Question: oEach problem should be on a separate spreadsheet tab. oAll known values, intermediate results and final results should be labeled as described in the 3-step

oEach problem should be on a separate spreadsheet tab.

oAll known values, intermediate results and final results should be labeled as described in the 3-step method.

oFormatting features should be used to clearly define the problem and enhance readability.

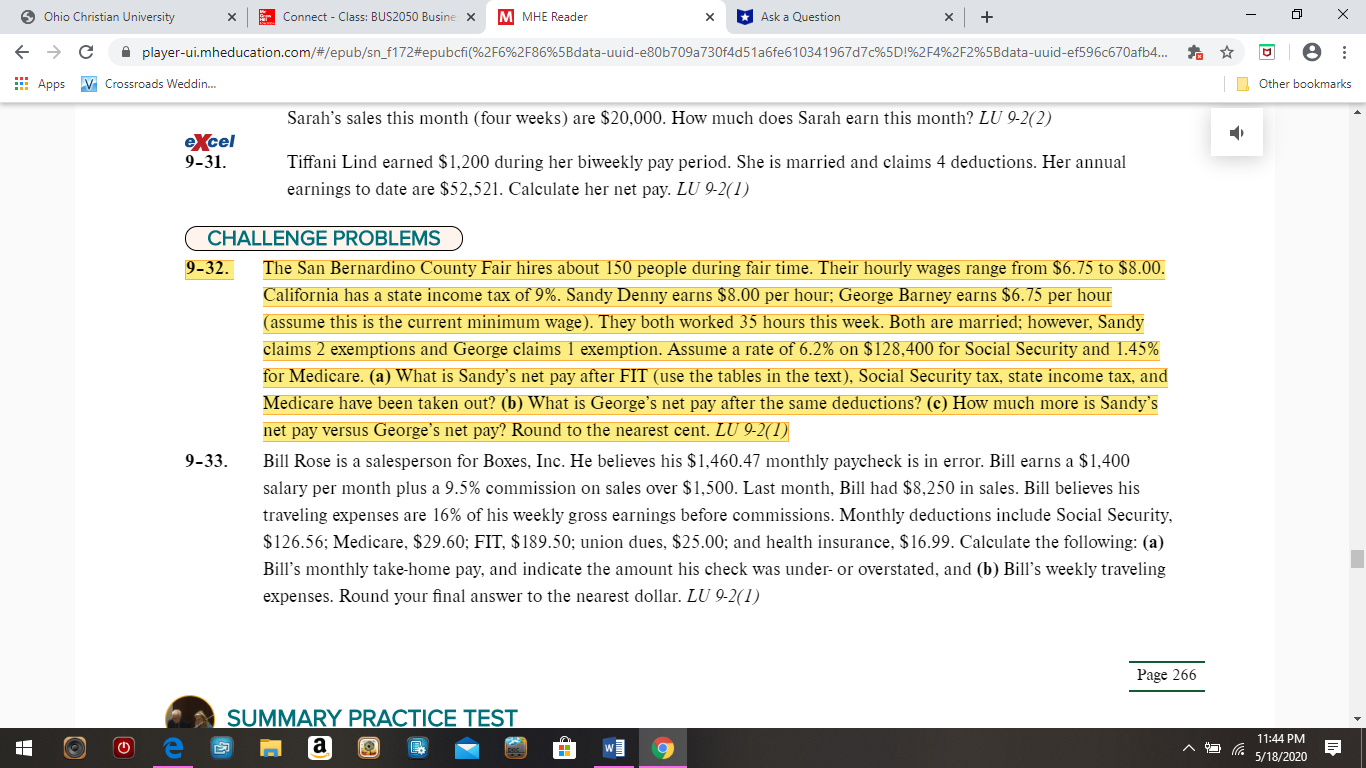

Ohio Christian University X Er Connect - Class: BUS2050 Businex M MHE Reader X Ask a Question X + X player-ui.mheducation.com/#/epub/sn_f172#epubcfi(%2F6%2F86%5Bdata-uuid-e806709a730f4d51a6fe610341967d7c%5D!%2F4%2F2%5Bdata-uuid-ef596c670afb4.. :: Apps V Crossroads Weddin.. Other bookmarks Sarah's sales this month (four weeks) are $20,000. How much does Sarah earn this month? LU 9-2(2) excel 9-31. Tiffani Lind earned $1,200 during her biweekly pay period. She is married and claims 4 deductions. Her annual earnings to date are $52,521. Calculate her net pay. LU 9-2(1) CHALLENGE PROBLEMS 9-32. The San Bernardino County Fair hires about 150 people during fair time. Their hourly wages range from $6.75 to $8.00. California has a state income tax of 9%. Sandy Denny earns $8.00 per hour; George Barney earns $6.75 per hour assume this is the current minimum wage). They both worked 35 hours this week. Both are married; however, Sandy claims 2 exemptions and George claims 1 exemption. Assume a rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare. (a) What is Sandy's net pay after FIT (use the tables in the text), Social Security tax, state income tax, and Medicare have been taken out? (b) What is George's net pay after the same deductions? (c) How much more is Sandy's net pay versus George's net pay? Round to the nearest cent. LU 9-2(1) 9-33. Bill Rose is a salesperson for Boxes, Inc. He believes his $1,460.47 monthly paycheck is in error. Bill earns a $1,400 salary per month plus a 9.5% commission on sales over $1,500. Last month, Bill had $8,250 in sales. Bill believes his traveling expenses are 16% of his weekly gross earnings before commissions. Monthly deductions include Social Security, $126.56; Medicare, $29.60; FIT, $189.50; union dues, $25.00; and health insurance, $16.99. Calculate the following: (a) Bill's monthly take-home pay, and indicate the amount his check was under- or overstated, and (b) Bill's weekly traveling expenses. Round your final answer to the nearest dollar. LU 9-2(1) Page 266 SUMMARY PRACTICE TEST e a EM 9 11:44 PM 5/18/2020