Question: Old MathJax webview Both 3.6 and 3.7 Problem 3.6 (15 pts) Stan elects to receive his retirement benefit over 20 years at the rate of

Old MathJax webview

Both 3.6 and 3.7

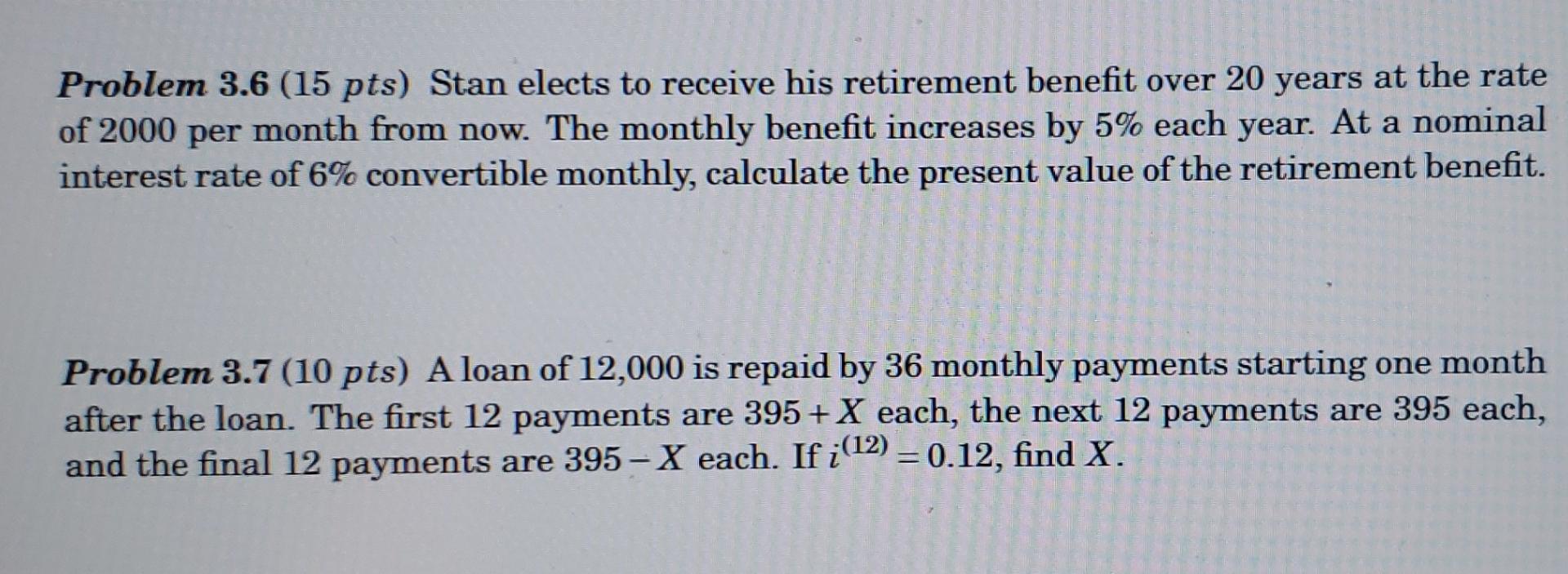

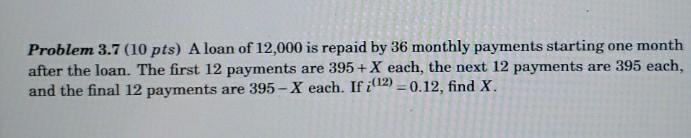

Problem 3.6 (15 pts) Stan elects to receive his retirement benefit over 20 years at the rate of 2000 per month from now. The monthly benefit increases by 5% each year. At a nominal interest rate of 6% convertible monthly, calculate the present value of the retirement benefit. a Problem 3.7 (10 pts) A loan of 12,000 is repaid by 36 monthly payments starting one month after the loan. The first 12 payments are 395 +X each, the next 12 payments are 395 each, and the final 12 payments are 395- X each. If i(12) = 0.12, find X. Problem 3.7 (10 pts) A loan of 12,000 is repaid by 36 monthly payments starting one month after the loan. The first 12 payments are 395+X each, the next 12 payments are 395 each, and the final 12 payments are 395- X each. If(12) = 0.12, find X. Problem 3.6 (15 pts) Stan elects to receive his retirement benefit over 20 years at the rate of 2000 per month from now. The monthly benefit increases by 5% each year. At a nominal interest rate of 6% convertible monthly, calculate the present value of the retirement benefit. a Problem 3.7 (10 pts) A loan of 12,000 is repaid by 36 monthly payments starting one month after the loan. The first 12 payments are 395 +X each, the next 12 payments are 395 each, and the final 12 payments are 395- X each. If i(12) = 0.12, find X. Problem 3.7 (10 pts) A loan of 12,000 is repaid by 36 monthly payments starting one month after the loan. The first 12 payments are 395+X each, the next 12 payments are 395 each, and the final 12 payments are 395- X each. If(12) = 0.12, find X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts