Question: Old MathJax webview Ann Arboe processing has the following expected future dividends to be paid at the end of the given years 7. Ann Arbor

Old MathJax webview

Ann Arboe processing has the following expected future dividends to be paid at the end of the given years

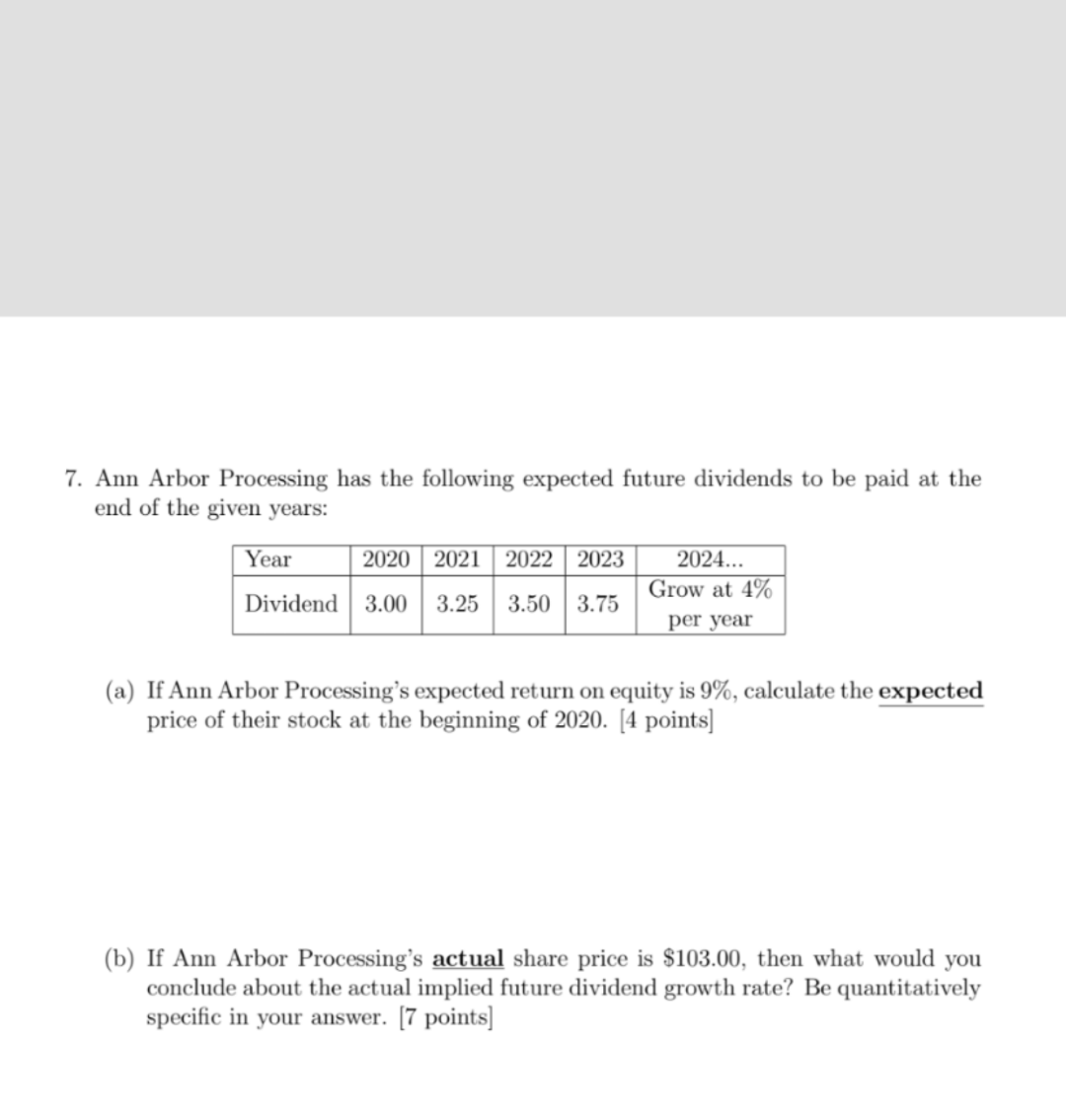

7. Ann Arbor Processing has the following expected future dividends to be paid at the end of the given years: Year 2020 2021 2022 2023 Dividend 3.00 2024... Grow at 4% per year 3.25 3.50 3.75 (a) If Ann Arbor Processing's expected return on equity is 9%, calculate the expected price of their stock at the beginning of 2020. [4 points) (b) If Ann Arbor Processing's actual share price is $103.00, then what would you conclude about the actual implied future dividend growth rate? Be quantitatively specific in your answer. [7 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts