Question: Old MathJax webview please answer part (d) and (c) in detailed steps please answer part (v) and (iv) (b) Consider a stock worth $25 that

Old MathJax webview

please answer part (d) and (c) in detailed steps

please answer part (v) and (iv)

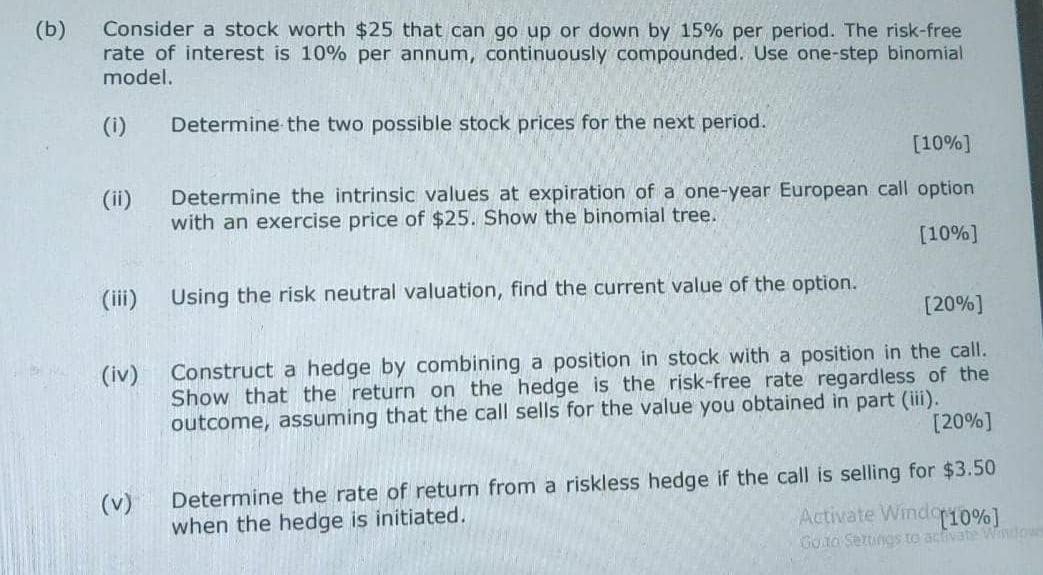

(b) Consider a stock worth $25 that can go up or down by 15% per period. The risk-free rate of interest is 10% per annum, continuously compounded. Use one-step binomial model. Determine the two possible stock prices for the next period. [10%] (ii) Determine the intrinsic values at expiration of a one-year European call option with an exercise price of $25. Show the binomial tree. (10%) (111 ) (iv) Using the risk neutral valuation, find the current value of the option. [20%) Construct a hedge by combining a position in stock with a position in the call. Show that the return on the hedge is the risk-free rate regardless of the outcome, assuming that the call sells for the value you obtained in part (iii). [20%) (v) Determine the rate of return from a riskless hedge if the call is selling for $3.50 when the hedge is initiated. Activate Windo (10%) Go to Settings te achat was

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts