AFDC) produces vending 8.50 x 11.00 in c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts