Question: ocator assignment-take Wv2| Online te... X ?[a Preview!?Clip E Auto ClipIED Clip List ? |21 Search-.| Print Share | More h... c TripAdvisor Operating Leverage

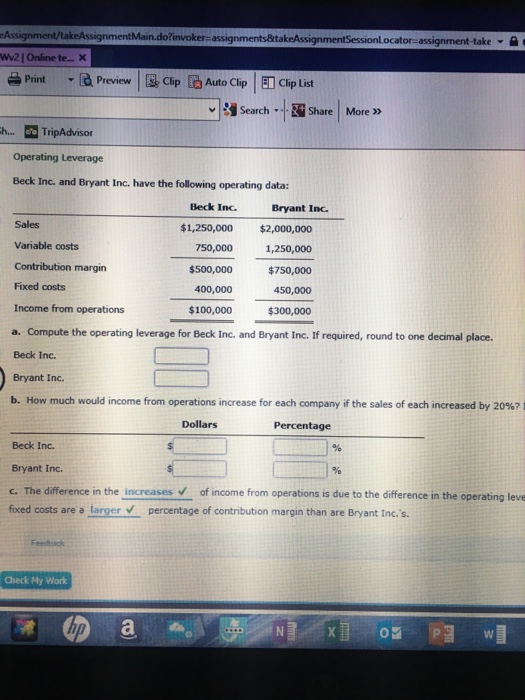

ocator assignment-take Wv2| Online te... X ?[a Preview!?Clip E Auto ClipIED Clip List ? |21 Search-.| Print Share | More h... c TripAdvisor Operating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc Bryant Inc. Sales Variable costs Contribution margin Fixed costs Income from operations a. Compute the operating leverage for Beck Inc. and Bryant Inc. If required, round to one decimal place. Beck Inc. Bryant Inc. b. How much would income from operations increase for each company if the sales of each increased by 20% $1,250,000 $2,000,000 750,000 1,250,000 $750,000 450,000 300,000 $500,000 400,000 $100,000 Dollars Percentage Beck Inc. Bryant Inc c. The difference in the increases of income from operations is due to the difference in the operating leve fixed costs are a larger percentage of contribution margin than are Bryant Inc. 's Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts