Question: Old MathJax webview asap asap Question 1 (50 points] XYZ Corporation began operations 2 years ago. Its adjusted account balances at July 31, 2014 are

Old MathJax webview

asap

![Old MathJax webview asap asap Question 1 (50 points] XYZ Corporation began](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6716298093b83_6636716297ff2514.jpg)

asap

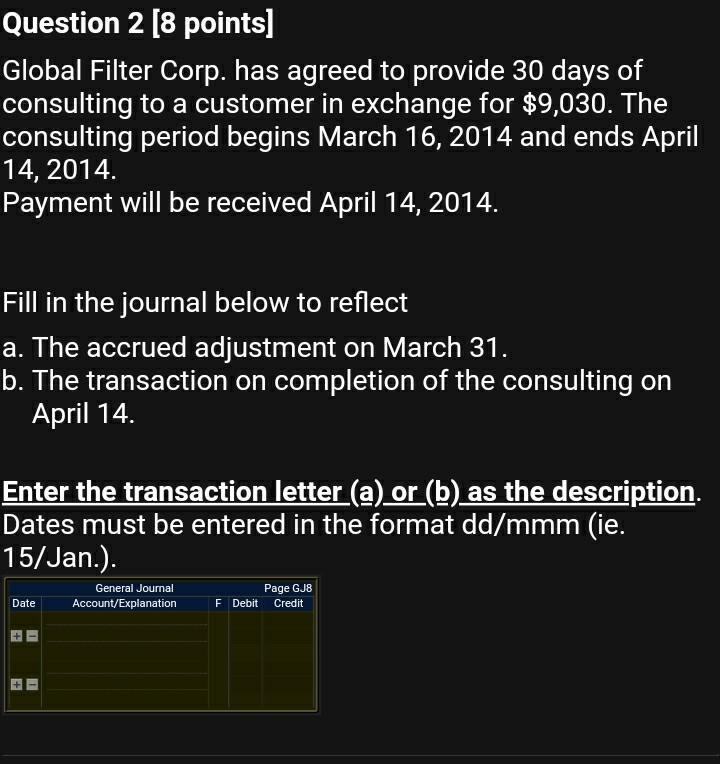

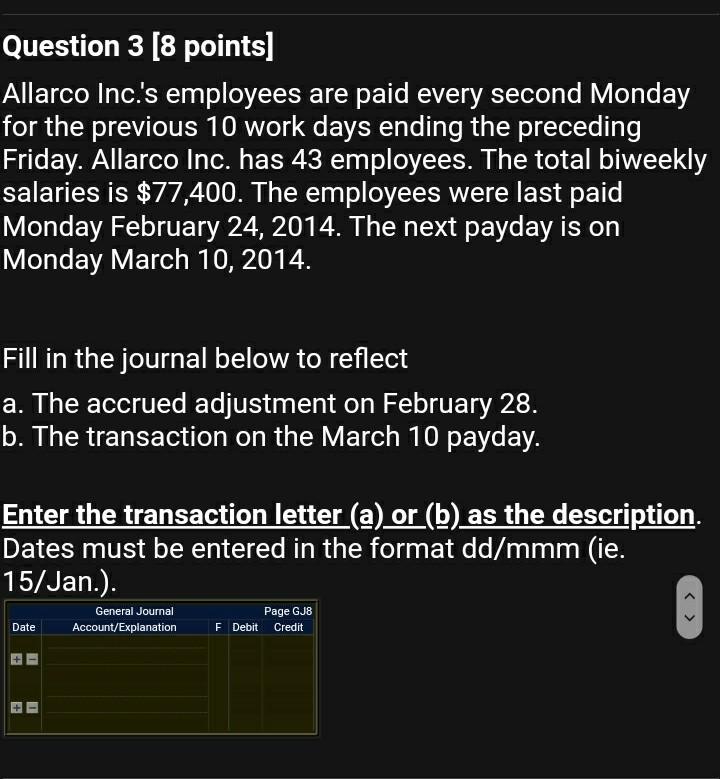

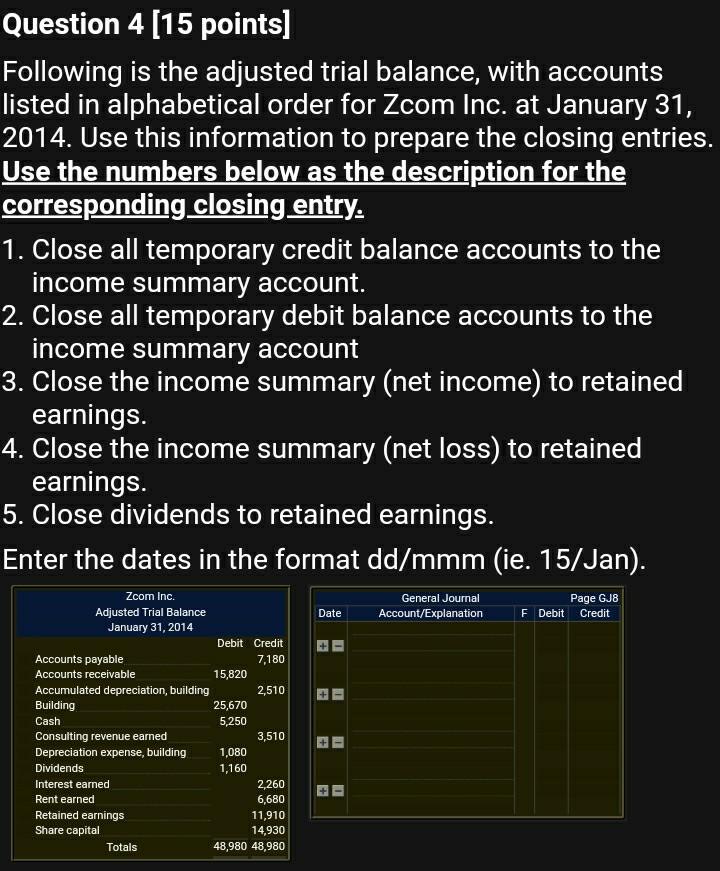

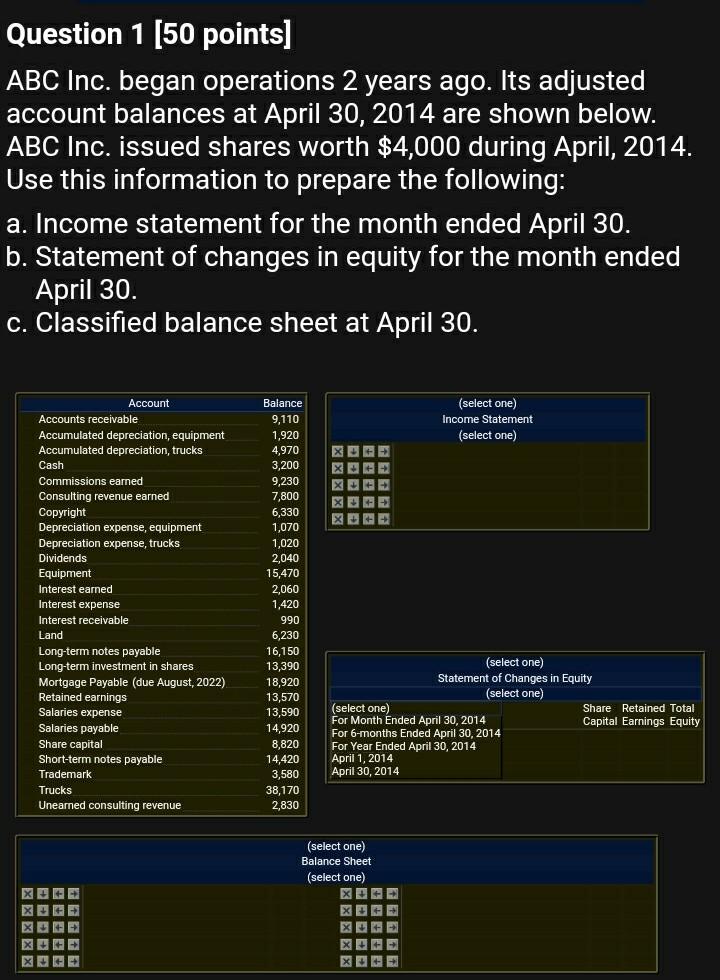

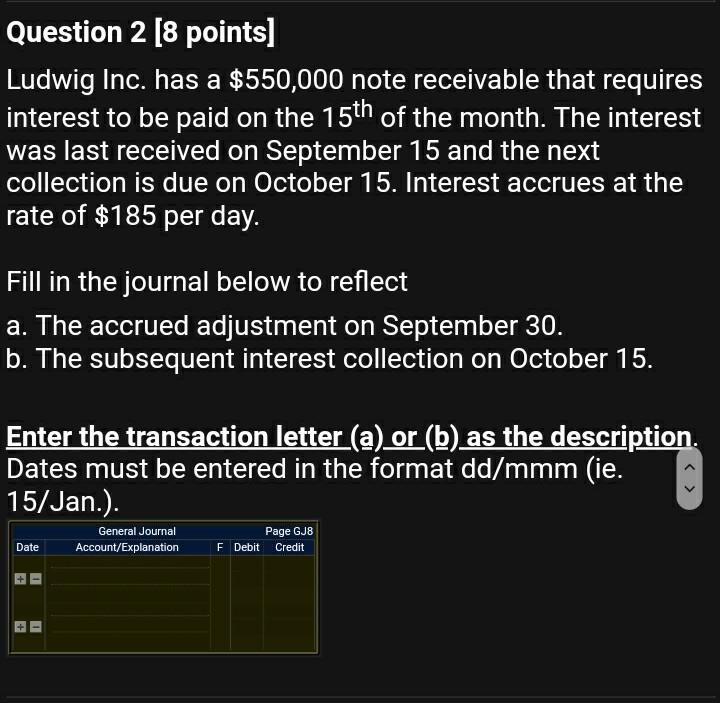

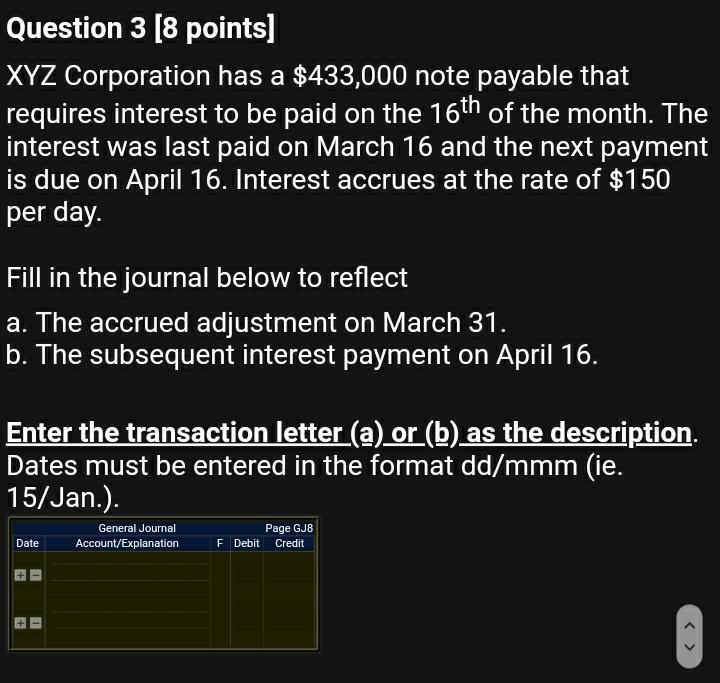

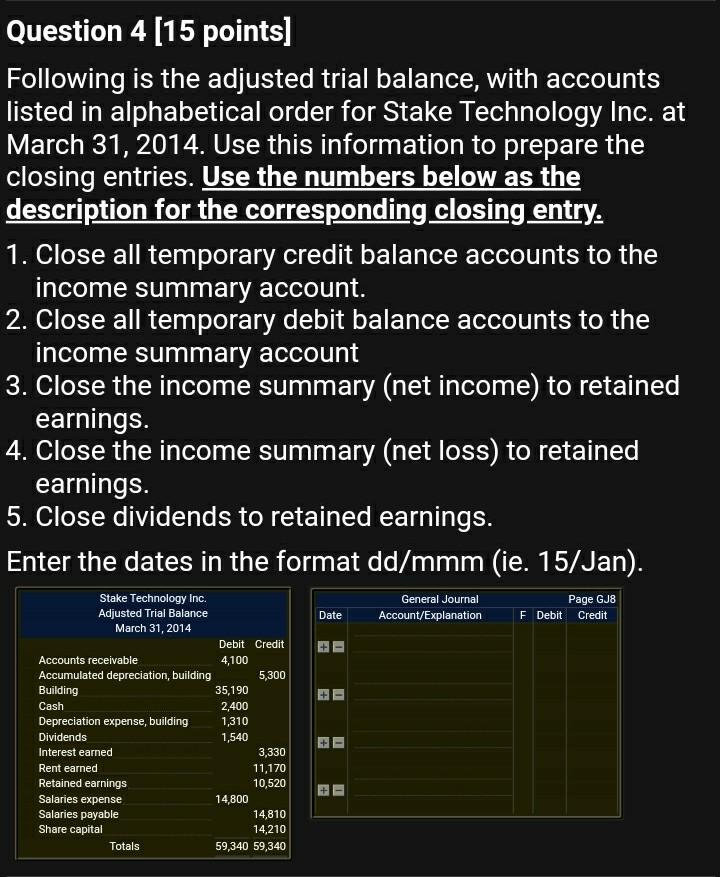

Question 1 (50 points] XYZ Corporation began operations 2 years ago. Its adjusted account balances at July 31, 2014 are shown below. XYZ Corporation issued shares worth $13,500 during July, 2014. Use this information to prepare the following: a. Income statement for the month ended July 31. b. Statement of changes in equity for the month ended July 31. c. Classified balance sheet at July 31. (select one) Income Statement (select one) X + Account Accounts receivable Accumulated depreciation, furniture Accumulated depreciation, trucks Advertising expense Advertising payable Bonds Payable (due April, 2022) Cash ".. Consulting revenue earned sans Copyright Depreciation expense, furniture Depreciation expense, trucks Dividends Furniture Balance 4,460 5,580 870 3,940 4,830 18,630 www 5,610 7,930 5,160 1,920 560 2,960 50,200 2820 14450 14,450 6640 0,040 23,950 4,280 6,470 12,000 18,670 5,320 3,750 Interest earned Land Land Long-term investment in shares Mortgage Payable (due April, 2022) Patents Rent earned Retained earnings Share capital Trucks Unearned consulting revenue (select one) Statement of Changes in Equity (select one) Share Retained Total Capital Earnings Equity X X DE (select one) Balance Sheet ect one) + X + XLE x +++ x++ + FE Question 2 [8 points) Global Filter Corp. has agreed to provide 30 days of consulting to a customer in exchange for $9,030. The consulting period begins March 16, 2014 and ends April 14, 2014. Payment will be received April 14, 2014. Fill in the journal below to reflect a. The accrued adjustment on March 31. b. The transaction on completion of the consulting on April 14. Enter the transaction letter (a) or (b) as the description. Dates must be entered in the format dd/mmm (ie. 15/Jan.). General Journal Account/Explanation Page GJS F Debit Credit Date + Question 3 [8 points) Allarco Inc.'s employees are paid every second Monday for the previous 10 work days ending the preceding Friday. Allarco Inc. has 43 employees. The total biweekly salaries is $77,400. The employees were last paid Monday February 24, 2014. The next payday is on Monday March 10, 2014. Fill in the journal below to reflect a. The accrued adjustment on February 28. b. The transaction on the March 10 payday. Enter the transaction letter (a) or (b) as the description. Dates must be entered in the format dd/mmm (ie. 15/Jan.). General Journal Account/Explanation Page GJ8 F Debit Credit Date + + Question 4 (15 points) Following is the adjusted trial balance, with accounts listed in alphabetical order for Zcom Inc. at January 31, 2014. Use this information to prepare the closing entries. Use the numbers below as the description for the corresponding closing entry. 1. Close all temporary credit balance accounts to the income summary account. 2. Close all temporary debit balance accounts to the income summary account 3. Close the income summary (net income) to retained earnings. 4. Close the income summary (net loss) to retained earnings. 5. Close dividends to retained earnings. Enter the dates in the format dd/mmm (ie. 15/Jan). Date General Journal Account/Explanation Page GJ8 F Debit Credit + + - 1 Zcom Inc. Adjusted Trial Balance January 31, 2014 Debit Credit Accounts payable 7,180 Accounts receivable 15,820 Accumulated depreciation, building 2,510 Building 25,670 Cash Consulting revenue earned 3,510 Depreciation expense, building 1,080 Dividends 1,160 Interest earned 2,260 Rent earned 6,680 Retained earnings 11,910 Share capital 14,930 Totals 48,980 48,980 5,250 + + + + - 1 Question 1 (50 points] ABC Inc. began operations 2 years ago. Its adjusted account balances at April 30, 2014 are shown below. ABC Inc. issued shares worth $4,000 during April, 2014. Use this information to prepare the following: a. Income statement for the month ended April 30. b. Statement of changes in equity for the month ended April 30. c. Classified balance sheet at April 30. (select one) Income Statement (select one) XDEE Account Accounts receivable Accumulated depreciation, equipment Accumulated depreciation, trucks Cash Commissions earned Consulting revenue earned Copyright Depreciation expense, equipment Depreciation expense, trucks Dividends Equipment Interest earned Interest expense Interest receivable Land Land Long-term notes payable Long-term investment in shares Mortgage Payable (due August, 2022) Retained earnings Salaries expense Sali Salaries payable Share capital CH Short-term notes payable Trademark Trucks Unearned consulting revenue Balance 9,110 1,920 4,970 3,200 9,230 7,800 6.330 120 1,070 1,020 2,040 15,470 2,060 1,420 990 XEE 6,230 16,150 13,390 18,920 13,570 ON 13,590 14,920 8,820 14,420 3,580 38,170 (select one) Statement of Changes in Equity (select one) (select one) Share Retained Total For Month Ended April 30, 2014 Capital Earnings Equity For 6-months Ended April 30, 2014 For Year Ended April 30, 2014 April 1, 2014 April 30, 2014 2,830 (select one) Balance Sheet (select one) X TEEN XF XEE x + + X + Question 2 [8 points] Ludwig Inc. has a $550,000 note receivable that requires interest to be paid on the 15th of the month. The interest was last received on September 15 and the next collection is due on October 15. Interest accrues at the rate of $185 per day. Fill in the journal below to reflect a. The accrued adjustment on September 30. b. The subsequent interest collection on October 15. Enter the transaction letter (a) or (b) as the description. Dates must be entered in the format dd/mmm (ie. 15/Jan.). Date General Journal Account/Explanation Page GJS F Debit Credit + - + 0 + - + Question 3 [8 points] XYZ Corporation has a $433,000 note payable that requires interest to be paid on the 16th of the month. The interest was last paid on March 16 and the next payment is due on April 16. Interest accrues at the rate of $150 per day. Fill in the journal below to reflect a. The accrued adjustment on March 31. b. The subsequent interest payment on April 16. Enter the transaction letter (a) or (b) as the description. Dates must be entered in the format dd/mmm (ie. 15/Jan.). Date General Journal Account/Explanation Page GJ8 F Debit Credit + - 0 + - + Question 4 (15 points) Following is the adjusted trial balance, with accounts listed in alphabetical order for Stake Technology Inc. at March 31, 2014. Use this information to prepare the closing entries. Use the numbers below as the description for the corresponding closing entry. 1. Close all temporary credit balance accounts to the income summary account. 2. Close all temporary debit balance accounts to the income summary account 3. Close the income summary (net income) to retained earnings. 4. Close the income summary (net loss) to retained earnings. 5. Close dividends to retained earnings. Enter the dates in the format dd/mmm (ie. 15/Jan). Date General Journal Account/Explanation Page GJS F Debit Credit + - 0 + + Stake Technology Inc. Adjusted Trial Balance March 31, 2014 Debit Credit Accounts receivable 4,100 Accumulated depreciation, building 5,300 Building 35,190 Cash 2,400 Depreciation expense, building 1,310 Dividends 1,540 Interest earned 3,330 Rent earned 11,170 Retained earnings 10,520 Salaries expense 14,800 Salaries payable 14,810 Share capital 14,210 Totals 59,340 59,340 + + 1 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts