Question: odule 3 Homework Assignment Score Save Submit Assignment for G roblem &1 Check My Work (2 remaining Click here to read the eBook: The Determinants

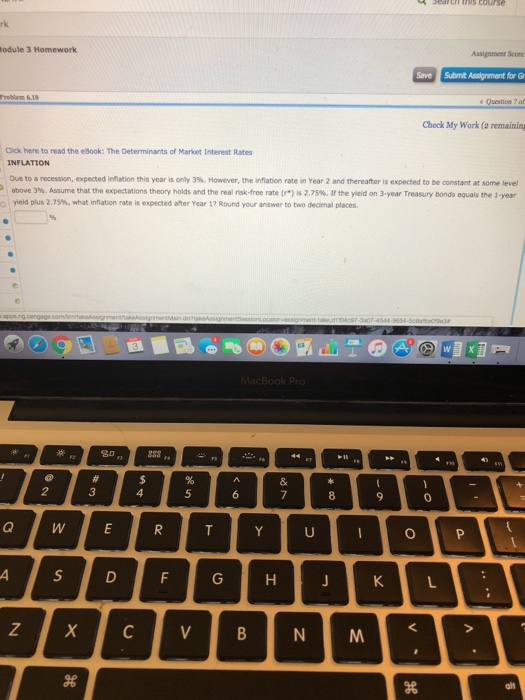

odule 3 Homework Assignment Score Save Submit Assignment for G roblem &1 Check My Work (2 remaining Click here to read the eBook: The Determinants of Market Interest Rates INFLATION Due to a recession, expected inflation this year is only 3%. However, the inflation rate in Year 2 and thereafter is expected to be constant at some evel above 3%. Assume that the expectations theory holds and the real risk-free rate (r.) is 2,75%. Ir the yeld on 3-year Treasury bonds equals the 1-year yield plus 2.75%, what inflation rate is expected after Year 17 Round your answer to two decinal places. 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts