Question: ock.csod.com / lms / scorm / clientlMS / LMS 3 . aspx?rNum = 1 8 aicc _ sid = 5 8 9 4 9 4

ock.csod.comlmsscormclientlMSLMSaspx?rNumaiccsidhrblock&lpac

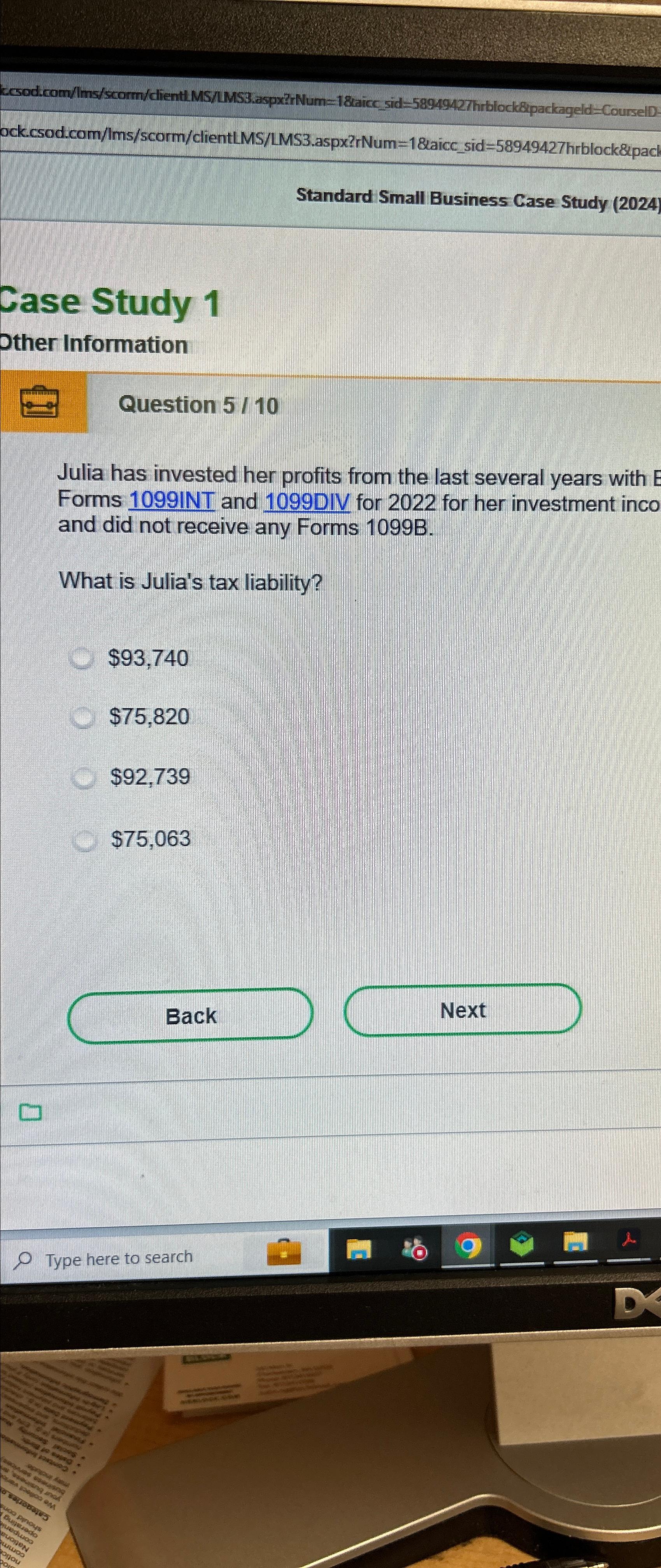

Standard Small Business Case Study

Case Study

ther Information

Question

Julia has invested her profits from the last several years with Forms INT and DIV for for her investment inco and did not receive any Forms B

What is Julia's tax liability?

$

$

$

$

Back

Next

Type here to search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock