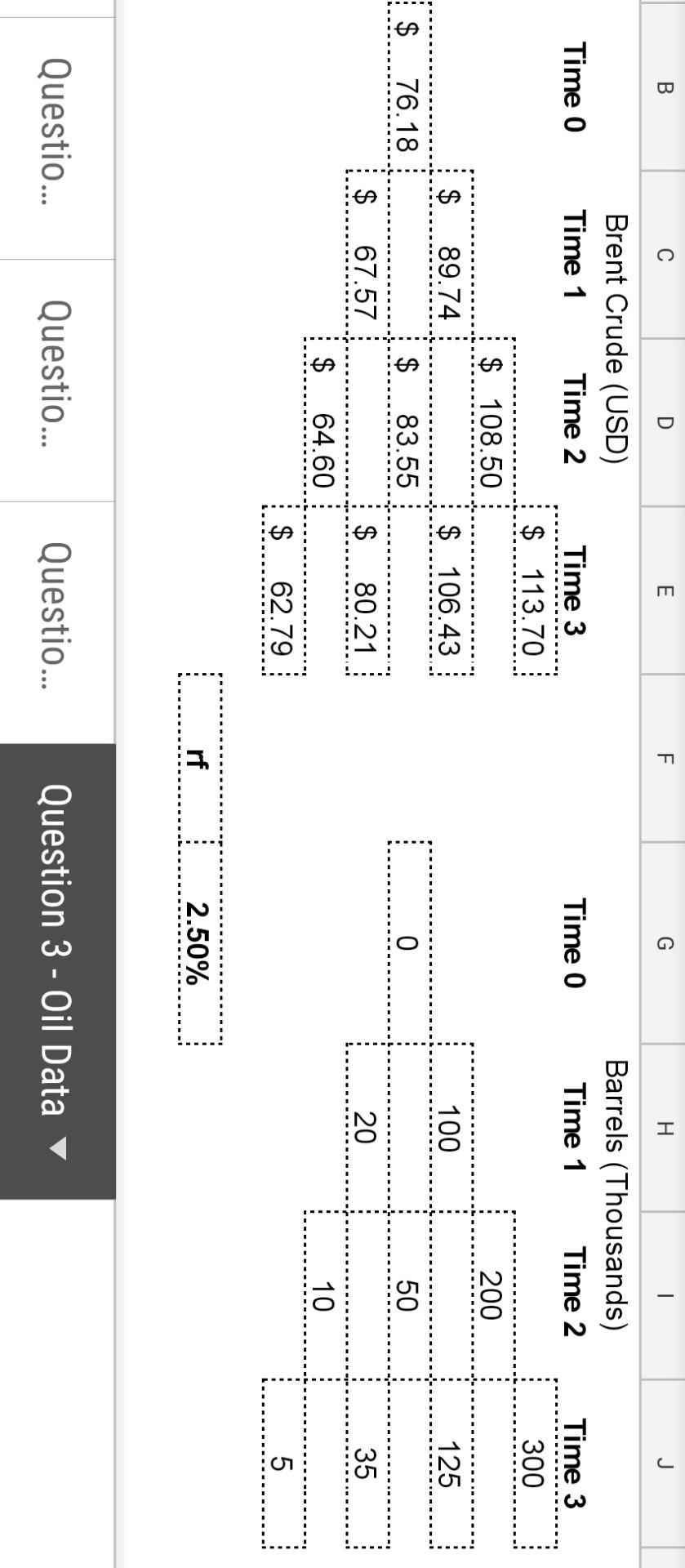

Question: Oil Data Question Please assist with workings and solution. The question is worth 35 marks B D E F G H J Brent Crude (USD)

Oil Data

Question

Please assist with workings and solution. The question is worth 35 marks

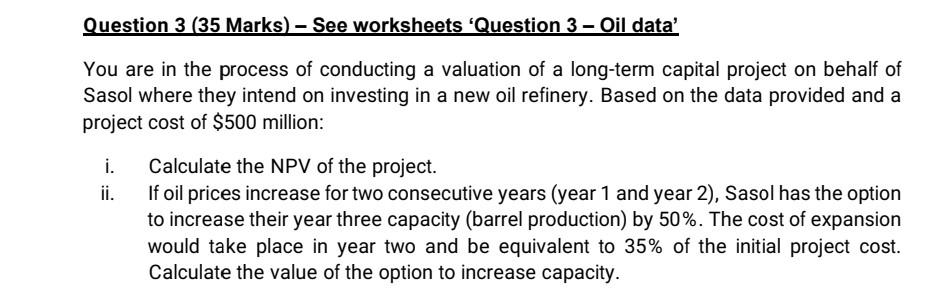

B D E F G H J Brent Crude (USD) Time 1 Time 2 Barrels (Thousands) Time 1 Time 2 Time 0 Time 0 Time 3 $ 113.70 Time 3 300 $ 108.50 200 $ 89.74 $ 106.43 100 125 $ 76.18 A: 83.55 0 50 $ 67.57 $ 80.21 20 35 $ 64.60 10 $ 62.79 5 rf 2.50% Questio... Questio... Questio... Question 3 - Oil Data Question 3 (35 Marks) - See worksheets 'Question 3 - Oil data' You are in the process of conducting a valuation of a long-term capital project on behalf of Sasol where they intend on investing in a new oil refinery. Based on the data provided and a project cost of $500 million: i. ii. Calculate the NPV of the project. If oil prices increase for two consecutive years (year 1 and year 2), Sasol has the option to increase their year three capacity (barrel production) by 50%. The cost of expansion would take place in year two and be equivalent to 35% of the initial project cost. Calculate the value of the option to increase capacity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts