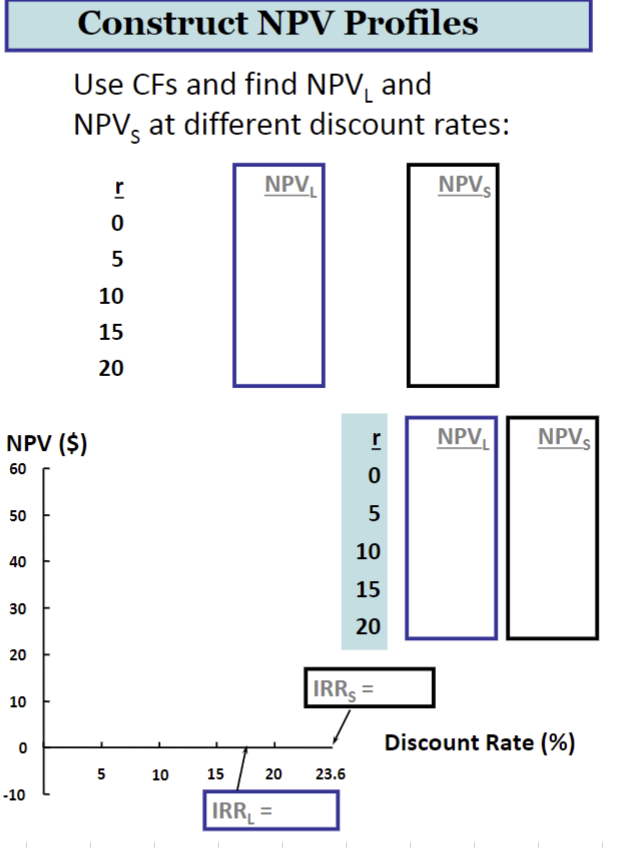

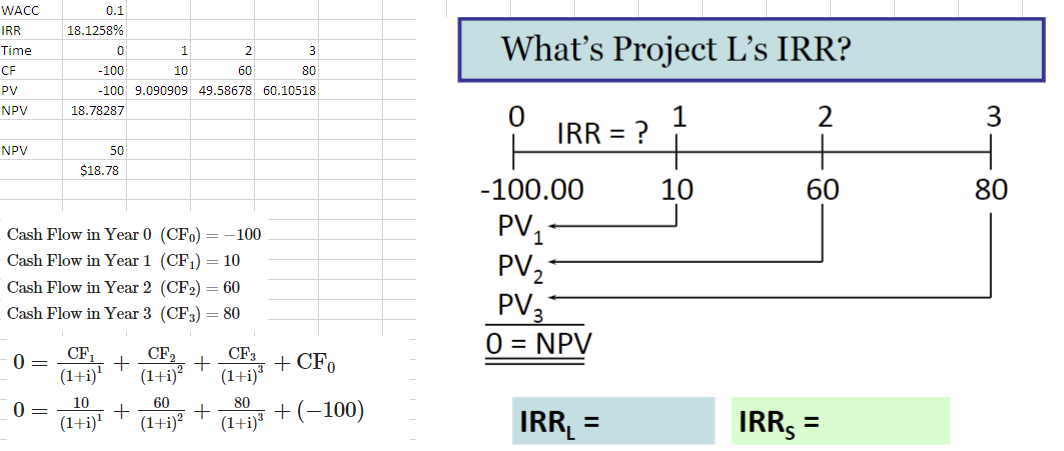

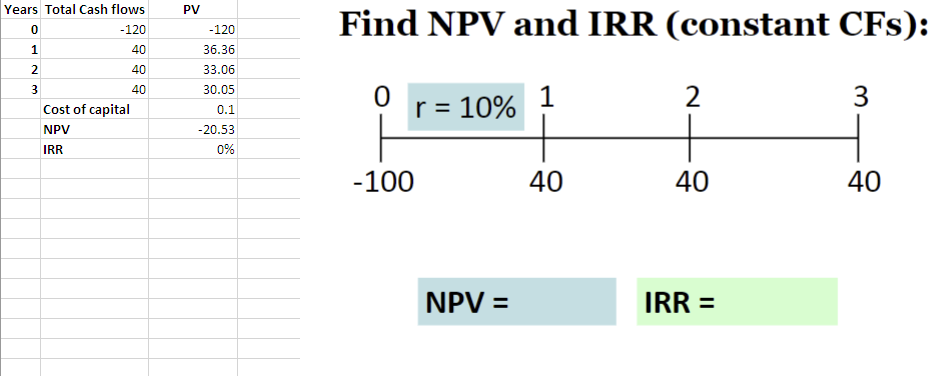

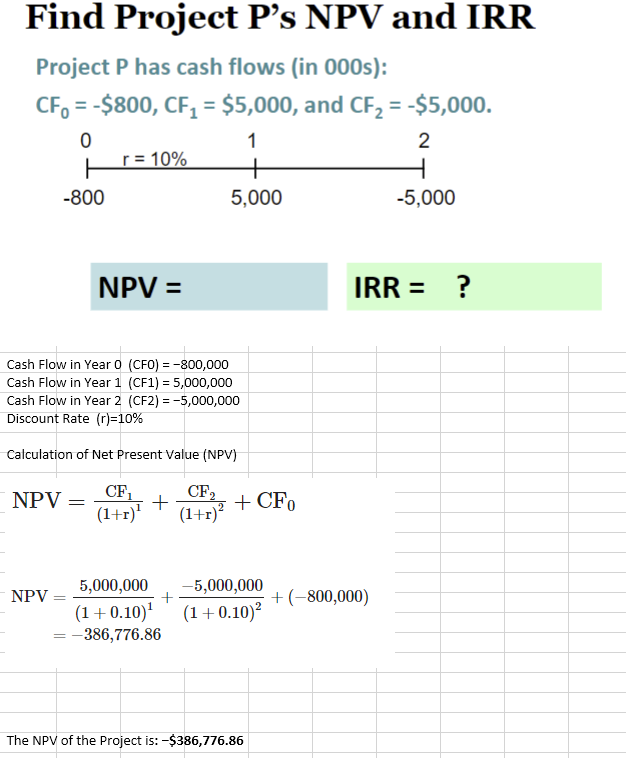

Question: Question: Context: Construct NPV Profiles Use CFs and find NPV L and NPVS at different discount rates: What's Project L's IRR? CashFlowinYear0(CF0)=100CashFlowinYear1(CF1)=10CashFlowinYear2(CF2)=60CashFlowinYear3(CF3)=800=(1+i)1CF1+(1+i)2CF2+(1+i)3CF3+CF00=(1+i)110+(1+i)260+(1+i)380+(100)IRRL=IRRS= Find NPV and

Question:

Context:

Construct NPV Profiles Use CFs and find NPV L and NPVS at different discount rates: What's Project L's IRR? CashFlowinYear0(CF0)=100CashFlowinYear1(CF1)=10CashFlowinYear2(CF2)=60CashFlowinYear3(CF3)=800=(1+i)1CF1+(1+i)2CF2+(1+i)3CF3+CF00=(1+i)110+(1+i)260+(1+i)380+(100)IRRL=IRRS= Find NPV and IRR (constant CFs): IRR = Find Project P's NPV and IRR Project P has cash flows (in 000s): CF0=$800,CF1=$5,000,andCF2=$5,000. NPV=IRR=? Cash Flow in Year O (CFO) =800,000 Cash Flow in Year 1 (CF1) =5,000,000 Cash Flow in Year 2( CF2) =5,000,000 Discount Rate (r)=10% Calculation of Net Present Value (NPV) NPV=(1+r)1CF1+(1+r)2CF2+CF0NPV=(1+0.10)15,000,000+(1+0.10)25,000,000+(800,000)=386,776.86 The NPV of the Project is: $386,776.86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts