Question: Old MathJax webview Chapter 9 - Section 11 - Exercise 3 Brian Hickman is an executive with Westco Distributors. His gross earnings are $11,200 per

Old MathJax webview

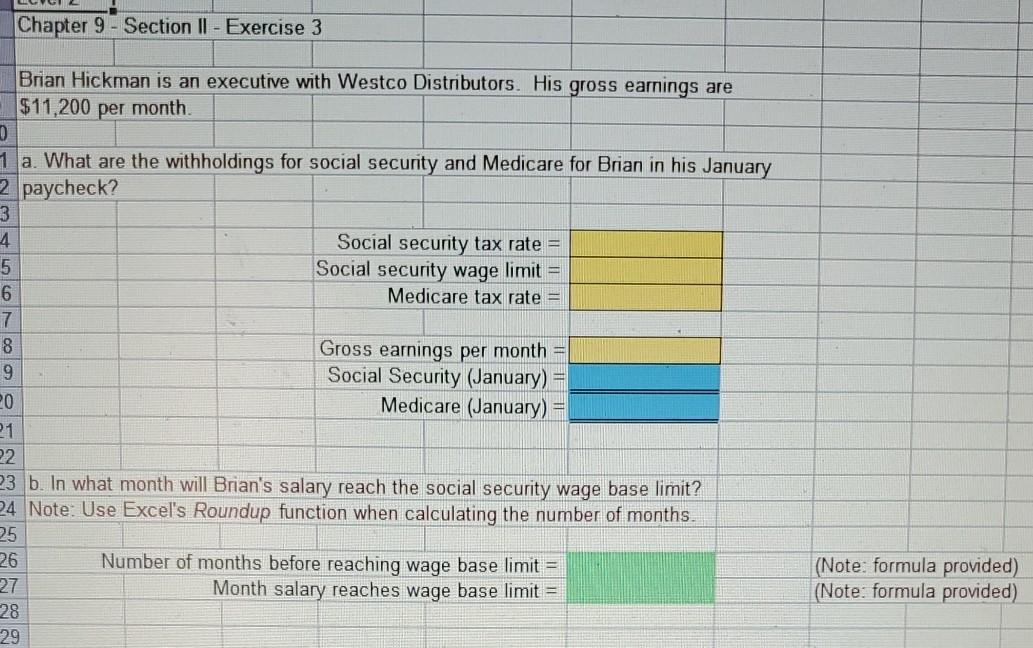

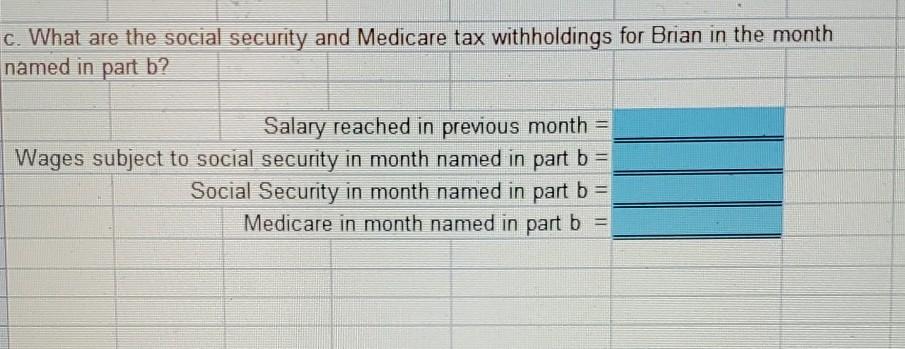

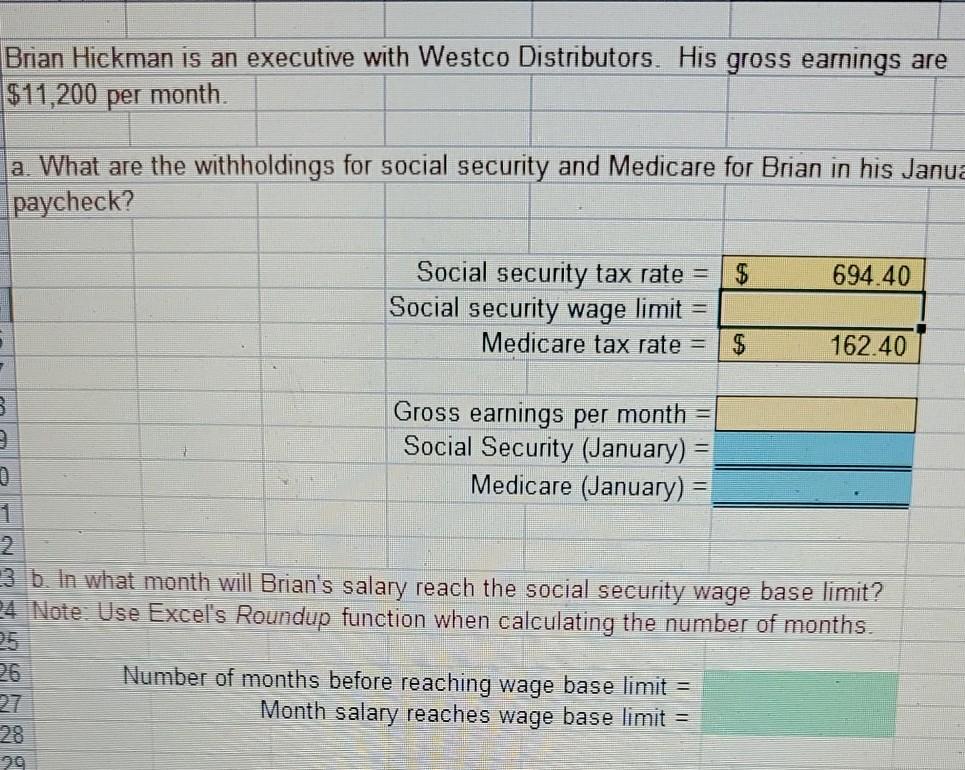

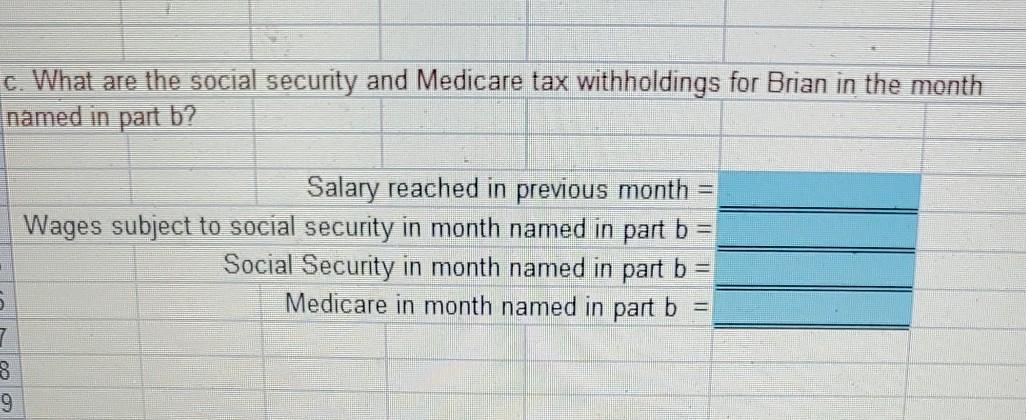

Chapter 9 - Section 11 - Exercise 3 Brian Hickman is an executive with Westco Distributors. His gross earnings are $11,200 per month D 1 a. What are the withholdings for social security and Medicare for Brian in his January 2. paycheck? 3 4 Social security tax rate = 5 Social security wage limit = 6 Medicare tax rate = 7 8 Gross earnings per month 9 Social Security (January) 20 Medicare (January) 21 22 23 b. In what month will Brian's salary reach the social security wage base limit? 24 Note: Use Excel's Roundup function when calculating the number of months. 25 26 Number of months before reaching wage base limit = 27 Month salary reaches wage base limit 28 29 (Note: formula provided) (Note: formula provided) C. What are the social security and Medicare tax withholdings for Brian in the month named in part b? Salary reached in previous month = Wages subject to social security in month named in part b Social Security in month named in part b = Medicare in month named in part b - Brian Hickman is an executive with Westco Distributors. His gross earnings are $11,200 per month a. What are the withholdings for social security and Medicare for Brian in his Janua paycheck? $ 694.40 Social security tax rate = Social security wage limit Medicare tax rate = $ 162.40 B Gross earnings per month Social Security (January) Medicare (January) 0 23 b. In what month will Brian's salary reach the social security wage base limit? 24 Note: Use Excel's Roundup function when calculating the number of months. Number of months before reaching wage base limit = Month salary reaches wage base limit = 99 c. What are the social security and Medicare tax withholdings for Brian in the month named in part b? Salary reached in previous month Wages subject to social security in month named in part b = Social Security in month named in part b Medicare in month named in part b = 1 8 9 Chapter 9 - Section 11 - Exercise 3 Brian Hickman is an executive with Westco Distributors. His gross earnings are $11,200 per month D 1 a. What are the withholdings for social security and Medicare for Brian in his January 2. paycheck? 3 4 Social security tax rate = 5 Social security wage limit = 6 Medicare tax rate = 7 8 Gross earnings per month 9 Social Security (January) 20 Medicare (January) 21 22 23 b. In what month will Brian's salary reach the social security wage base limit? 24 Note: Use Excel's Roundup function when calculating the number of months. 25 26 Number of months before reaching wage base limit = 27 Month salary reaches wage base limit 28 29 (Note: formula provided) (Note: formula provided) C. What are the social security and Medicare tax withholdings for Brian in the month named in part b? Salary reached in previous month = Wages subject to social security in month named in part b Social Security in month named in part b = Medicare in month named in part b - Brian Hickman is an executive with Westco Distributors. His gross earnings are $11,200 per month a. What are the withholdings for social security and Medicare for Brian in his Janua paycheck? $ 694.40 Social security tax rate = Social security wage limit Medicare tax rate = $ 162.40 B Gross earnings per month Social Security (January) Medicare (January) 0 23 b. In what month will Brian's salary reach the social security wage base limit? 24 Note: Use Excel's Roundup function when calculating the number of months. Number of months before reaching wage base limit = Month salary reaches wage base limit = 99 c. What are the social security and Medicare tax withholdings for Brian in the month named in part b? Salary reached in previous month Wages subject to social security in month named in part b = Social Security in month named in part b Medicare in month named in part b = 1 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts