Question: Old MathJax webview please do both questions in 50 minutes please urgently... I'll give you up thumb definitely Do only Q.11 and 14....No need to

Old MathJax webview

please do both questions in 50 minutes please urgently... I'll give you up thumb definitely

Do only Q.11 and 14....No need to do Q.12

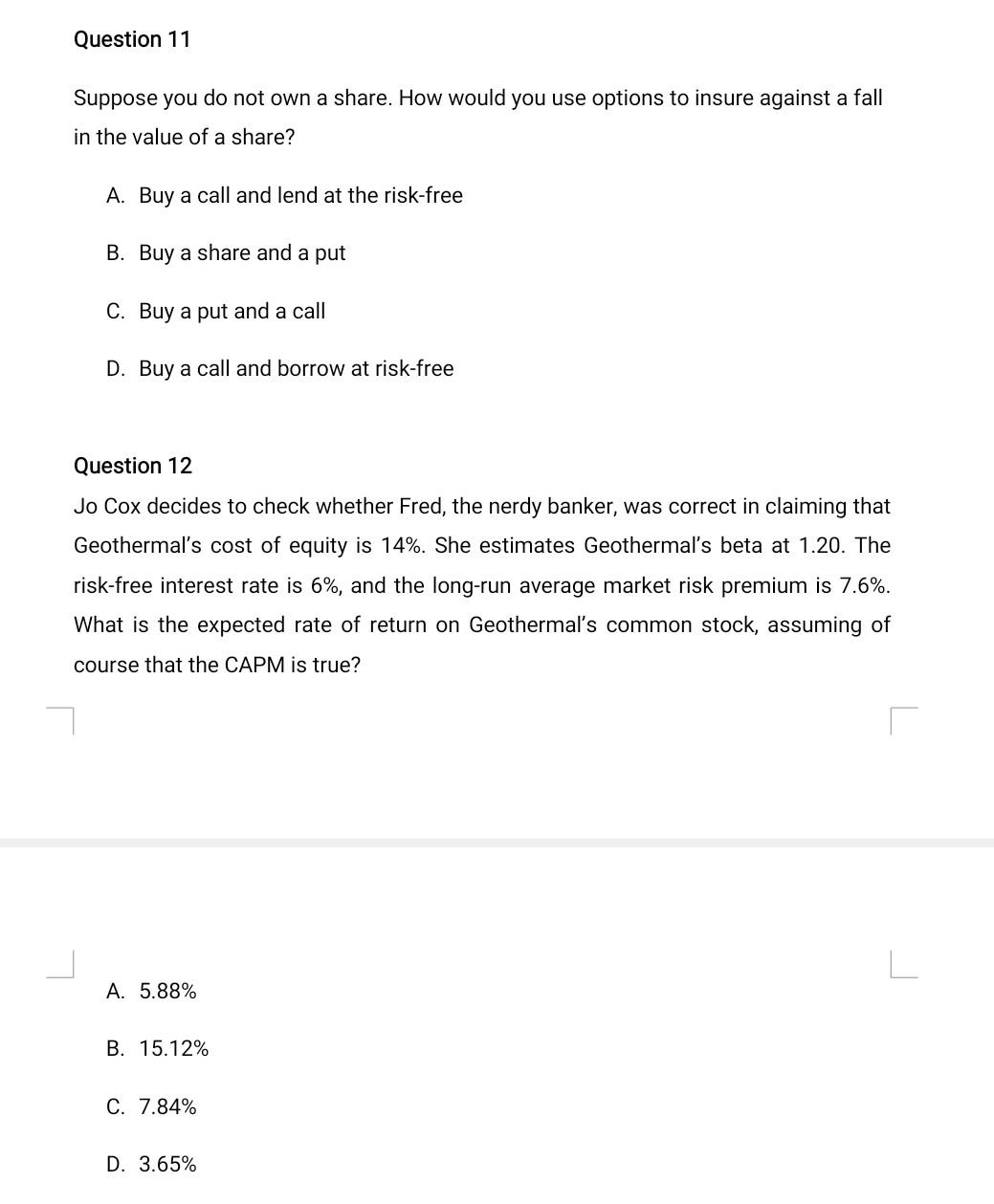

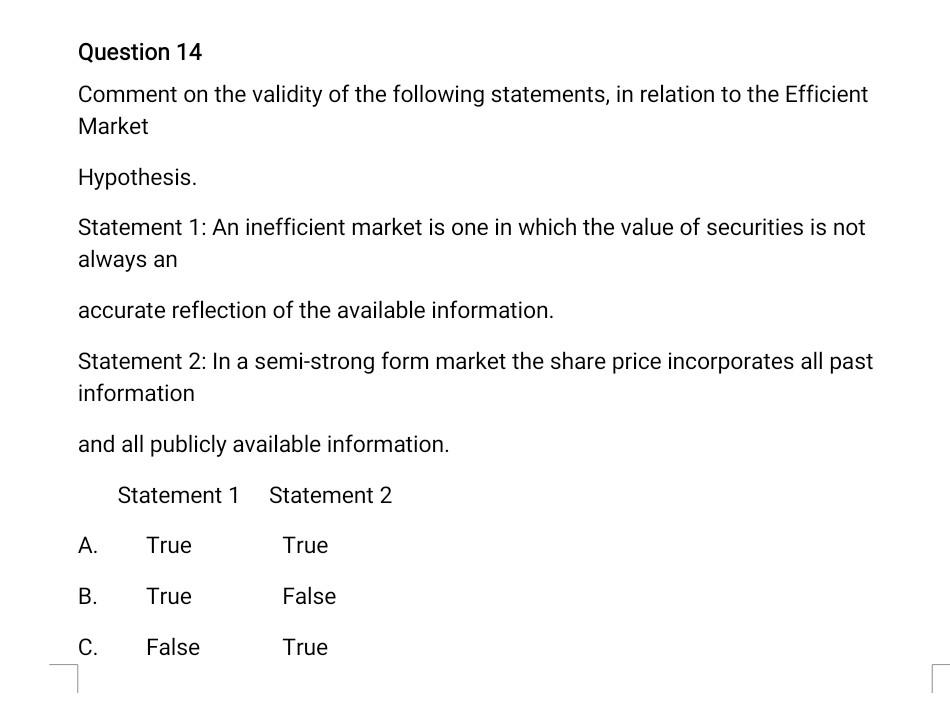

Question 11 Suppose you do not own a share. How would you use options to insure against a fall in the value of a share? A. Buy a call and lend at the risk-free B. Buy a share and a put C. Buy a put and a call D. Buy a call and borrow at risk-free Question 12 Jo Cox decides to check whether Fred, the nerdy banker, was correct in claiming that Geothermal's cost of equity is 14%. She estimates Geothermal's beta at 1.20. The risk-free interest rate is 6%, and the long-run average market risk premium is 7.6%. What is the expected rate of return on Geothermal's common stock, assuming of course that the CAPM is true? A. 5.88% B. 15.12% C. 7.84% D. 3.65% Question 14 Comment on the validity of the following statements, in relation to the Efficient Market Hypothesis. Statement 1: An inefficient market is one in which the value of securities is not always an accurate reflection of the available information. Statement 2: In a semi-strong form market the share price incorporates all past information and all publicly available information. Statement 1 Statement 2 A. True True B. True False C. False True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts