Question: Old MathJax webview Old MathJax webview explain how to hedag one option long option and short sell? 1-Calculate delta 2-explain how to hedge one option

Old MathJax webview

explain how to hedag one option long option and short sell?

1-Calculate delta 2-explain how to hedge one option short sell and Long position

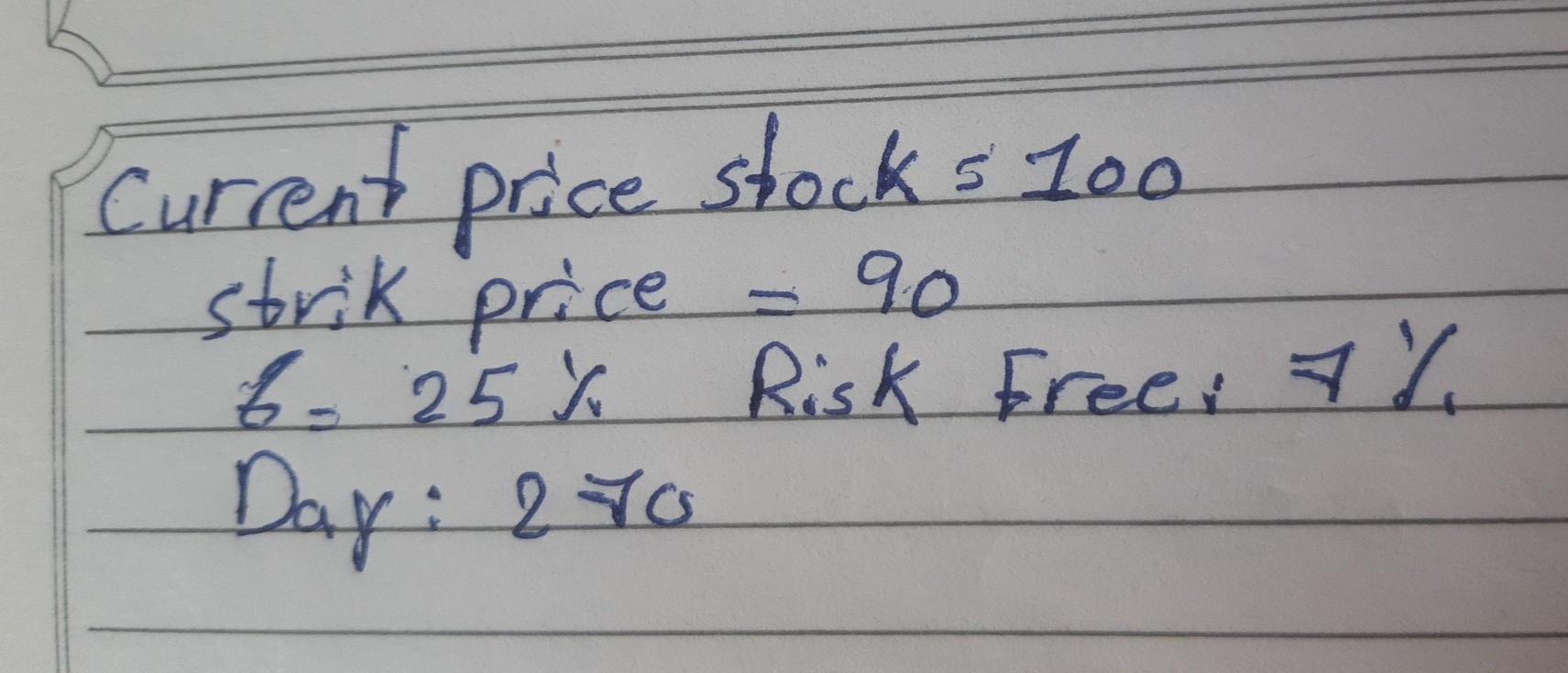

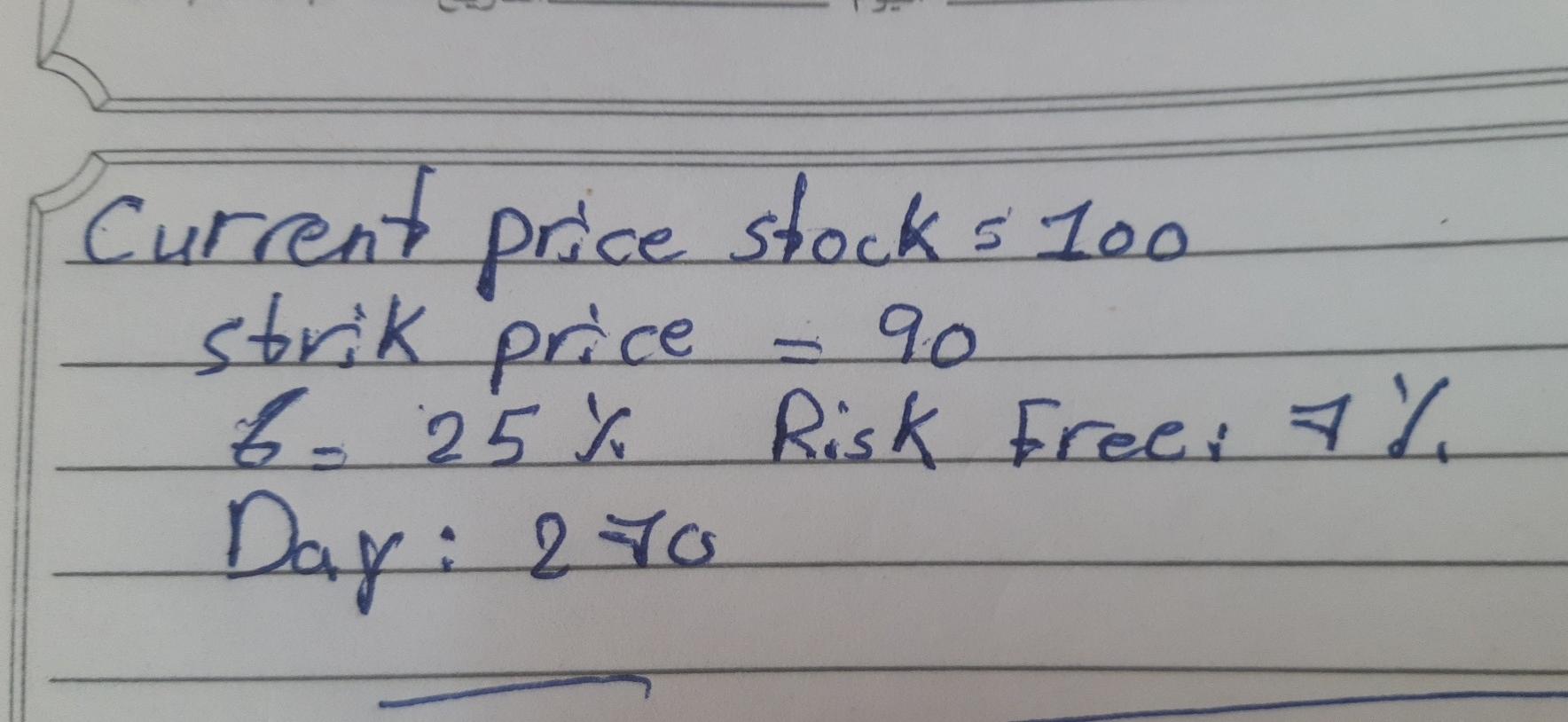

Current price stocks 100 strik price 90 6. 25 % Risk Free: 7% Day: 250 90 Curent price stocks 100 strik price 6- 25 % Risk free, 7 % Day: 2 ro Cash discounts.16 (2 (2 ) conveniently separate the pricing of credit and cash customers .increase profit margins on sales .reduce the collection of receivables non of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts