Question: Old MathJax webview Old MathJax webview please follow the instructions on 2nd page can you do both yes Remember to proactively check in with colleagues

Old MathJax webview

please follow the instructions on 2nd page

can you do both

yes

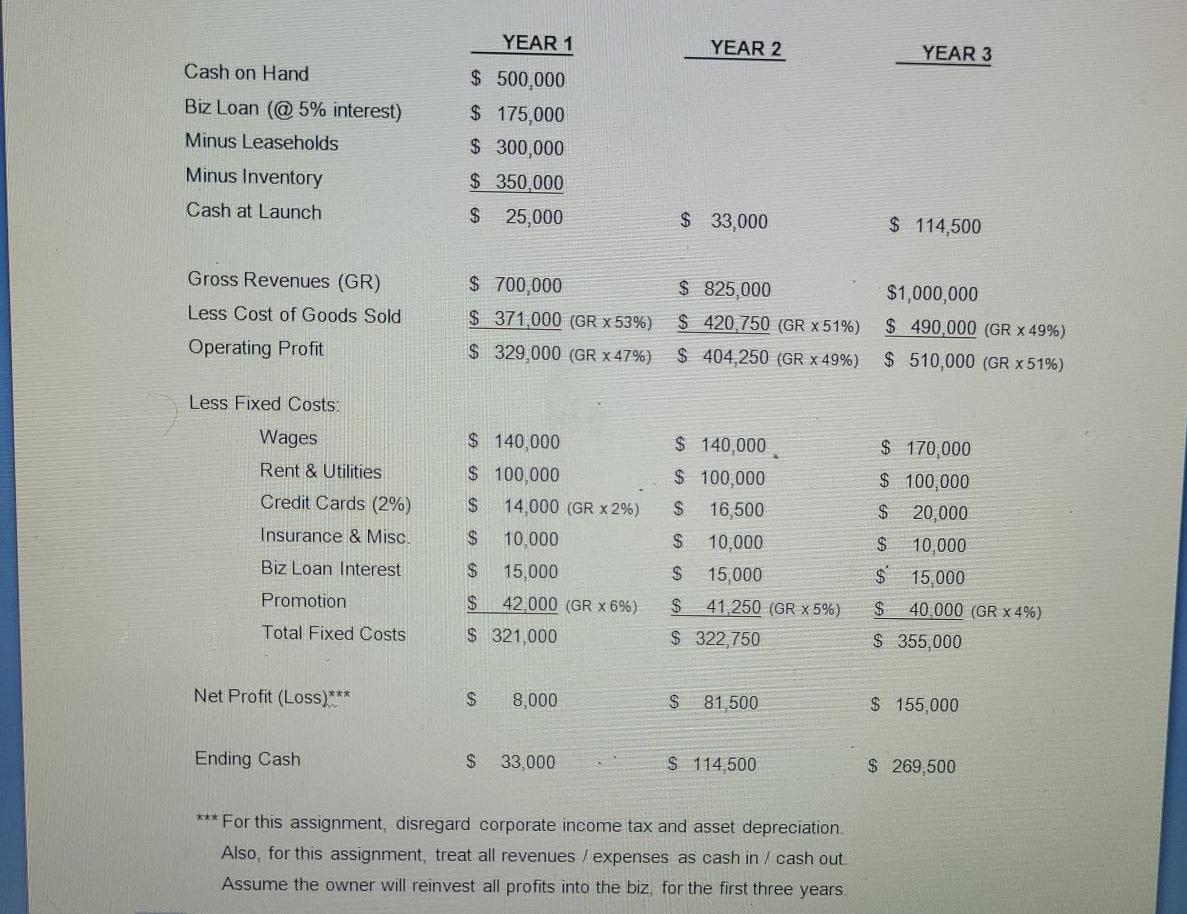

Remember to proactively check in with colleagues to ensure work is progressing with the agreed upon quality. Appendix 1: Include projected cash-flow statement for years one through three (use the following sample but customize so it is applicable to your client's industry and business model). Beginning / ending cash balances for each of the first three years will provide a sense of the cash that will be required as you build the business to a point of profitability. Search the internet and industry websites for approximate revenues / expenses. Most indo is readily available. State assumptions as warranted. YEAR 1 YEAR 2 YEAR 3 Cash on Hand Biz Loan (@ 5% interest) Minus Leaseholds $ 500,000 $ 175,000 $ 300,000 $ 350,000 $ 25,000 Minus Inventory Cash at Launch $ 33,000 $ 114,500 Gross Revenues (GR) Less Cost of Goods Sold $ 700,000 $ 371,000 (GR x 53%) $ 329,000 (GR x 47%) $ 825,000 $ 420.750 (GR x 51%) $ 404,250 (GR x 49%) $1,000,000 $ 490,000 (GR x 49%) $ 510,000 (GR x 51%) Operating Profit Less Fixed Costs: Wages Rent & Utilities Credit Cards (2%) Insurance & Misc $ 140,000 $ 100,000 $ 14,000 (GR X2%) $ 10,000 $ 15,000 $ 42,000 (GR x 6%) $ 321,000 $ 140,000 $ 100,000 $ 16,500 $ 10,000 $ 15,000 $ 41.250 (GR x 5%) $ 322,750 $ 170,000 $ 100,000 $ 20,000 $ 10,000 $ 15,000 $ 40.000 (GR x 4%) $ 355,000 Biz Loan Interest Promotion Total Fixed Costs Net Profit (Loss)*** $ 8,000 $ 81,500 $ 155,000 Ending Cash $ 33,000 $ 114,500 $ 269,500 *** For this assignment, disregard corporate income tax and asset depreciation Also, for this assignment, treat all revenues / expenses as cash in /cash out. Assume the owner will reinvest all profits into the biz, for the first three years. Remember to proactively check in with colleagues to ensure work is progressing with the agreed upon quality. Appendix 1: Include projected cash-flow statement for years one through three (use the following sample but customize so it is applicable to your client's industry and business model). Beginning / ending cash balances for each of the first three years will provide a sense of the cash that will be required as you build the business to a point of profitability. Search the internet and industry websites for approximate revenues / expenses. Most indo is readily available. State assumptions as warranted. YEAR 1 YEAR 2 YEAR 3 Cash on Hand Biz Loan (@ 5% interest) Minus Leaseholds $ 500,000 $ 175,000 $ 300,000 $ 350,000 $ 25,000 Minus Inventory Cash at Launch $ 33,000 $ 114,500 Gross Revenues (GR) Less Cost of Goods Sold $ 700,000 $ 371,000 (GR x 53%) $ 329,000 (GR x 47%) $ 825,000 $ 420.750 (GR x 51%) $ 404,250 (GR x 49%) $1,000,000 $ 490,000 (GR x 49%) $ 510,000 (GR x 51%) Operating Profit Less Fixed Costs: Wages Rent & Utilities Credit Cards (2%) Insurance & Misc $ 140,000 $ 100,000 $ 14,000 (GR X2%) $ 10,000 $ 15,000 $ 42,000 (GR x 6%) $ 321,000 $ 140,000 $ 100,000 $ 16,500 $ 10,000 $ 15,000 $ 41.250 (GR x 5%) $ 322,750 $ 170,000 $ 100,000 $ 20,000 $ 10,000 $ 15,000 $ 40.000 (GR x 4%) $ 355,000 Biz Loan Interest Promotion Total Fixed Costs Net Profit (Loss)*** $ 8,000 $ 81,500 $ 155,000 Ending Cash $ 33,000 $ 114,500 $ 269,500 *** For this assignment, disregard corporate income tax and asset depreciation Also, for this assignment, treat all revenues / expenses as cash in /cash out. Assume the owner will reinvest all profits into the biz, for the first three years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts