Question: OCapital Structure and Leverage: Determining the Optimal Capital Structure o The optimal capital structure is the one that -Select the price of the firm's stock,

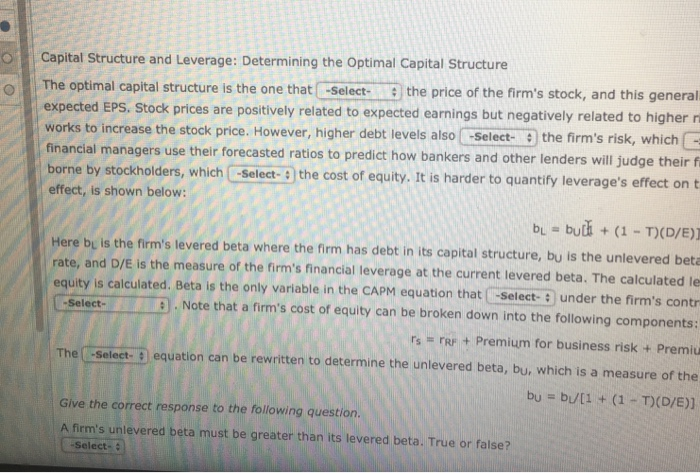

OCapital Structure and Leverage: Determining the Optimal Capital Structure o The optimal capital structure is the one that -Select the price of the firm's stock, and this general expected EPS. Stock prices are positively related to expected earnings but negatively related to higher n works to increase the stock price. However, higher debt levels also -Select- the firm's risk, which financial managers use their forecasted ratios to predict how bankers and other lenders will judge their f borne by stockholders, which -Select- 9 the cost of equity. It is harder to quantify leverage's effect on t effect, is shown below: bu bui (1 T)(D/E) Here bu is the firm's levered beta where the firm has debt in its capital structure, bu is the unlevered beta rate, and D/E is the measure of the firm's financial leverage at the current levered beta. The calculated le equity is calculated. Beta is the only variable in the CAPM equation that -Select- under the firm's contr . Note that a firm's cost of equity can be broken down into the following components: rs RF + Premium for business risk + Premiu The (-Select- equation can be rewritten to determine the unlevered beta, bu, which is a measure of the bu b/[1 +(1 T(D/E)] Select- Give the correct response to the following question. A firm's unlevered beta must be greater than its levered beta. True or false? Select- OCapital Structure and Leverage: Determining the Optimal Capital Structure o The optimal capital structure is the one that -Select the price of the firm's stock, and this general expected EPS. Stock prices are positively related to expected earnings but negatively related to higher n works to increase the stock price. However, higher debt levels also -Select- the firm's risk, which financial managers use their forecasted ratios to predict how bankers and other lenders will judge their f borne by stockholders, which -Select- 9 the cost of equity. It is harder to quantify leverage's effect on t effect, is shown below: bu bui (1 T)(D/E) Here bu is the firm's levered beta where the firm has debt in its capital structure, bu is the unlevered beta rate, and D/E is the measure of the firm's financial leverage at the current levered beta. The calculated le equity is calculated. Beta is the only variable in the CAPM equation that -Select- under the firm's contr . Note that a firm's cost of equity can be broken down into the following components: rs RF + Premium for business risk + Premiu The (-Select- equation can be rewritten to determine the unlevered beta, bu, which is a measure of the bu b/[1 +(1 T(D/E)] Select- Give the correct response to the following question. A firm's unlevered beta must be greater than its levered beta. True or false? Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts