Question: Old MathJax webview do next one Bank tucenciation Statement on S-1-33 Pertuan Asunto Amount Overdron as per Can Book Lex Checus buad na predno 12101823810

Old MathJax webview

do next one

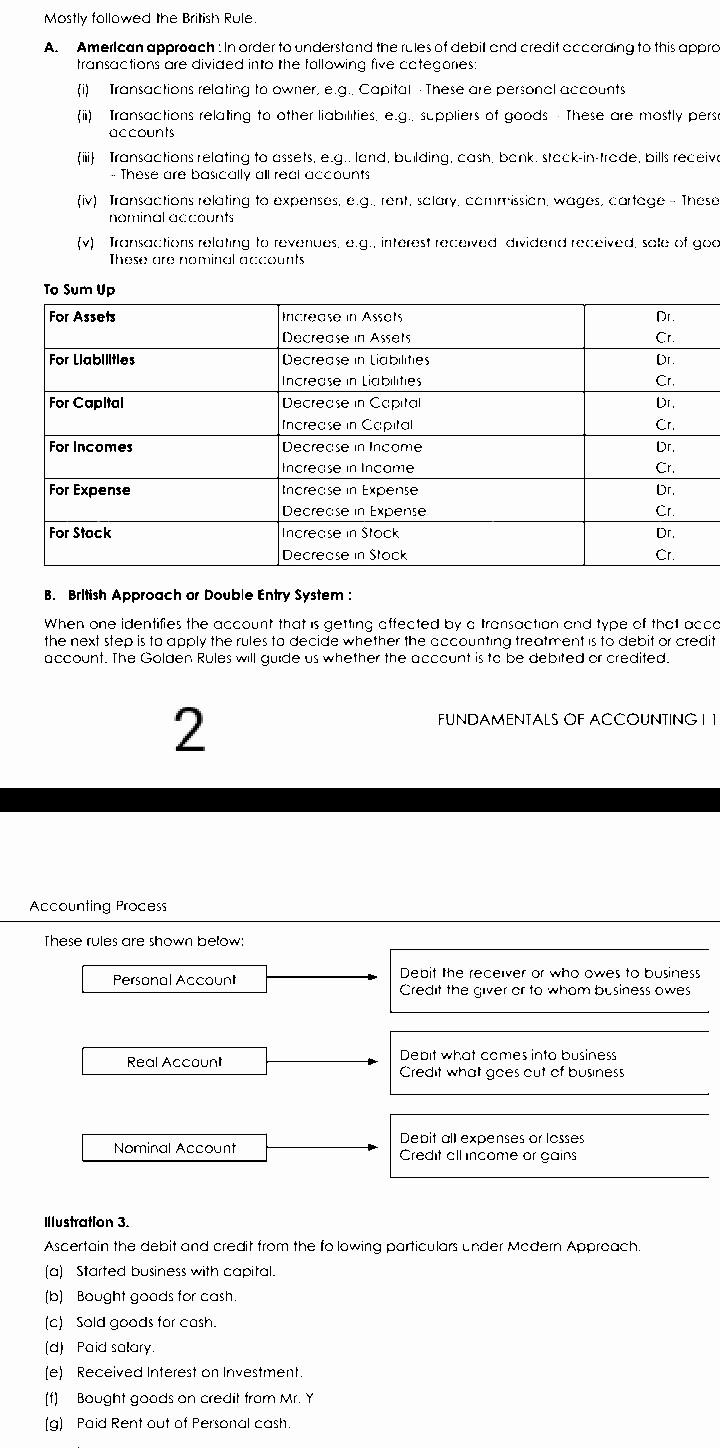

Bank tucenciation Statement on S-1-33 Pertuan Asunto Amount Overdron as per Can Book Lex Checus buad na predno 12101823810 2.40 Le Dect depot by Jamie 304 Ad Cheques deputed but not come 13524888 2.1401 Add: poyable not recorded in C 100 2240 Balance as per Pau Bock Under mood, we are too that eam which in both the con Book ond The Bank Statement but not in the same con. The put lick man inercionih prired on the door de to Bock and a look arane Sinodvice Warsawhich need reconciliation lustration 12 In the books of Mr. . Mukherjee Dr 34 Cash Book Bank Column only Particules Amount Date Particuliers Amount 2015 feb 3.000 2013 ARE March Mancha ale te 5. Han 1,0001 Son A 1000 Sul Ale 4000 12. DSC 2.000 SAL 20. Pal Alc 3.000 a WC 341 Rent A 01A cech Ball a DY Dale U Ar Bank Pass Back Mt. Mukherjee in Particulo Amm Dute Particular concebid 200 Sun Ale 1.000 YA 1.Kumar AC 2.000 CA co AVC 10 SA D. Soha AC 1.000 PAC 1. Soha Ale 3.000 A 2.000 3.000 Mostly followed the British Rule A. Amerlcan approach: In order to understand the rules of debit cnd credit cccording to this appro transactions are divided into the following five cctegones: {i} Transactions relating to owner, e.g. Capital . These are personel accounts {i} Transactions relating to other liabilities. e... suppliers of goods These are mostly pers accounts { Transactions relating to assets, e.g. lond, building, cash. bcok, stcck-in-licde, bills receive These are basically all real accounts {iv) Transactions relating to expenses, e.g. rent, sciary, comission. wages, cartoge - These nominal accounts (v) Transactions relating to revenues. e.g., interest received dividend received soke of goo These are nominal accounts To Sum Up For Assets Dr. Cr For Llabilities Or CI For Capital Dr. Cr ricrease in Assets Decrease in Assets Decrease in liabilities Increase in Liabilities Decrecse in Capital Increcse in Capital Decrecse in Income Increase in Income Increcse in Expense Decrecse in Expense Increcse in Stock Decrecse in Stock For Incomes Dr. Cr For Expense Dr. Cr. For Stock Dr. Cr B. British Approach or Double Entry System: When one identifies the account that is getting cffected by c transaction cnd type of the occo the next step is to apply the rules to decide whether the cccounting treatment is to debit or credit account. The Golden Rules will guide us whether the account is to be debited or credited. FUNDAMENTALS OF ACCOUNTINGTI 2 Accounting Process These rules are shown below: Personal Account Deoit the receiver or who owes to business Credit the giver or to whom business owes Real Account Depit what comes into business Credit what goes cut cf business Nominal Account Depit all expenses or losses Credit cll income or gains illustration 3 Ascertain the debit and credit from the fo lowing particulars under Mcdern Approach (a) Started business with capital. (b) Bought goods for cash. (c) Sold goods for cash. (d) Paid salary (e) Received Interest on Investment. (1) Bought goods on credit from Mr. Y (g) Paid Rent out of Personal cashStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock