Question: Old MathJax webview Old Spice: Revitalizing Glacial Falls (Case Study by Derek D. Rucker) Q#1: Should Old Spice keep the Glacial Scent, discontinue the scent

Old MathJax webview

Old Spice: Revitalizing Glacial Falls (Case Study by Derek D. Rucker)

Q#1: Should Old Spice

- keep the Glacial Scent,

- discontinue the scent entirely,

- discontinue the scent and replace with a new scent,

- attempt to reposition the scent, or

- examine another course of action?

What is the rationale for your recommendation?

Q#2:: Should Old Spice change the scent target?

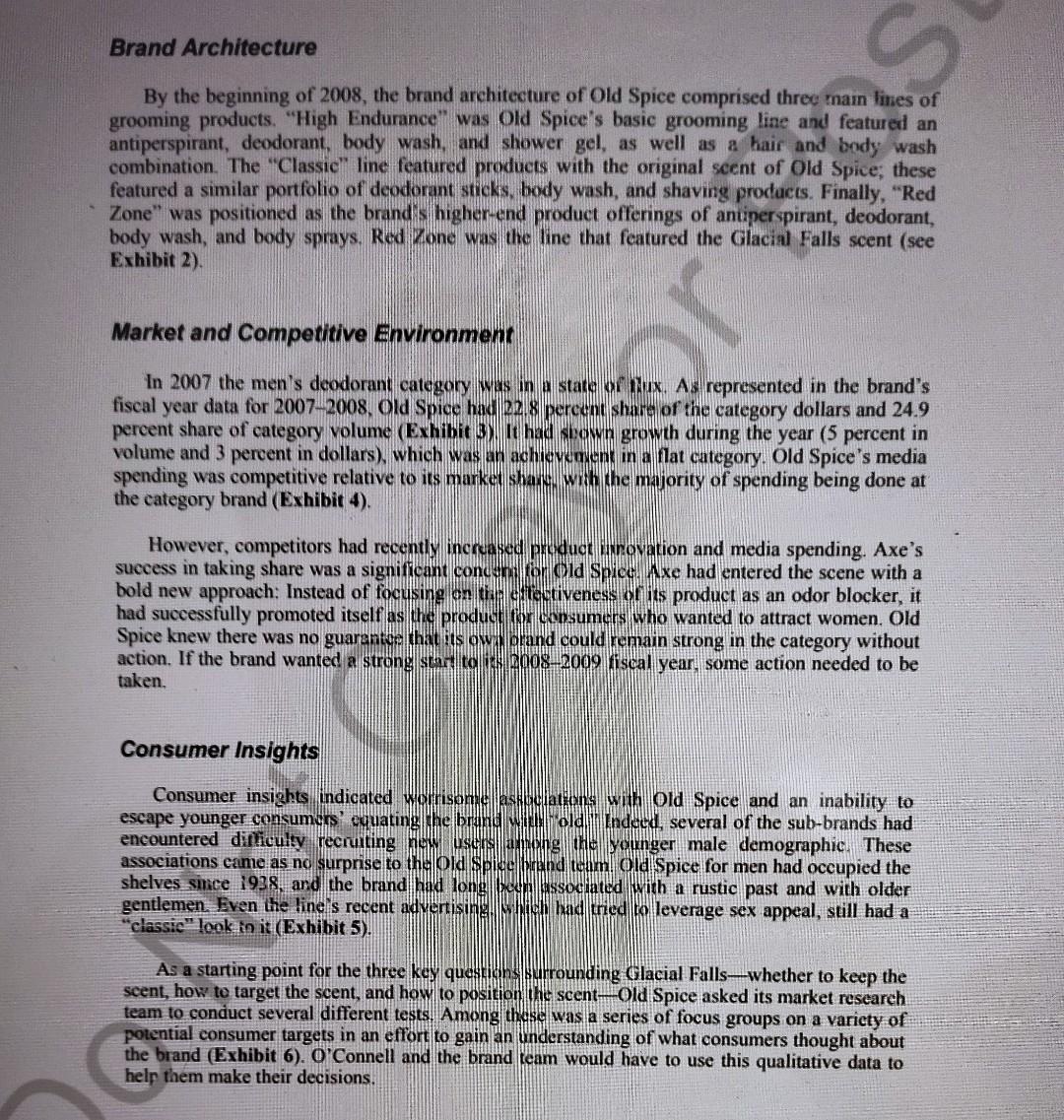

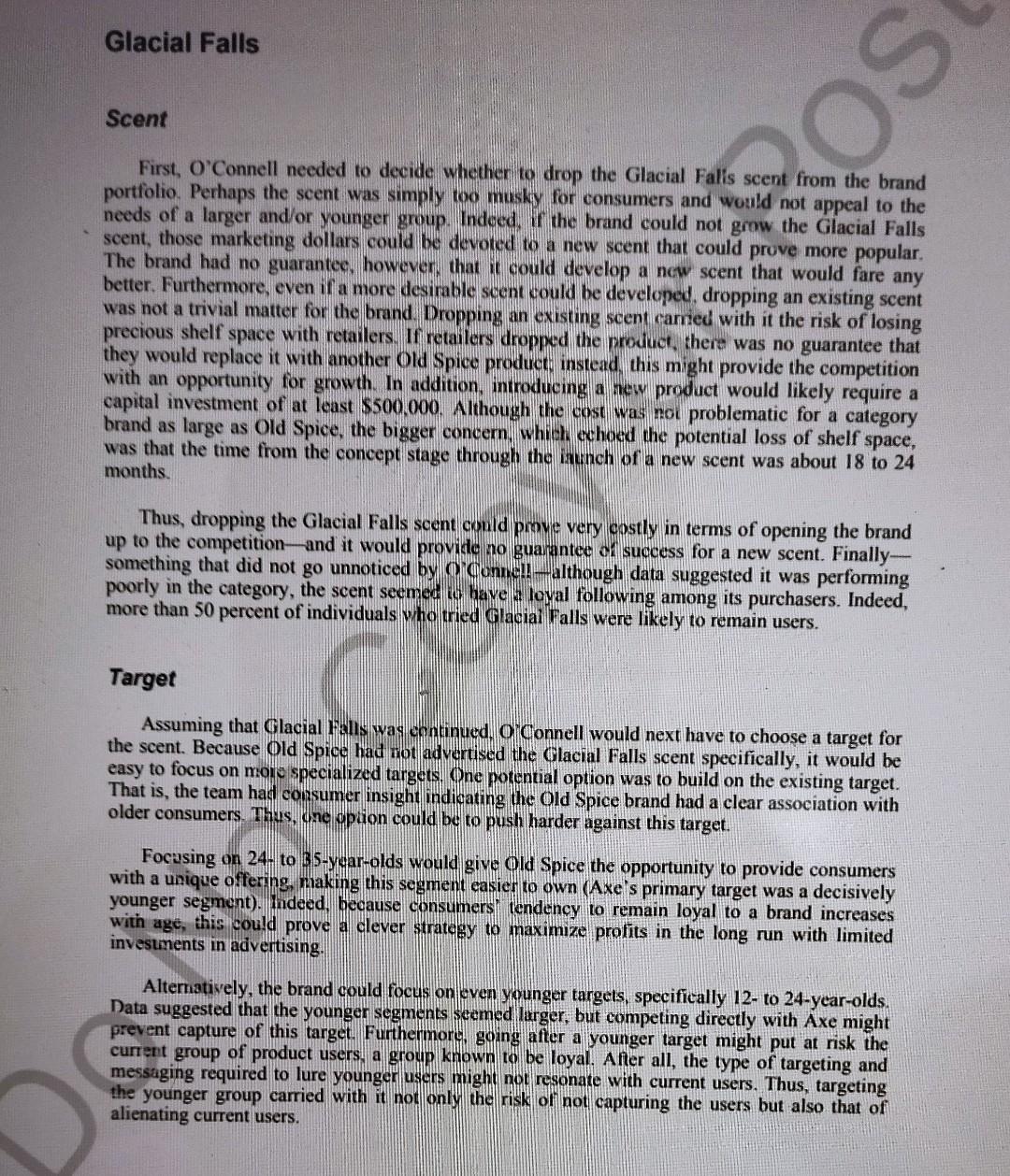

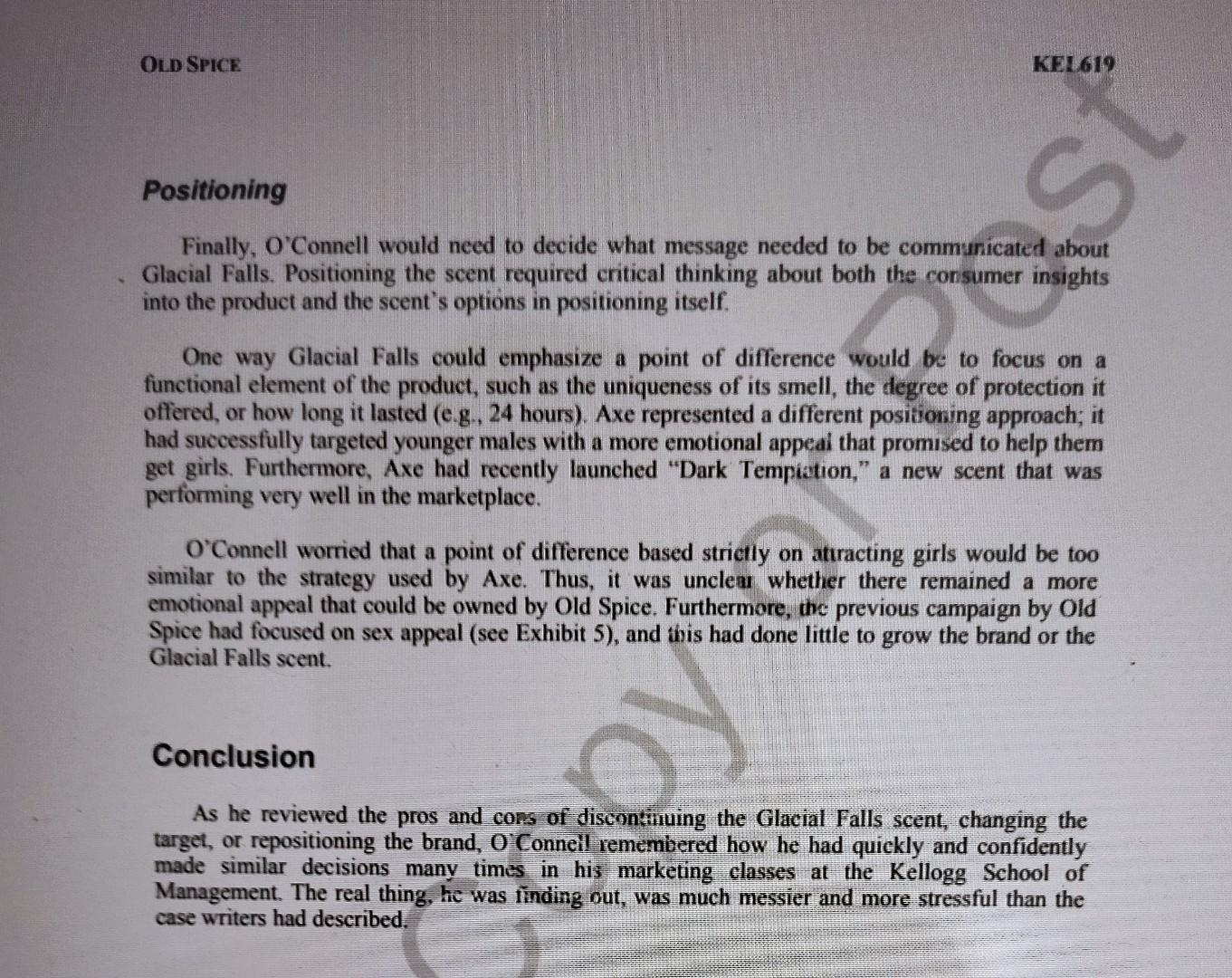

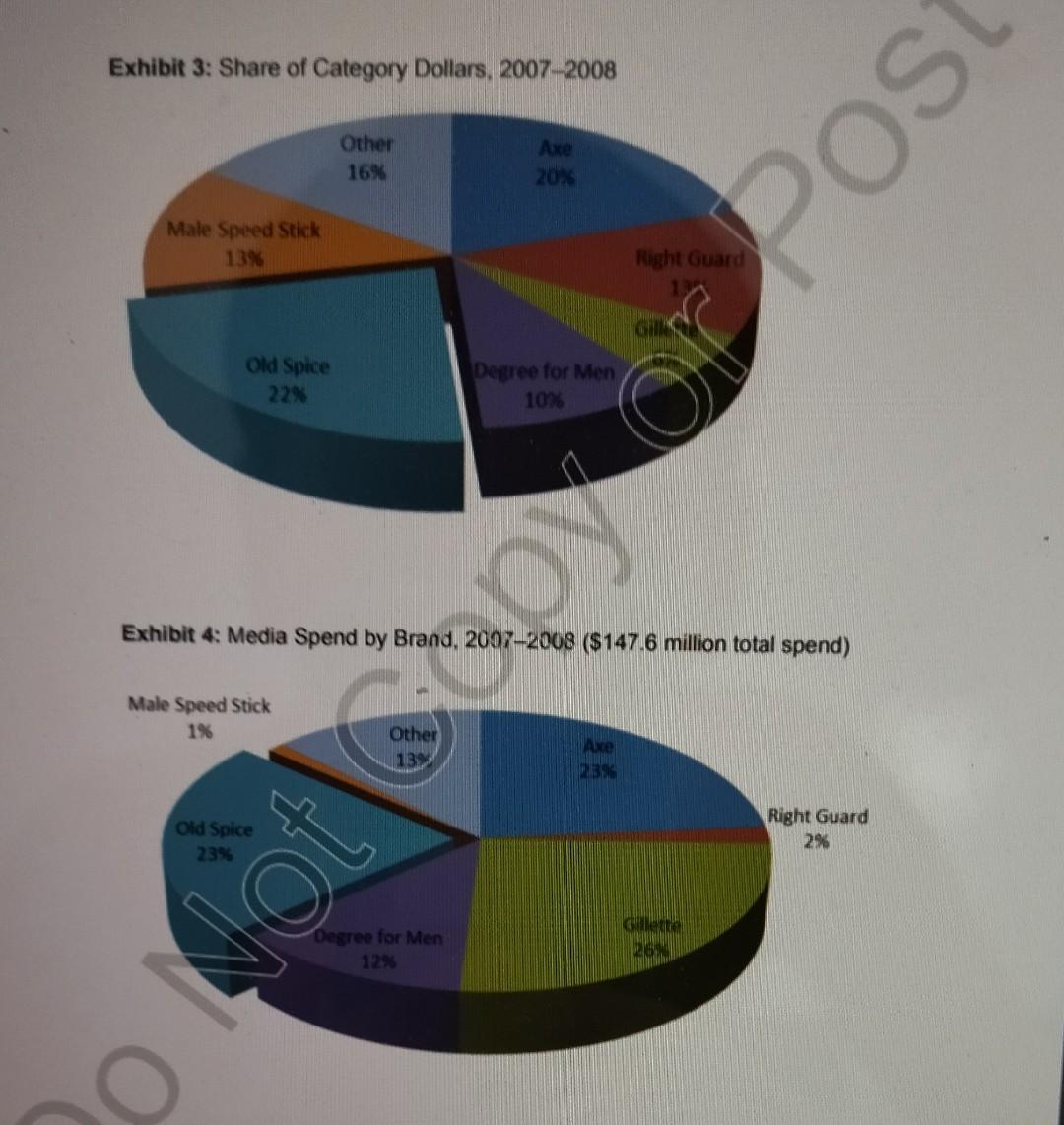

DEREK D. RUCKER Old Spice: Revitalizing Glacial Falls It was New Year's Eve December 31, 2007but Procter & Gamble assistant brand manager Mauricio O'Connell did not feel like celebrating. The date marked the end of a successful first half of the fiscal year for P&G-owned Old Spice, the market share leader in male deodorant, but O'Connell, a newly minted MBA, had been given an unenviable assignment. His task was to address the foundering sales of Glacial Falls, which was the worst-performing scent not only in Old Spice's portfolio but also in the entire category. O'Connell and the brand team had spent what otherwise would have been a holiday in P&G's Cincinnati, Ohio, headquarters discussing possible alternatives for revitalizing sales. Each proposal had its proponents, so O'Connell knew it was up to him to answer the key questions about Glacial Falls: Should he keep the scent or drop it? Should he change its target? And should he change the positioning message? Old Spice History and Positioning 200 Bom in 1934, Old Spice quickly acquired a position of dominant player in the male deodorant and body wash category. The brand became associated with a clear and identifiable nautical theme that remained to this day (Exhibit 1); the original packaging included images of the clipper ships Grand Turk and Friendship. Old Spice was purchased by P&G from the Shulton Company in the early 1990s, and with the acquisition came a decision to replace the clipper ships with a yacht logo. Since then, the brand had continued to grow steadily by regularly launching new scents and forms of deodorant sticks, body washes, and body sprays, among others. In 2008 Old Spice underwent another major packaging change this time to emphasize its "Classic Scent." The original white glass bottles were replaced with plastic, and the grey stoppers were changed to red. In addition, a new slogan was created to accompany the Old Spice Classic shower gel. "The original. If your grandfather hadn't worn it, you wouldn't exist.""! Brand Architecture By the beginning of 2008, the brand architecture of Old Spice comprised three main lines of grooming products. "High Endurance was Old Spice's basic grooming line and featured an antiperspirant, deodorant, body wash, and shower gel, as well as a hair and body wash combination. The "Classic" line featured products with the original scent of Old Spice; these featured a similar portfolio of deodorant sticks, body wash, and shaving products. Finally, "Red Zone" was positioned as the brand is higher-end product offerings of antiperspirant, deodorant, body wash, and body sprays. Red Zone was the line that featured the Glacial Falls scent (see Exhibit 2). Market and Competitive Environment In 2007 the men's deodorant category was in a state or bux. As represented in the brand's fiscal year data for 2007-2008. Old Spice had 22.8 percent share of the category dollars and 24.9 percent share of category volume (Exhibit Bit had shown growth during the year (5 percent in volume and 3 percent in dollars), which was an achievement in a flat category. Old Spice's media spending was competitive relative to its market share with the majority of spending being done at the category brand (Exhibit 4). However, competitors had recently increased product innovation and media spending. Axe's success in taking share was a significant content on Old Spice, Axe had entered the scene with a bold new approach: Instead of focusing on the festiveness on its product as an odor blocker, it had successfully promoted itself as the product or consumers who wanted to attract women. Old Spice knew there was no guarantee that its own brand could remain strong in the category without action. If the brand wanted a strong sean to 2008-2009 fiscal year, some action needed to be taken. Consumer Insights Consumer insights indicated worrisonclashciations with Old Spice and an inability to escape younger consumers equating the brand old Indeed, several of the sub-brands had encountered difficulty recruiting new users among the younger male demographic. These associations came as nd surprise to the Old Spice and team. Old Spice for men had occupied the shelves since 1938, and the brand had long been associated with a rustic past and with older gentlemen. Even the line's recent advertising we had tned to leverage sex appeal, still had a *classie" look to it (Exhibit 5). As a starting point for the three key questions surrounding Glacial Fallswhether to keep the scent, how to target the scent, and how to position the scent Old Spice asked its market research team to conduct several different tests. Among these was a series of focus groups on a variety of potential consumer targets in an effort to gain an understanding of what consumers thought about the brand (Exhibit 6). O'Connell and the brand team would have to use this qualitative data to help them make their decisions. Glacial Falls SO Scent First, O'Connell needed to decide whether to drop the Glacial Falls scent from the brand portfolio. Perhaps the scent was simply too musky for consumers and would not appeal to the needs of a larger and/or younger group. Indeed, if the brand could not grow the Glacial Falls scent, those marketing dollars could be devoted to a new scent that could prove more popular, The brand had no guarantee, however, that it could develop a new scent that would fare any better. Furthermore, even if a more desirable scent could be developed, dropping an existing scent was not a trivial matter for the brand. Dropping an existing scent camed with it the risk of losing precious shelf space with retailers. If retailers dropped the product, there was no guarantee that they would replace it with another Old Spice product instead, this might provide the competition with an opportunity for growth. In addition, introducing a new product would likely require a capital investment of at least $500,000. Although the cost was not problematic for a category brand as large as Old Spice, the bigger concern, which echoed the potential loss of shelf space, was that the time from the concept stage through the munch of a new scent was about 18 to 24 months. Thus, dropping the Glacial Falls scent could prve very costly in terms of opening the brand up to the competition and it would provide no guarantee of success for a new scent. Finally- something that did not go unnoticed by O'Connel! - although data suggested it was performing poorly in the category, the scent seemed to have a loyal following among its purchasers. Indeed, more than 50 percent of individuals who tried Glacial Falls were likely to remain users. Target Assuming that Glacial Falls was continued. O'Connell would next have to choose a target for the scent. Because Old Spice had not advertised the Glacial Falls scent specifically, it would be easy to focus on more specialized targets. One potential option was to build on the existing target. That is, the team had consumer insight indicating the Old Spice brand had a clear association with older consumers. Thus, one opion could be to push harder against this target. Focusing on 24- to 35-year-olds would give Old Spice the opportunity to provide consumers with a unique offering, making this segment easier to own (Axe's primary target was a decisively younger segment). Indeed, because consumers tendency to remain loyal to a brand increases with age, this could prove a clever strategy to maximize profits in the long run with limited invesuments in advertising. Alternatively, the brand could focus on even younger targets, specifically 12- to 24-year-olds. Data suggested that the younger segments seemed larger, but competing directly with Axe might prevent capture of this target. Furthermore, going after a younger target might put at risk the current group of product users. a group known to be loyal. After all, the type of targeting and messaging required to lure younger users might not resonate with current users. Thus, targeting the younger group carried with it not only the risk of not capturing the users but also that of alienating current users. OLD SPICE KEL619 is Positioning Finally, O'Connell would need to decide what message needed to be communicated about Glacial Falls. Positioning the scent required critical thinking about both the consumer insights into the product and the scent's options in positioning itself. One way Glacial Falls could emphasize a point of difference would be to focus on a functional element of the product, such as the uniqueness of its smell, the degree of protection it offered, or how long it lasted (eg., 24 hours). Axe represented a different positioning approach; it had successfully targeted younger males with a more emotional appeal that promised to help them get girls. Furthermore, Axe had recently launched "Dark Tempiction," a new scent that was performing very well in the marketplace. O'Connell worried that a point of difference based strictly on attracting girls would be too similar to the strategy used by Axe. Thus, it was unclea whether there remained a more emotional appeal that could be owned by Old Spice. Furthermore, the previous campaign by Old Spice had focused on sex appeal (see Exhibit 5), and this had done little to grow the brand or the Glacial Falls scent. Conclusion As he reviewed the pros and cons of discontinuing the Glacial Falls scent, changing the target, or repositioning the brand, o Connell remembered how he had quickly and confidently made similar decisions many times in his marketing classes at the Kellogg School of Management. The real thing, he was finding out, was much messier and more stressful than the case writers had described. Exhibit 1: Glacial Falls Packaging, 2007 800 PRIVATE NE RED ZONE NET Do Not Copy or Post, Exhibit 2: Brand (Corporate Brand) Procter and Gamble (Category Brand Old Spice (Individual Product Brands) Red Zone High Endur (Scent) Glacial Falls Exhibit 3: Share of Category Dollars, 2007-2008 Pos Other 16% Axe 20% Male Speed Stick 13% Old Spice 22% Degree for Men Exhibit 4: Media Spend by Brand, 20072008 ($147.6 million total spend) Male Speed Stick 1% Other 13 2396 Old Spice Right Guard 2% Degree for Men 12% Gente M O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts