Question: Old MathJax webview please do it in 50 minutes please urgently... I'll give you up thumb definitely This is first page of question Current Attempt

Old MathJax webview

please do it in 50 minutes please urgently... I'll give you up thumb definitely

This is first page of question

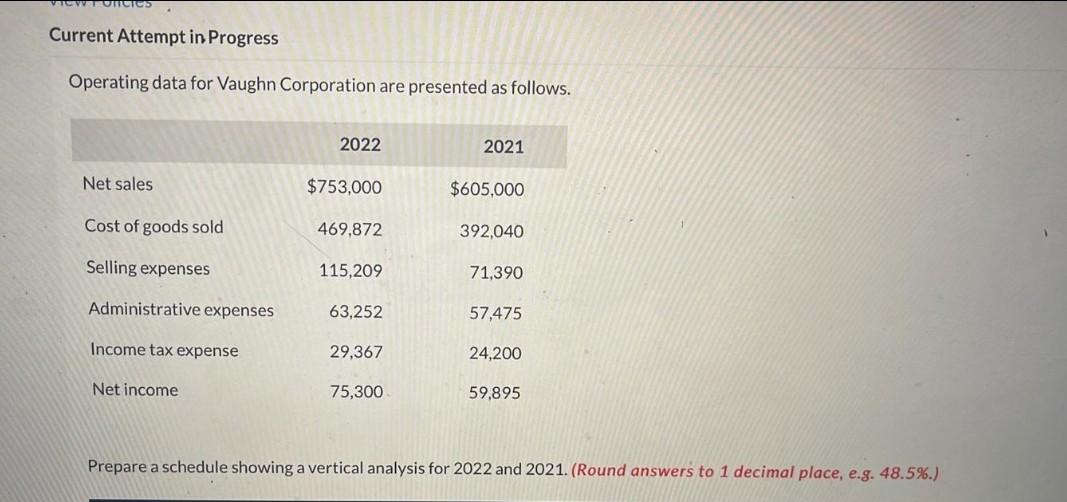

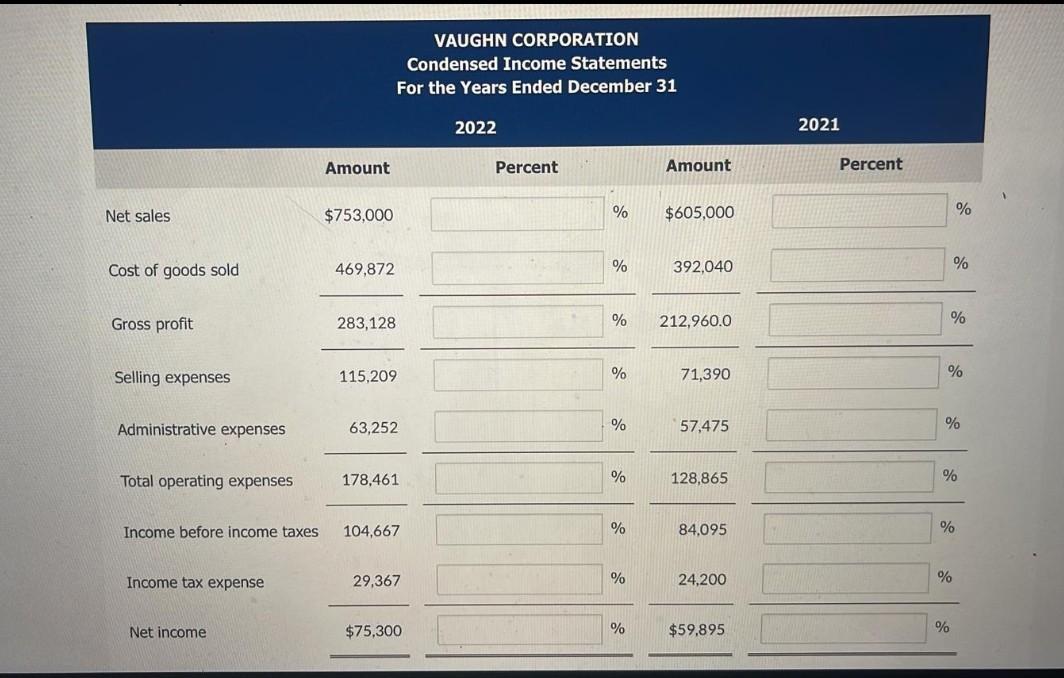

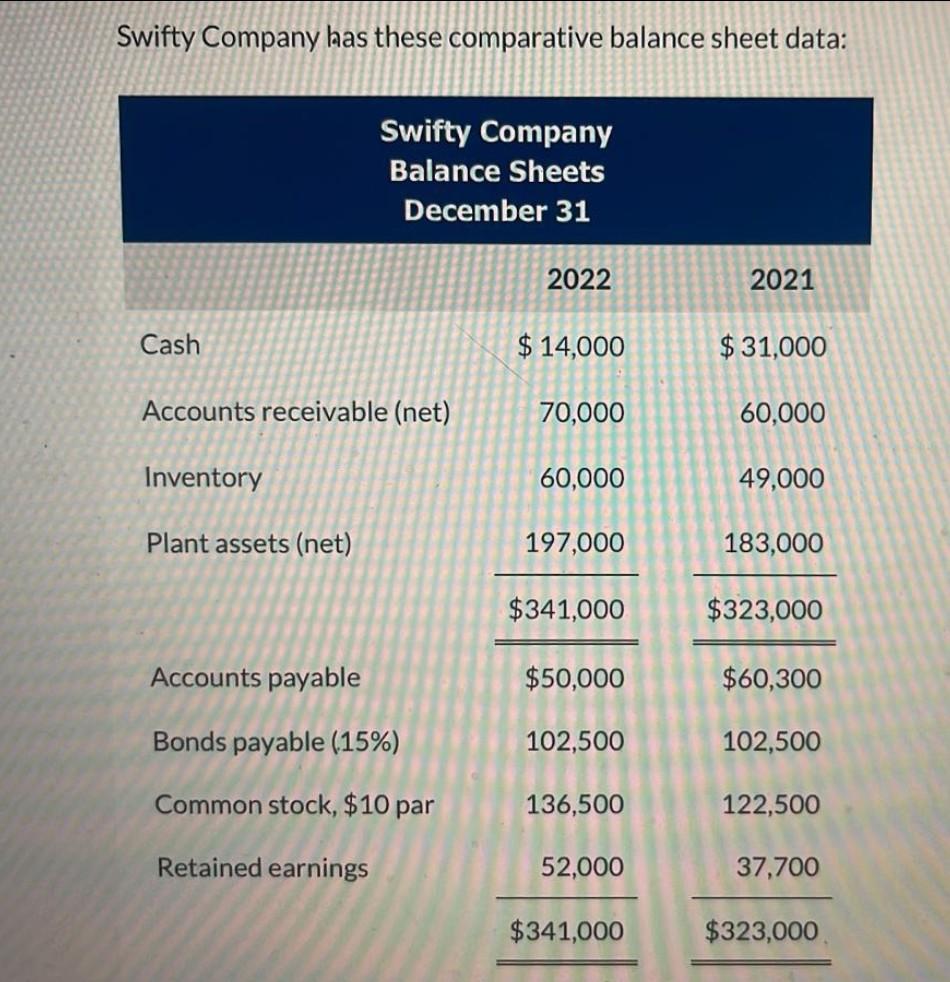

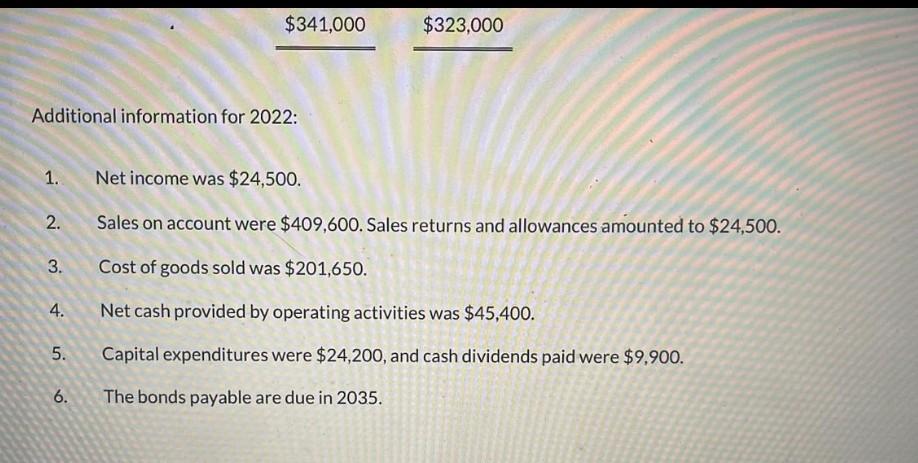

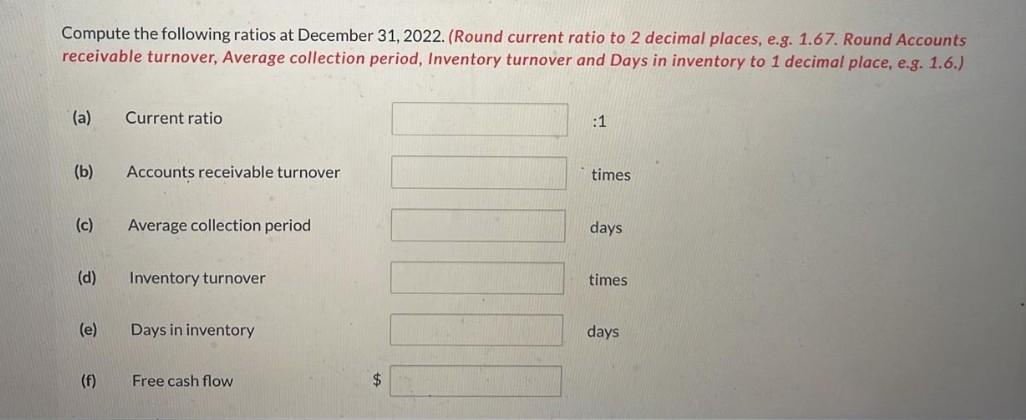

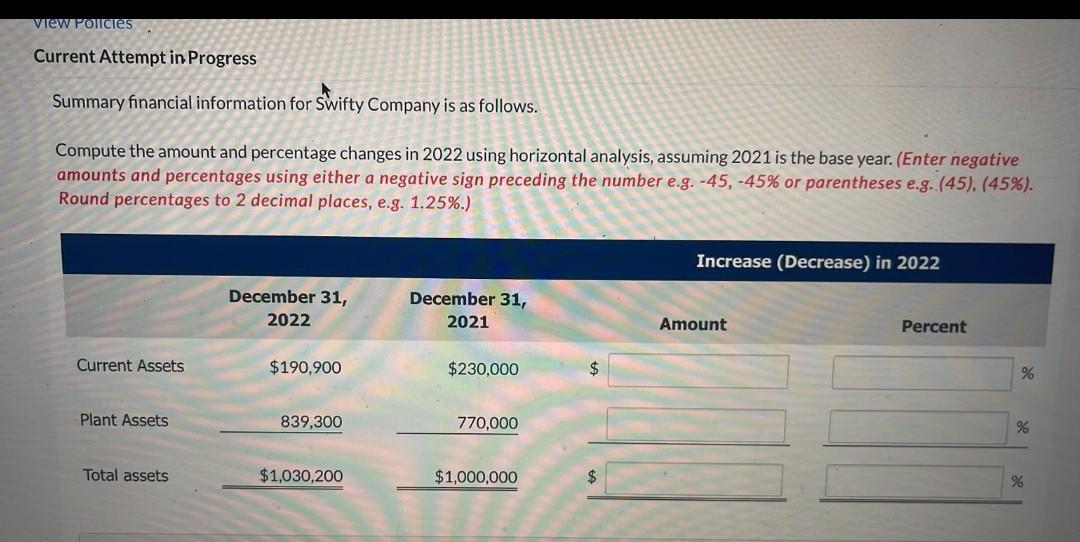

Current Attempt in Progress Operating data for Vaughn Corporation are presented as follows. 2022 2021 Net sales $753,000 $605,000 Cost of goods sold 469,872 392,040 Selling expenses 115,209 71,390 Administrative expenses 63,252 57,475 Income tax expense 29,367 24,200 Net income 75,300 59,895 Prepare a schedule showing a vertical analysis for 2022 and 2021. (Round answers to 1 decimal place, e.g. 48.5%.) VAUGHN CORPORATION Condensed Income Statements For the Years Ended December 31 2022 2021 Amount Percent Amount Percent Net sales $753,000 % $605,000 % % 469,872 % Cost of goods sold 392,040 283,128 Gross profit % 212,960.0 % Selling expenses 115,209 % 71,390 % Administrative expenses 63,252 % 57,475 % Total operating expenses 178,461 % 128,865 % Income before income taxes 104,667 % 84,095 % Income tax expense 29,367 % 24,200 % $75,300 Net income % $59,895 % Swifty Company has these comparative balance sheet data: Swifty Company Balance Sheets December 31 2022 2021 Cash $ 14,000 $ 31,000 Accounts receivable (net) 70,000 60,000 Inventory 60,000 49,000 Plant assets (net) 197,000 183,000 $341,000 $323,000 Accounts payable $50,000 $60,300 Bonds payable (15%) 102,500 102,500 Common stock, $10 par 136,500 122,500 Retained earnings 52,000 37,700 $341,000 $323,000 $341,000 $323,000 Additional information for 2022: 1. Net income was $24,500. 2. Sales on account were $409,600. Sales returns and allowances amounted to $24,500. 3. Cost of goods sold was $201,650. 4. Net cash provided by operating activities was $45,400. 5. Capital expenditures were $24,200, and cash dividends paid were $9,900. 6. The bonds payable are due in 2035. Compute the following ratios at December 31, 2022. (Round current ratio to 2 decimal places, e.g. 1.67. Round Accounts receivable turnover, Average collection period, Inventory turnover and Days in inventory to 1 decimal place, e.g. 1.6.) (a) Current ratio :1 (b) Accounts receivable turnover times (c) Average collection period days (d) Inventory turnover times (e) Days in inventory days (1) Free cash flow $ view Policies Current Attempt in Progress Summary financial information for Swifty Company is as follows. Compute the amount and percentage changes in 2022 using horizontal analysis, assuming 2021 is the base year. (Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45, -45% or parentheses e.g. (45), (45%). Round percentages to 2 decimal places, e.g. 1.25%.) Increase (Decrease) in 2022 December 31, 2022 December 31, 2021 Amount Percent Current Assets $190,900 $230,000 % Plant Assets 839,300 770,000 % Total assets $1,030,200 $1,000,000 $ %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts