Question: Old MathJax webview d. L'Bron plc. is considering issuing debt that matures in one year, and has come up with the following estimates of the

Old MathJax webview

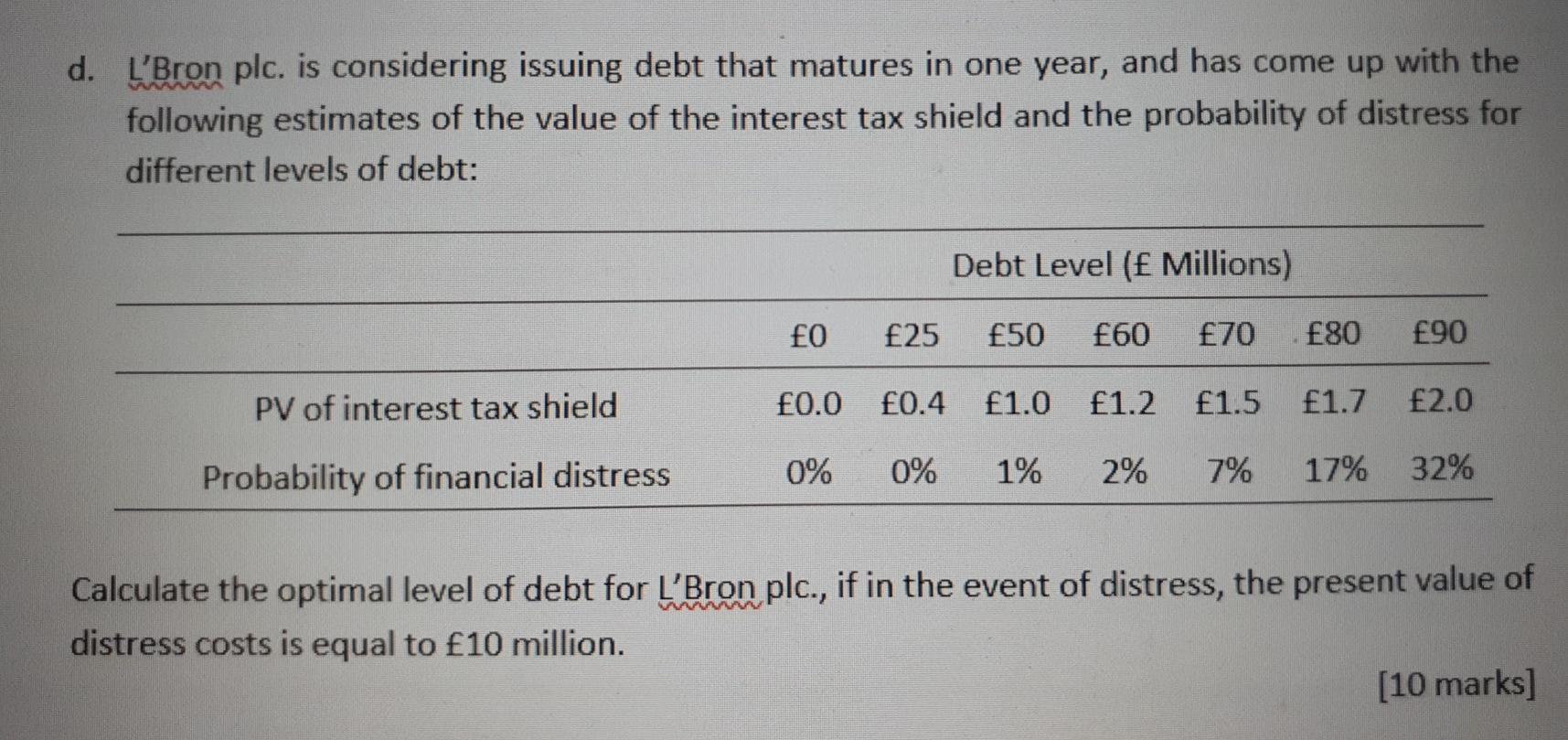

d. L'Bron plc. is considering issuing debt that matures in one year, and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt: Debt Level ( Millions) fo 25 50 60 70 80 90 PV of interest tax shield 0.0 0.4 1.0 1.2 1.5 1.7 2.0 Probability of financial distress 0% 0% 1% 2% 7% 17% 32% Calculate the optimal level of debt for L'Bron plc., if in the event of distress, the present value of distress costs is equal to 10 million. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts